Best viewed on desktop or laptop

Mobile might struggle a bit

ARVIND SETHIA - FEATURED PROJECT

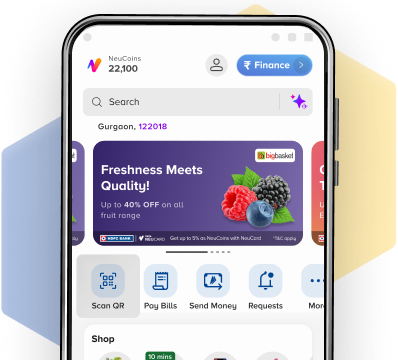

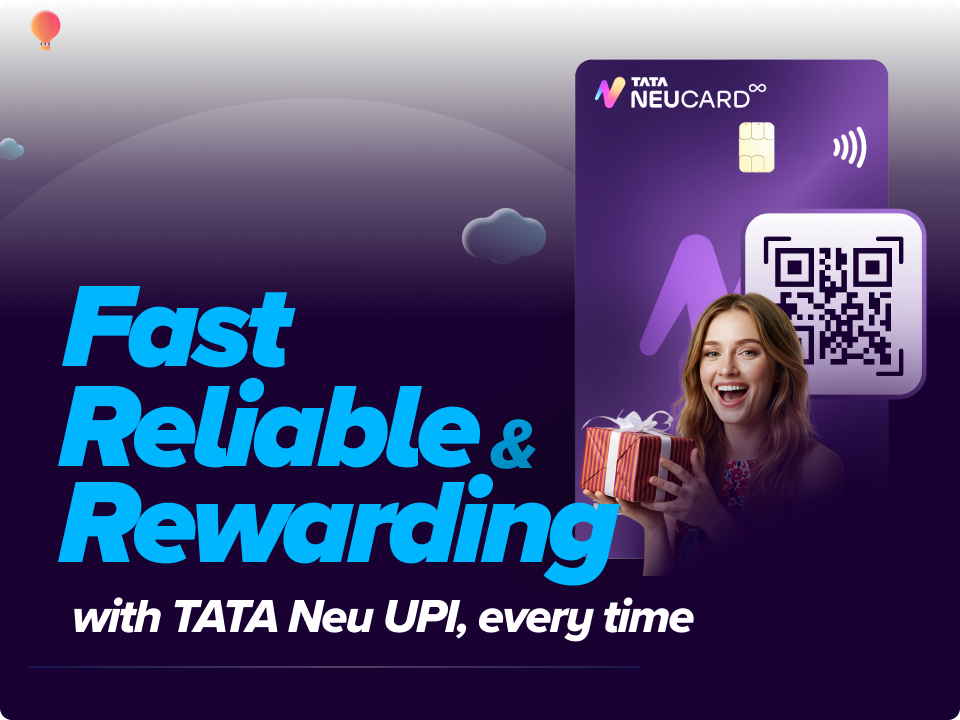

Tata Neu UPI

Repositioning UPI for a Credit-First, Reward-Led India

UX execution

“UPI was buried under commerce modules. Zero visibility, zero habit.”

THE PROBLEM

1

Low success rate:People abandoned Tata Neu for GPay/PhonePe

2

Slow app experience: Contradicted what UPI must be

3

Scan & Pay buried:

Users couldn’t even find the core feature

4

Brand perception weak: “too slow, not a UPI app, don’t trust it”

THE STRATEGIC INSIGHT

A new reliable banking partner fixed the underlying performance issues.

At the same time, NPCI enabled Credit Card on UPI.

Tata Neu had 2M+ existing credit card users — an advantage no one else had at this scale.

OPPORTUNITY

Win not on generic UPI.

Win on:

Credit-first value +

Meaningful rewards.

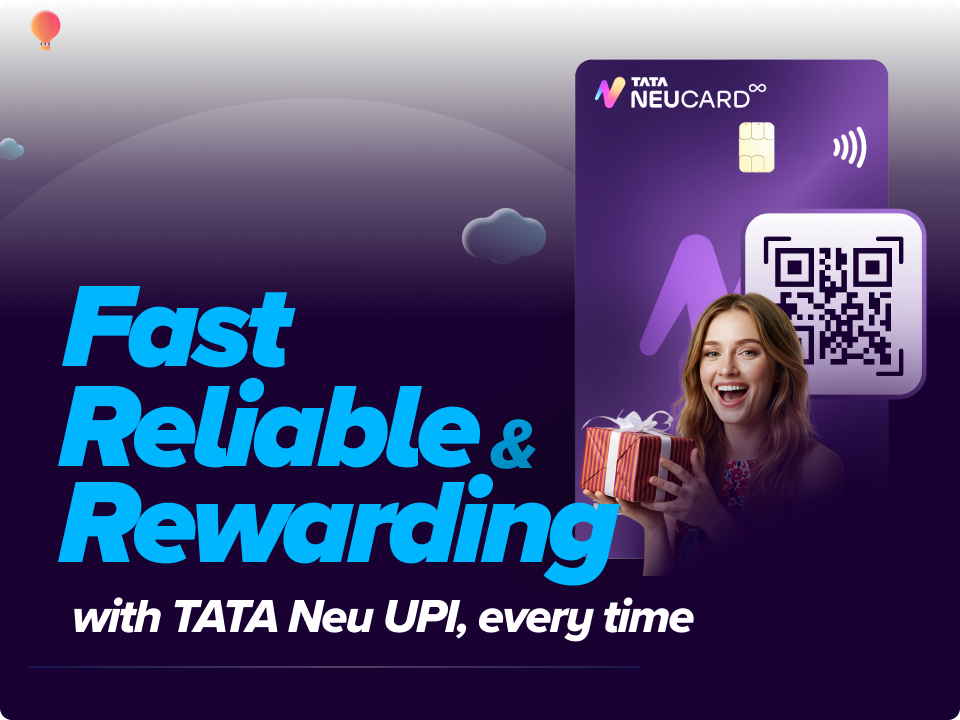

THE DESIGN NORTH STAR

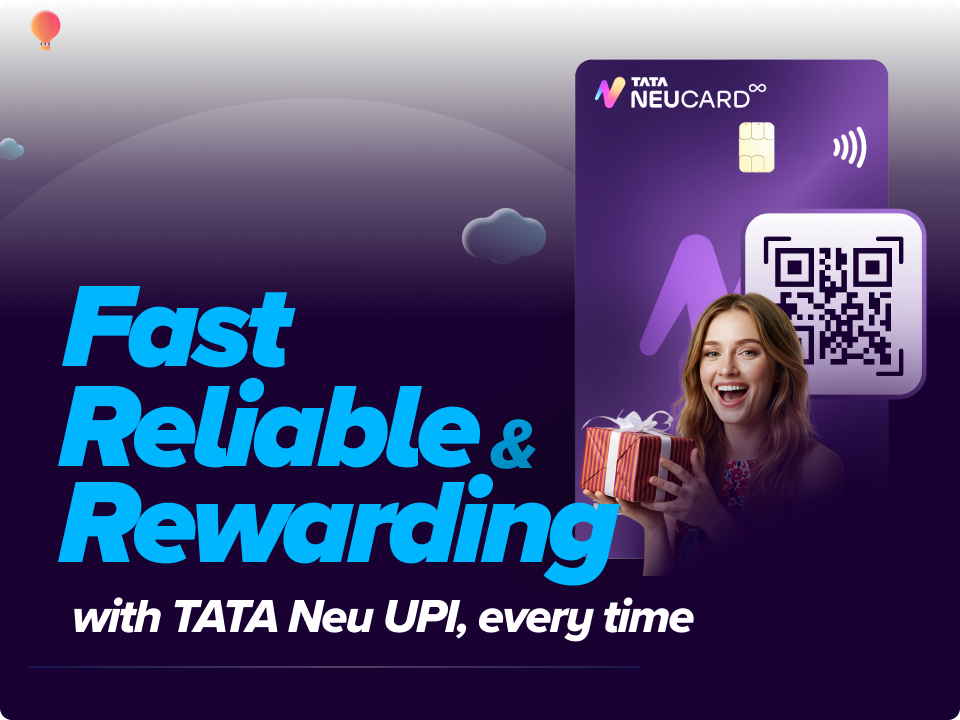

“The most rewarding credit-first UPI experience in India.”

A shift from paying → Earning.

From utility → Engagement engine.

From buried feature → Primary entry point.

This north star aligned Product, Business, Tech, and Design.

“Rebuilt the identity: Not cutting corners in Reliability, Speed in interaction, Value in every payment.”

WHAT I LED

Design Leadership

- Ran a 3-hour alignment workshop (18 cross-functional leaders).

- Co-led hypothesis-driven UPI research (21 hypotheses, 3 archetypes validated).

- Defined target user mix: Careful Explorers (60%) + Switchers (40%).

- Established the Core–Peripheral–Magic framework adopted across teams.

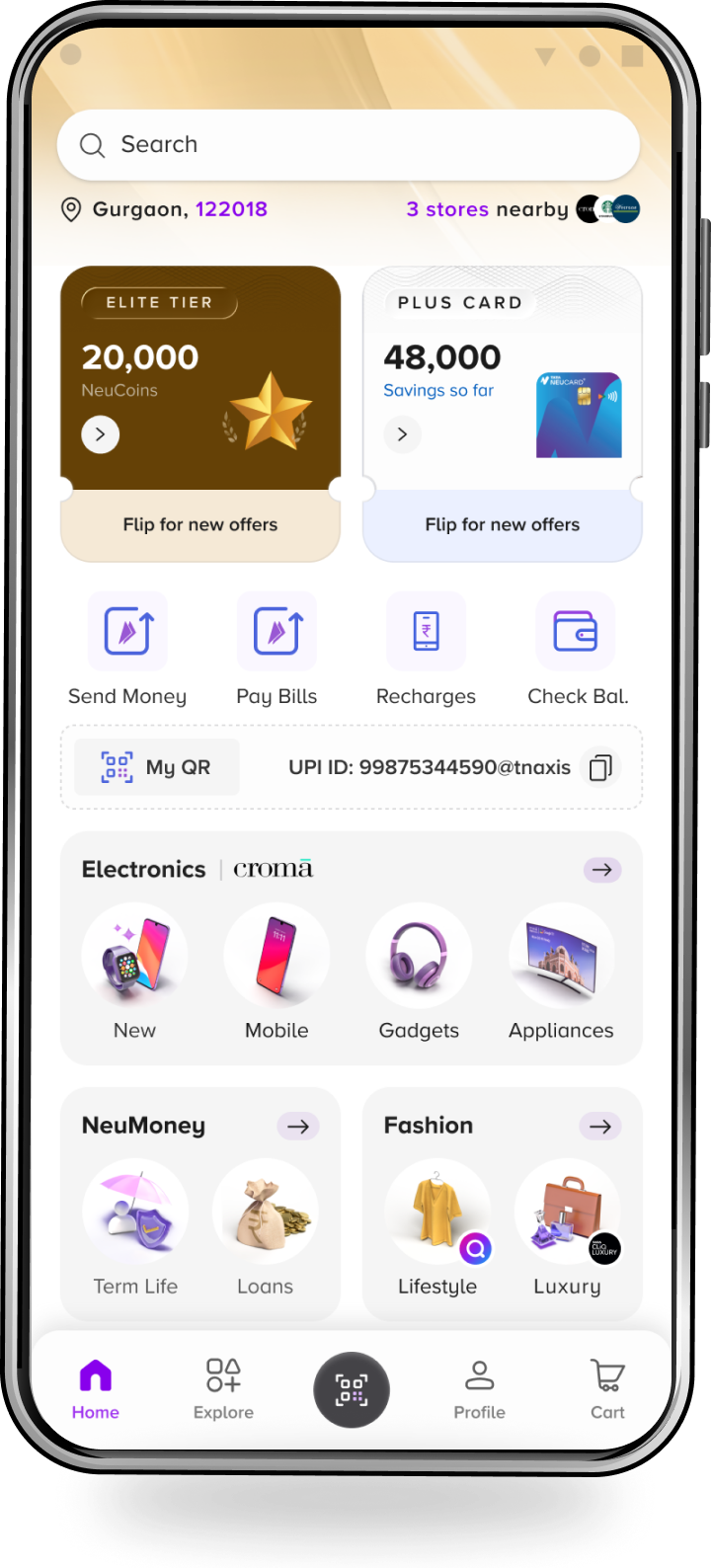

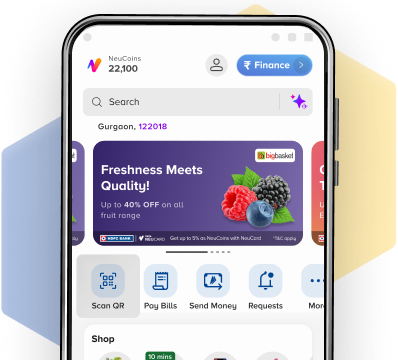

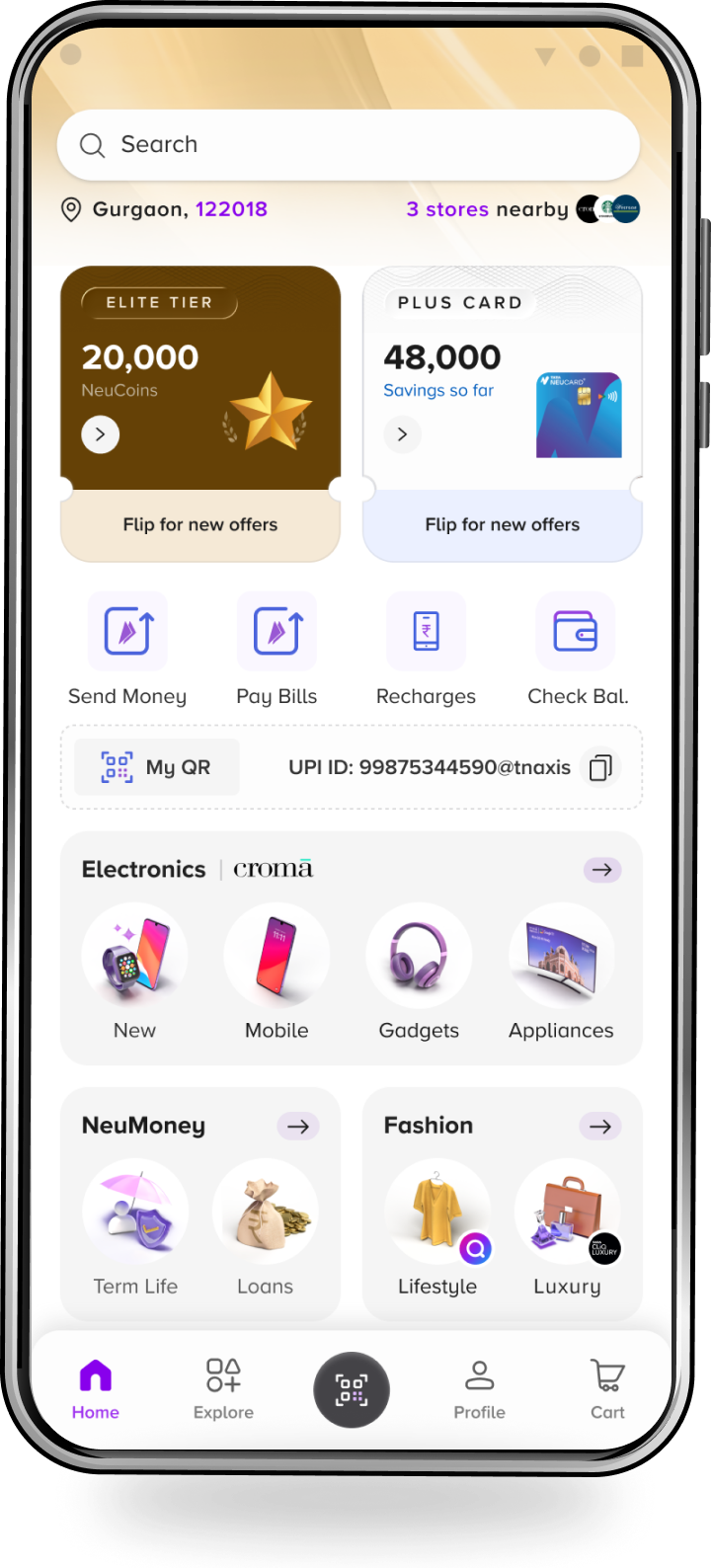

- Reset homepage & navigation priorities to bring UPI to the foreground.

- Directed end-to-end UX, UI, Visual, Motion for the entire redesign. (1team of 3TDesign lead- 1 (Myself), UX/UI Designer - 1, VD - )

- Ensured reward system clarity and alignment between product, loyalty, and tech.

FRAMEWORK: Core → Peripheral → Magic

Core (must-have for adoption)

- Upfront Discoverability

- Immediate Scan & Pay

- Dedicated UPI widget

- Reliable Transaction Loop

- Clear pending → processing → success states

- Fast perceived feedback

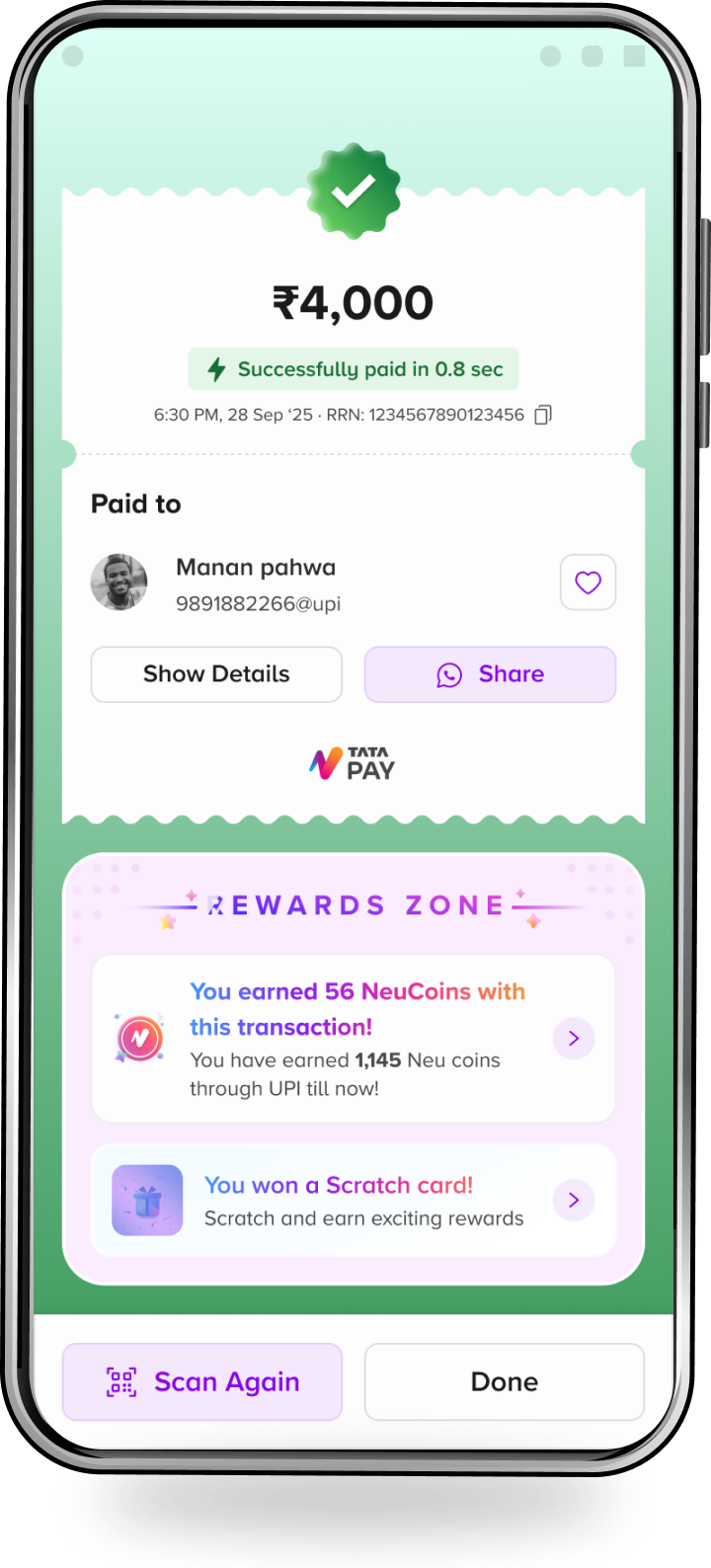

- Meaningful Reward Clarity

- Direct NeuCoins with visible value

- No random scratch card

Peripheral (reinforces trust + preference)

Speed

Sense of Security

Payment insights (Expenses & Rewards)

Bold visuals

Magic (unique to Tata Neu)

Credit-Driven Reward Flywheel

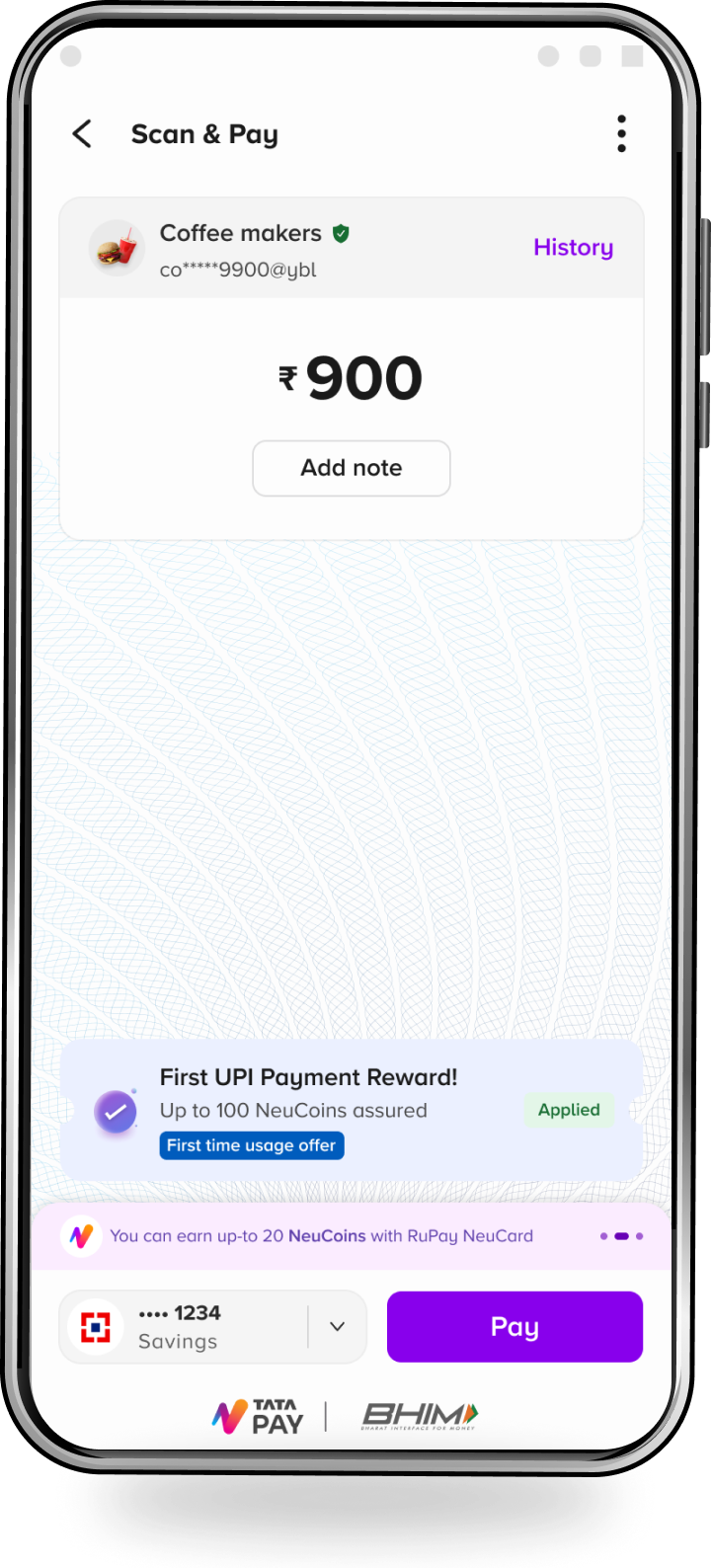

- CC-on-UPI benefit surfaced before payment

- Higher NeuCoin earnings for CC-linked transactions

- Tier progression → habit formation

Ecosystem Advantage

- Utility of rewards across Croma, BigBasket, Cliq, 1mg

- Unified value visualization

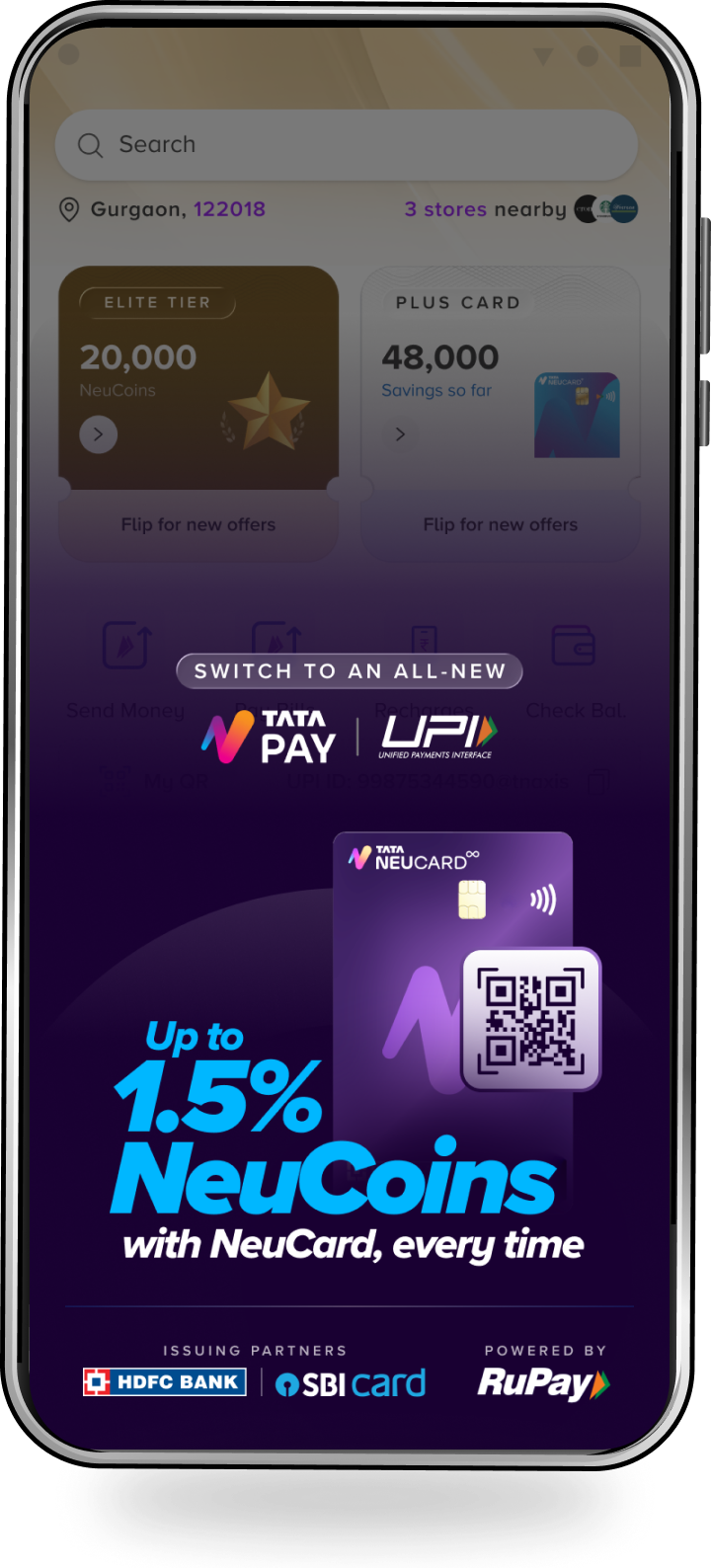

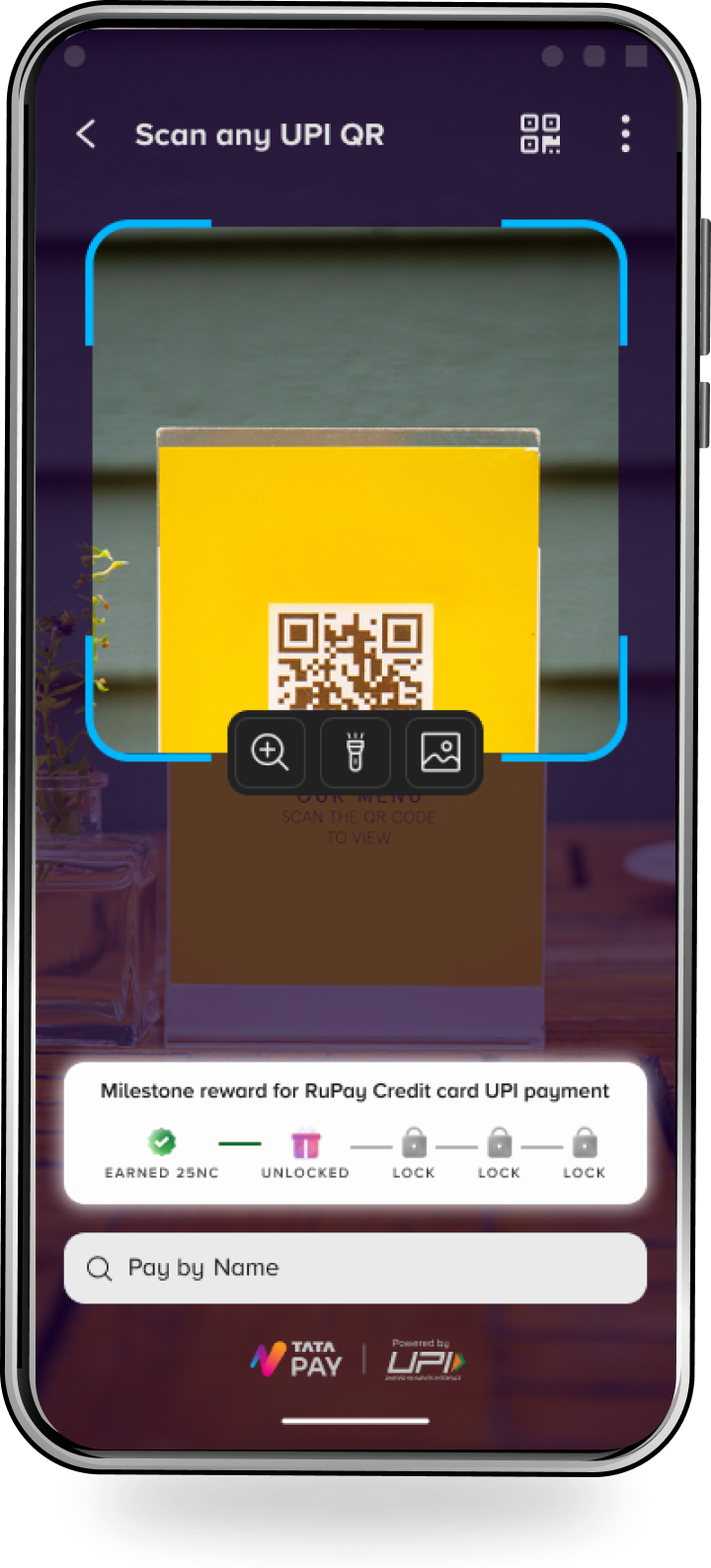

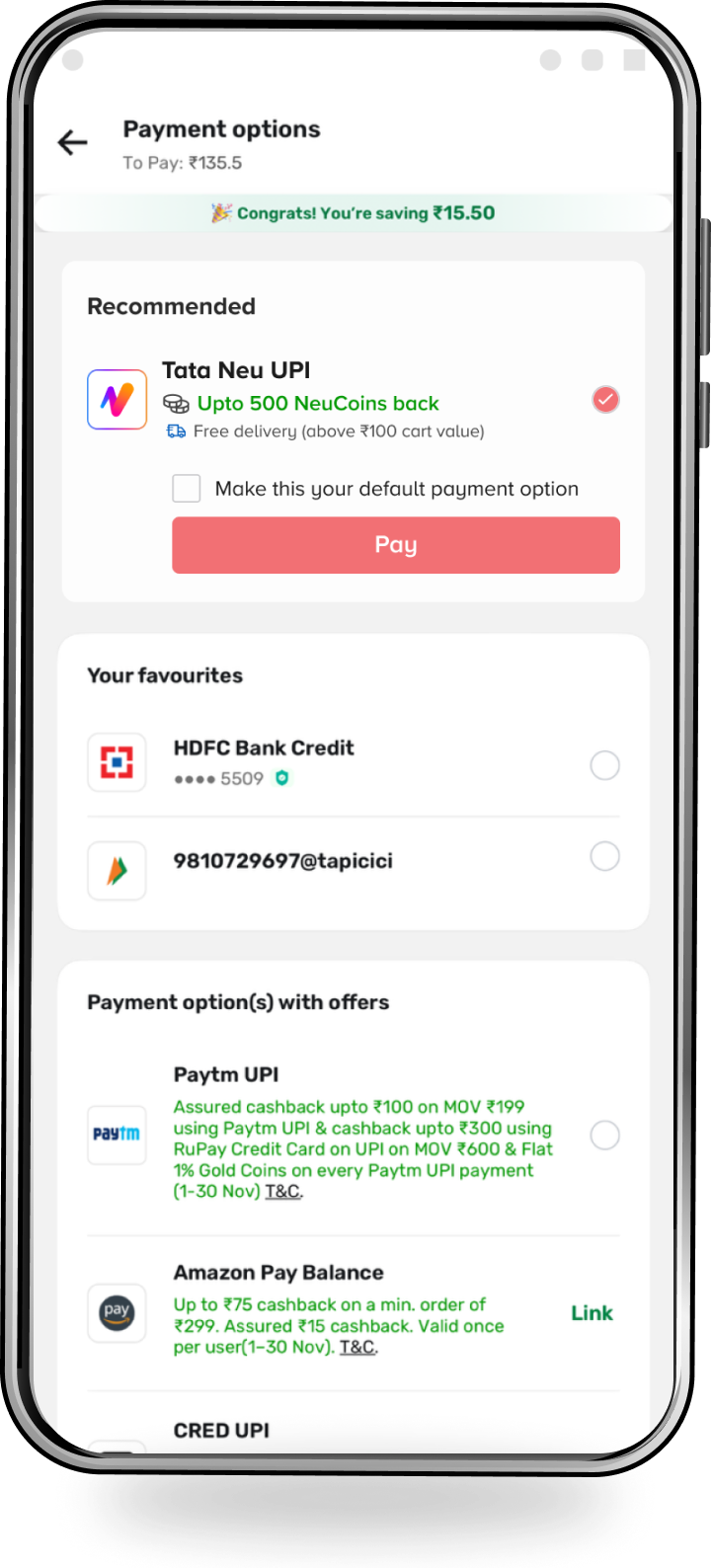

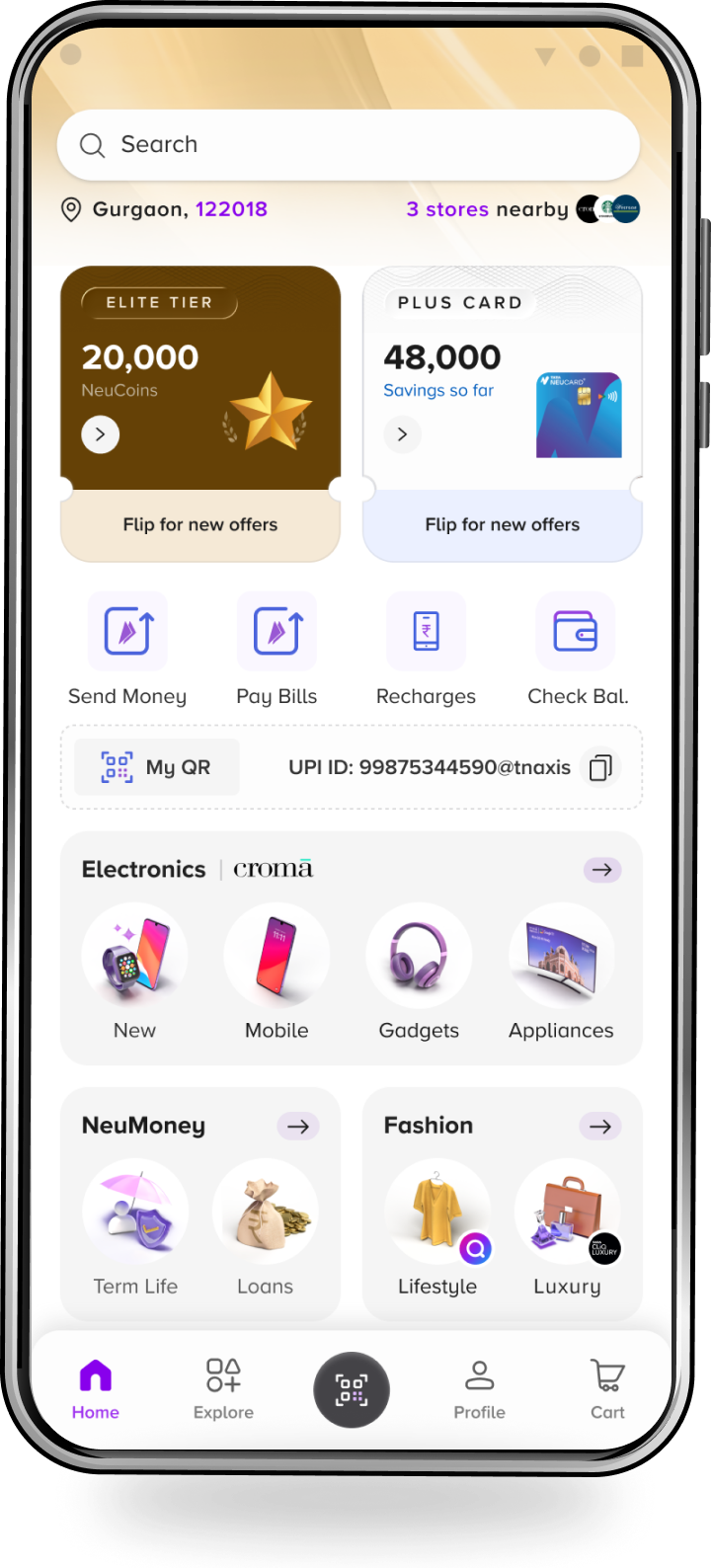

KEY DESIGNS

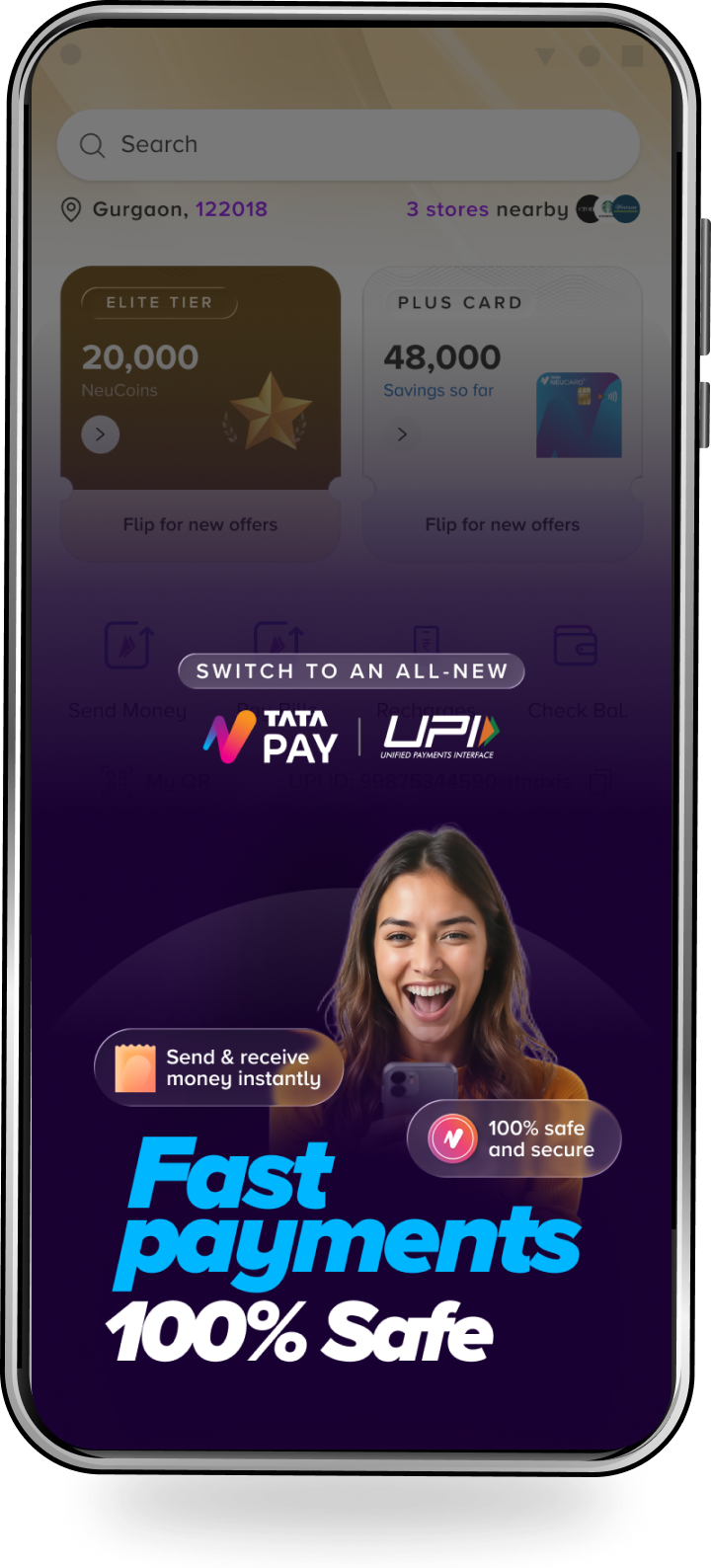

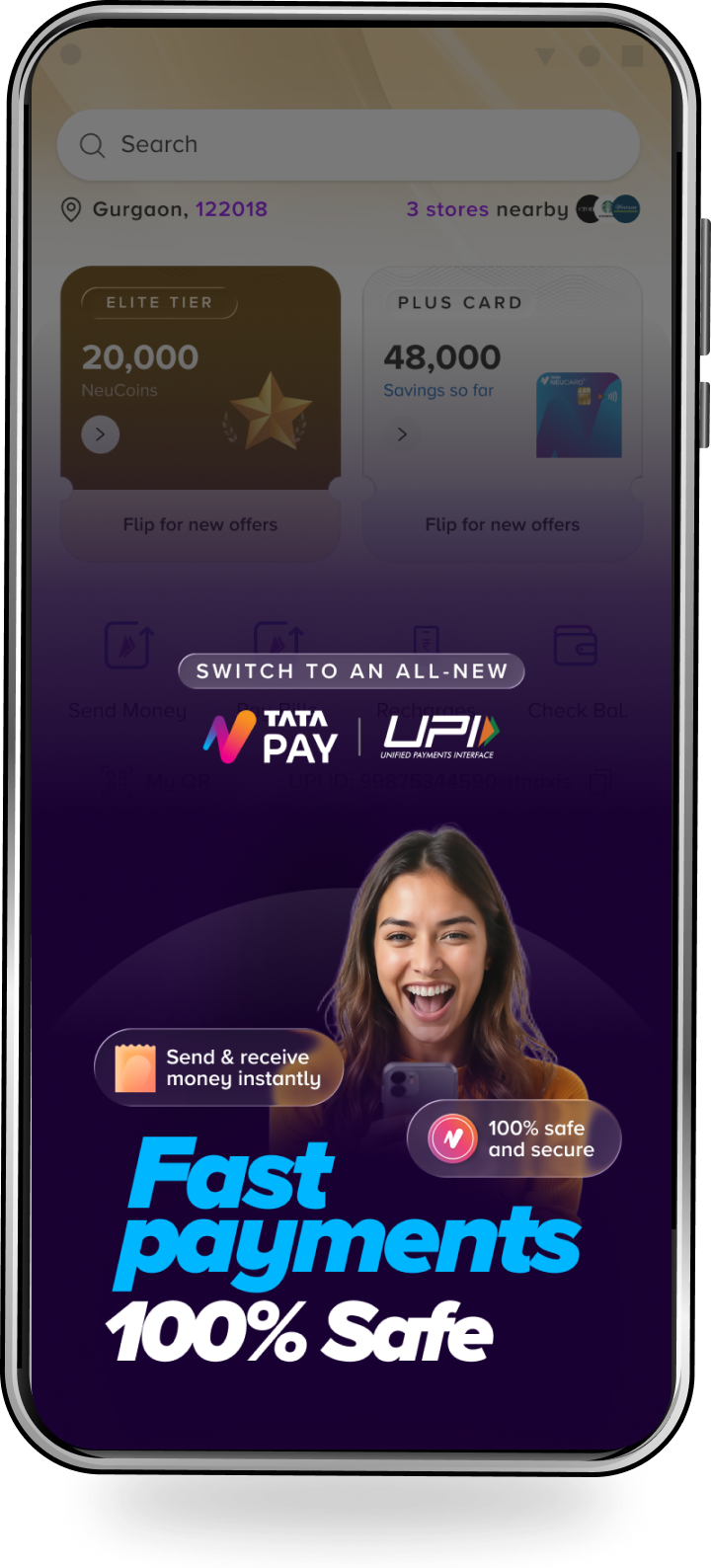

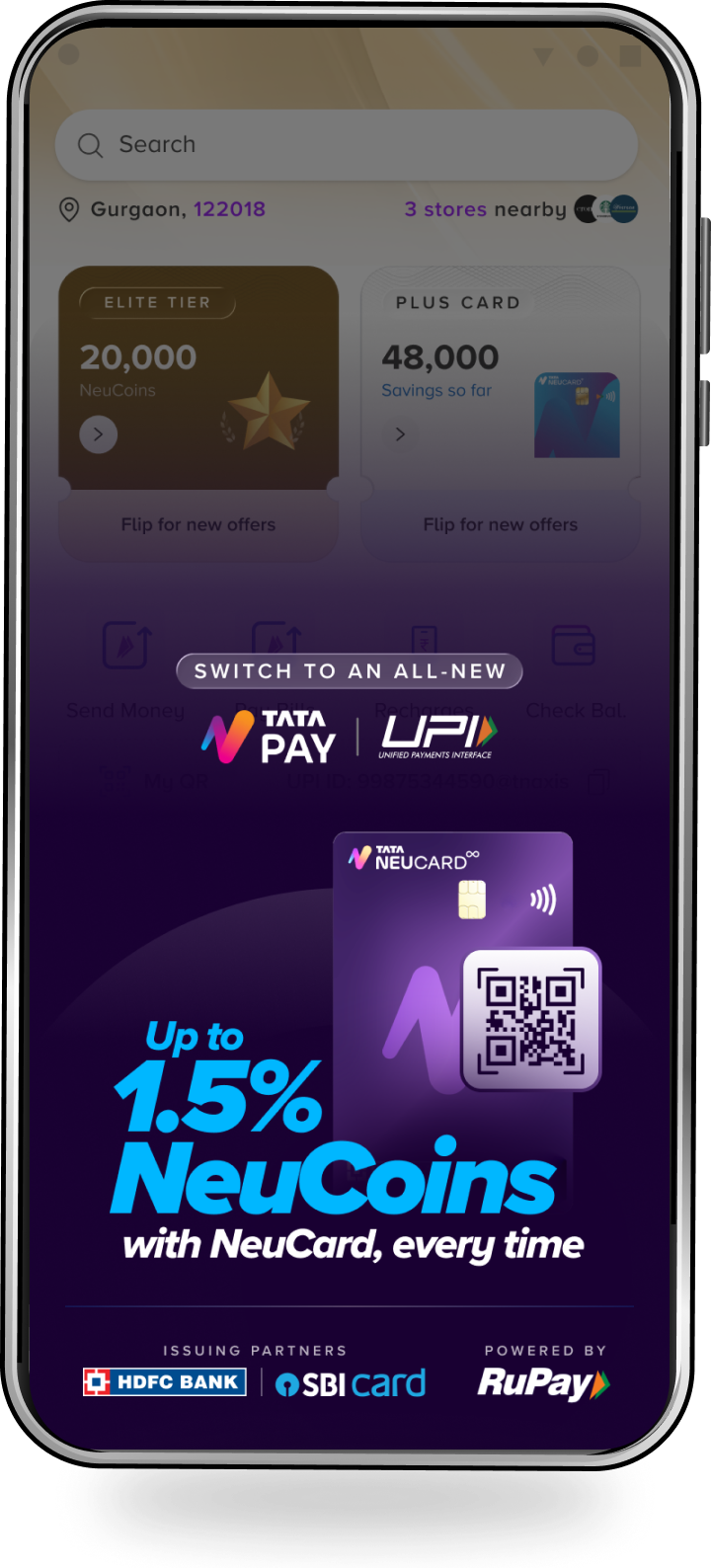

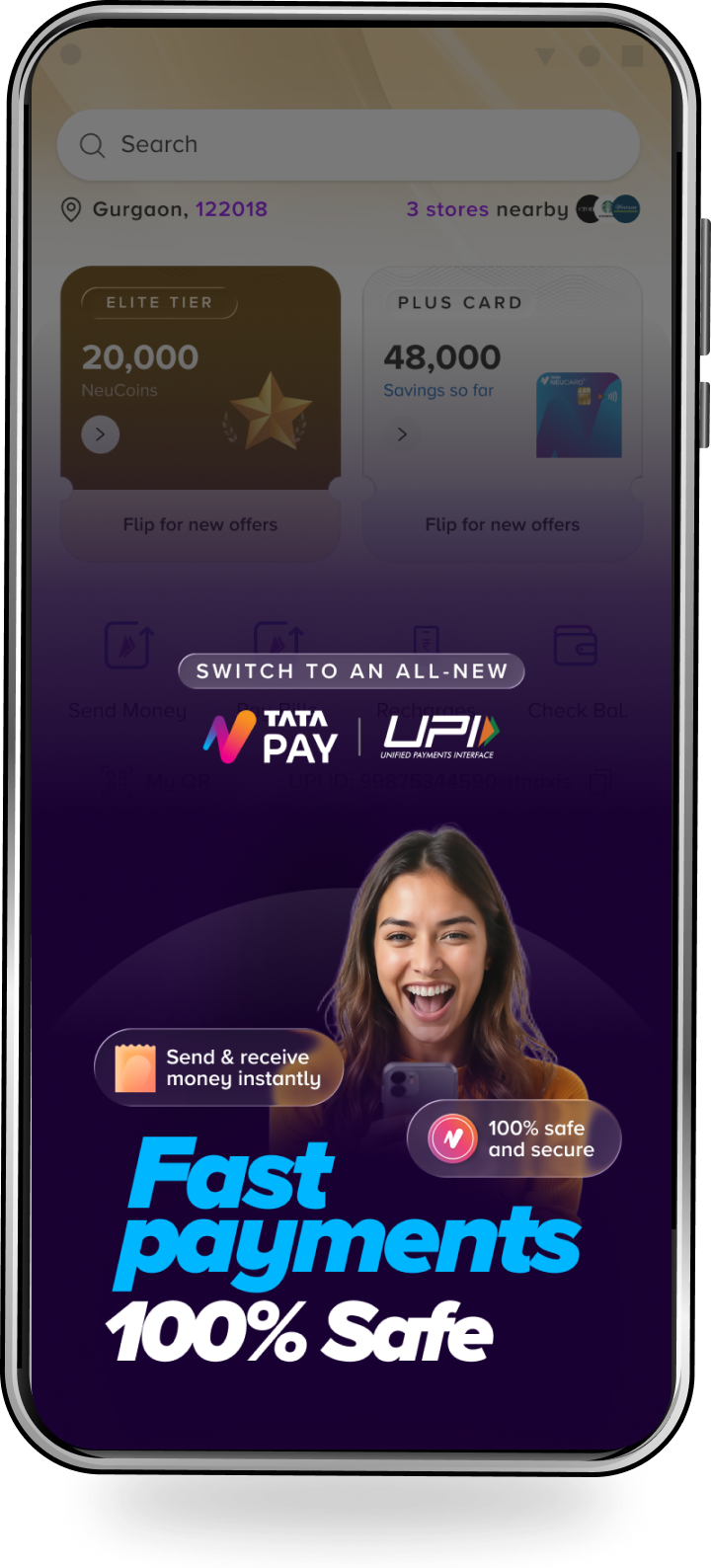

Why are we doing this and for whom

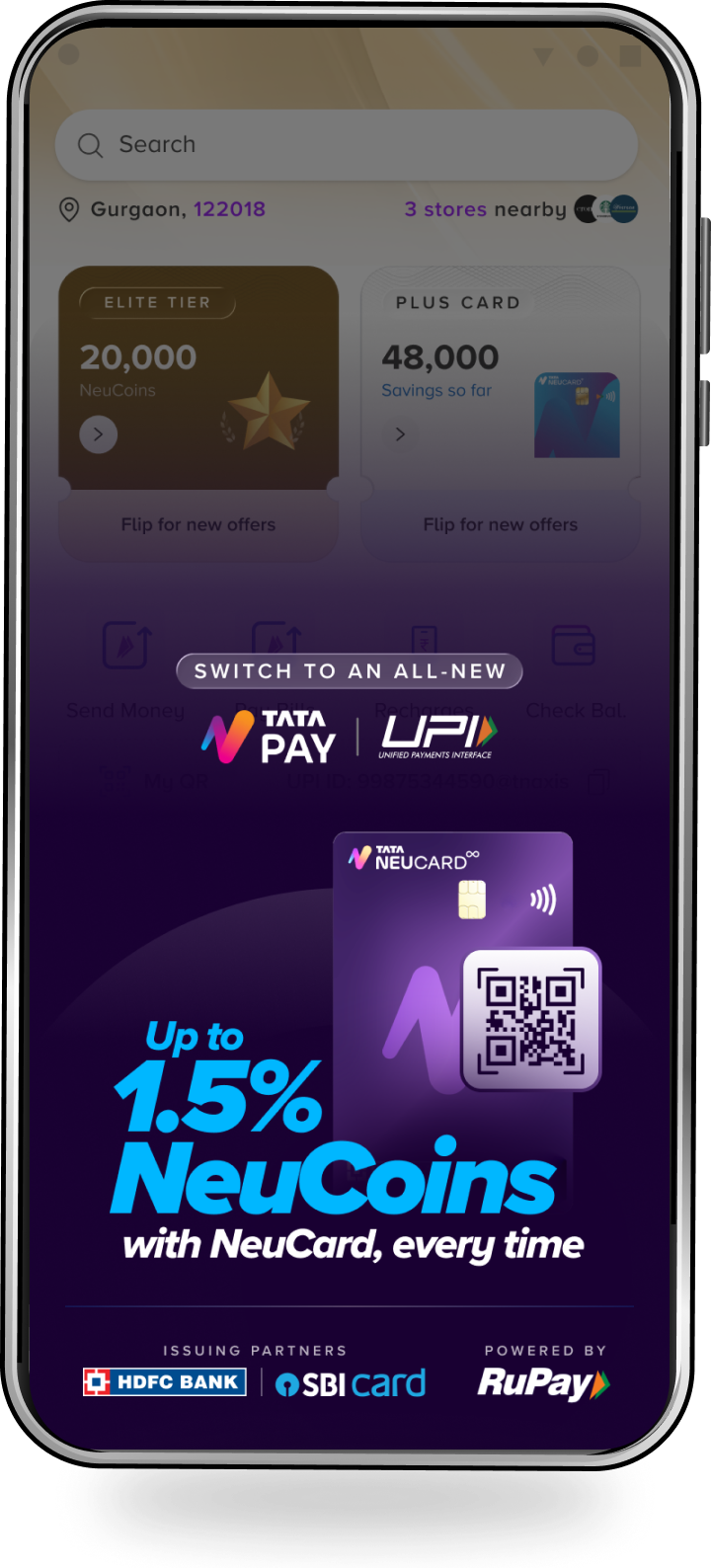

Meaningful reward clarity - Onboarding

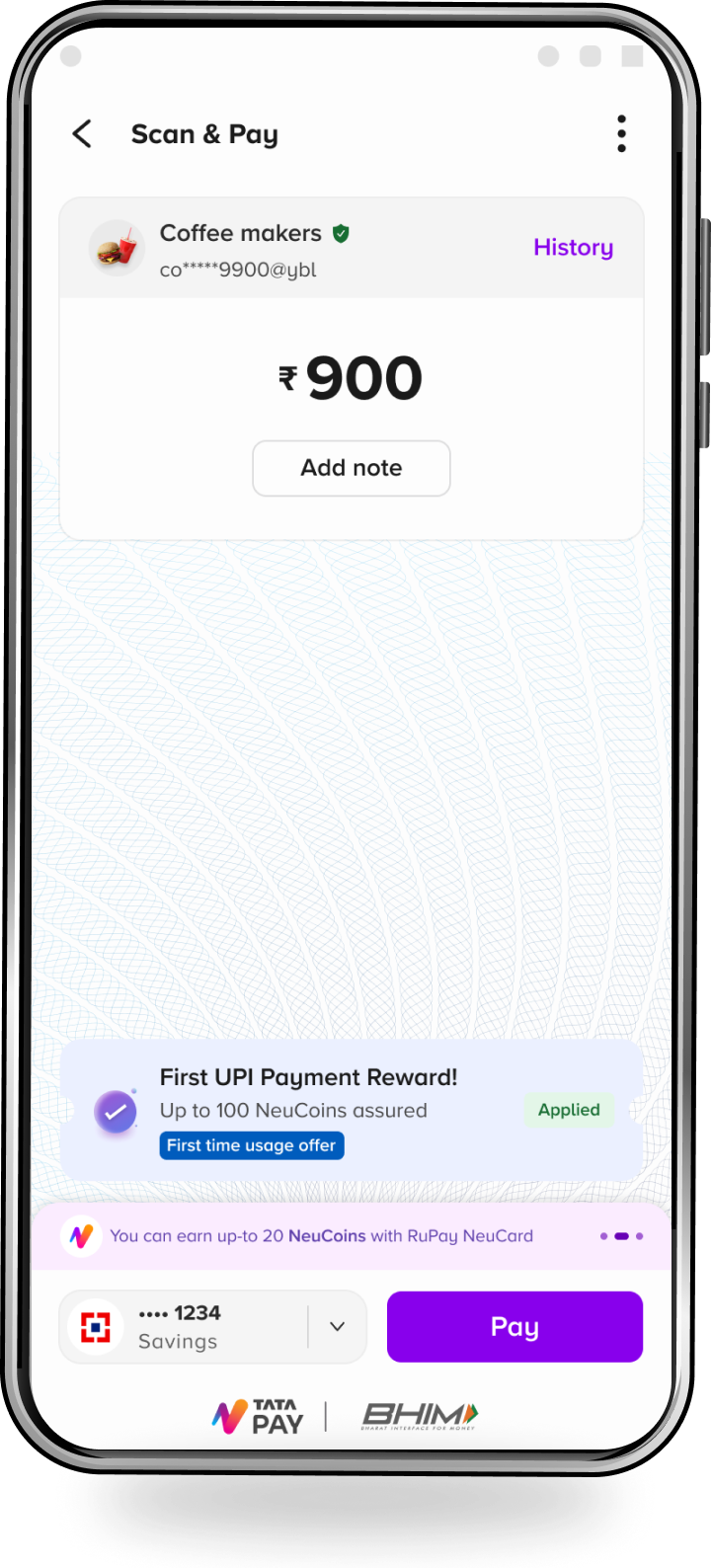

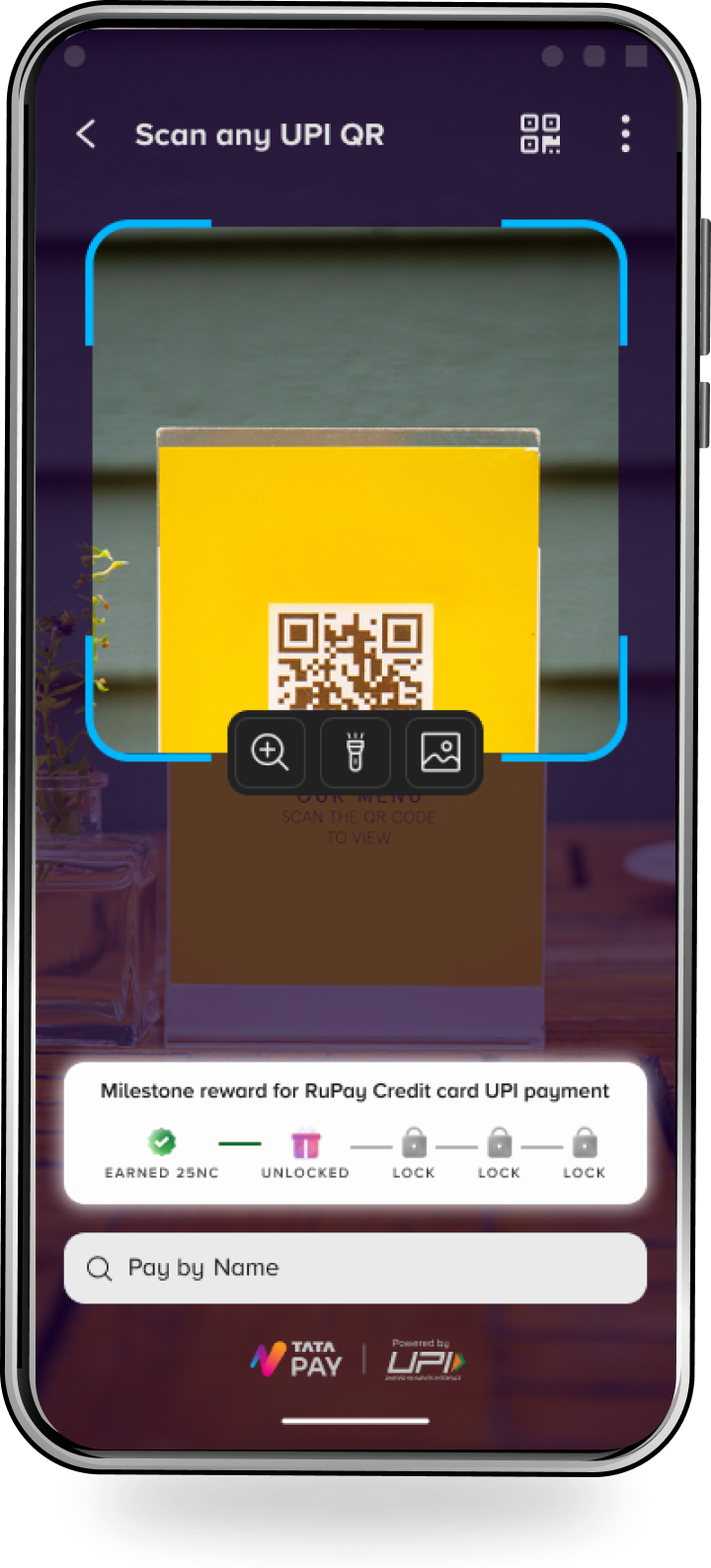

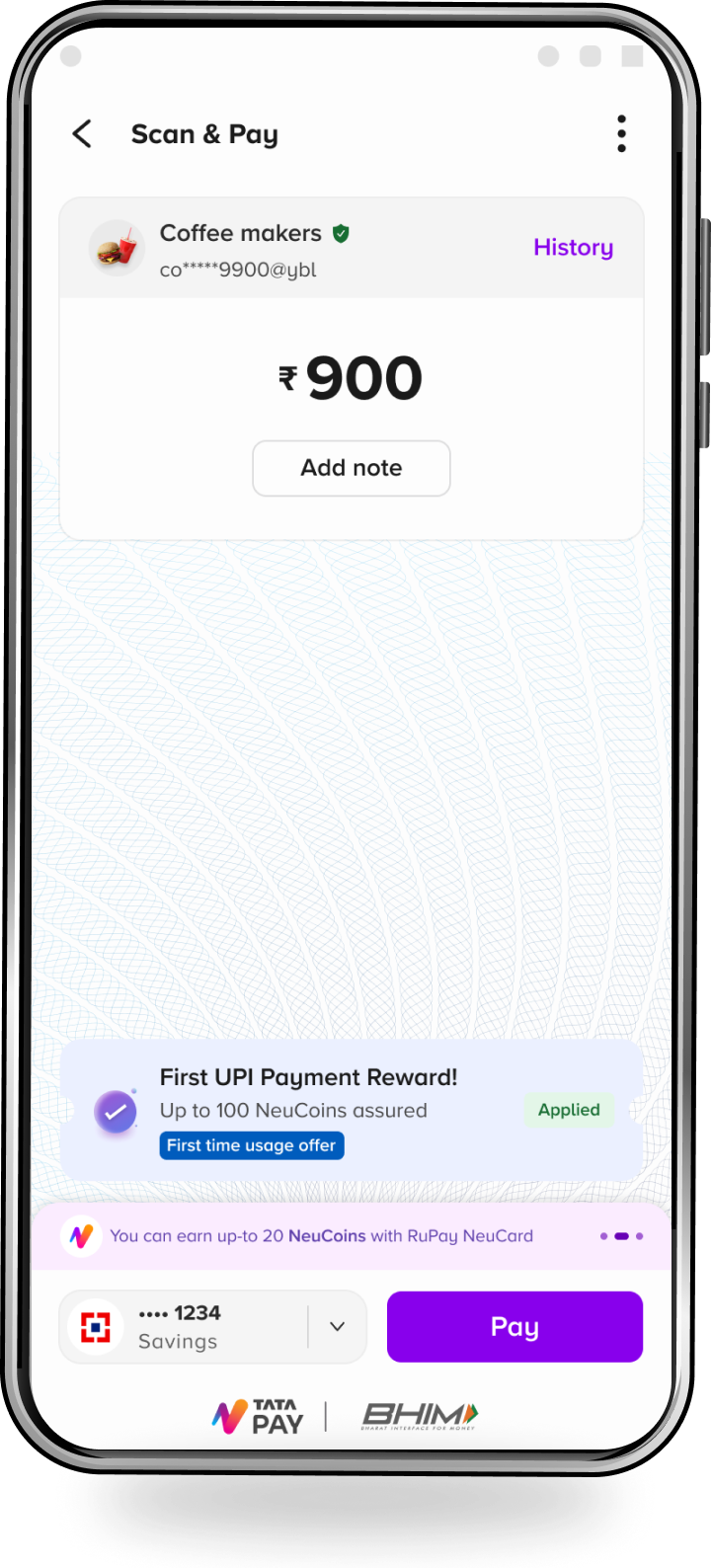

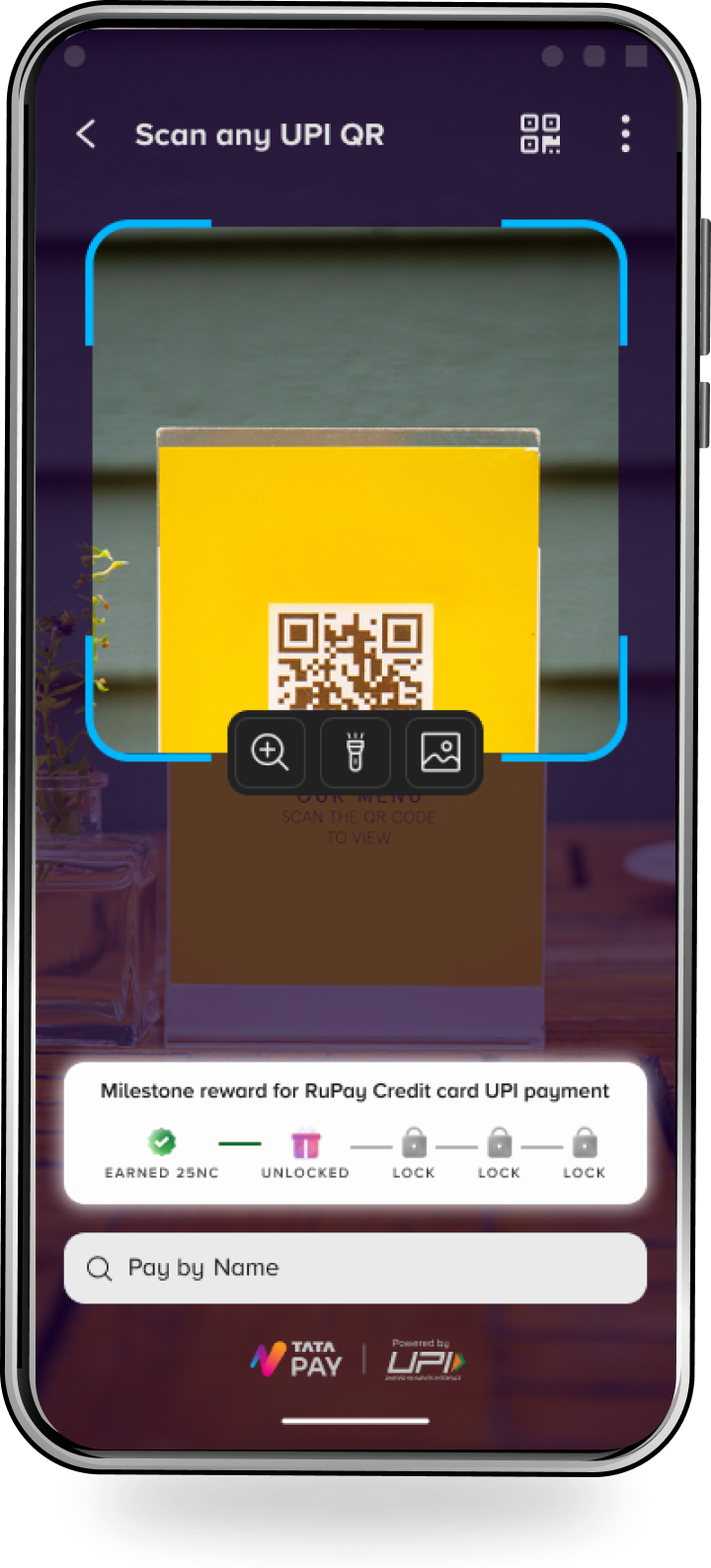

Scan & Pay with a delightful twist

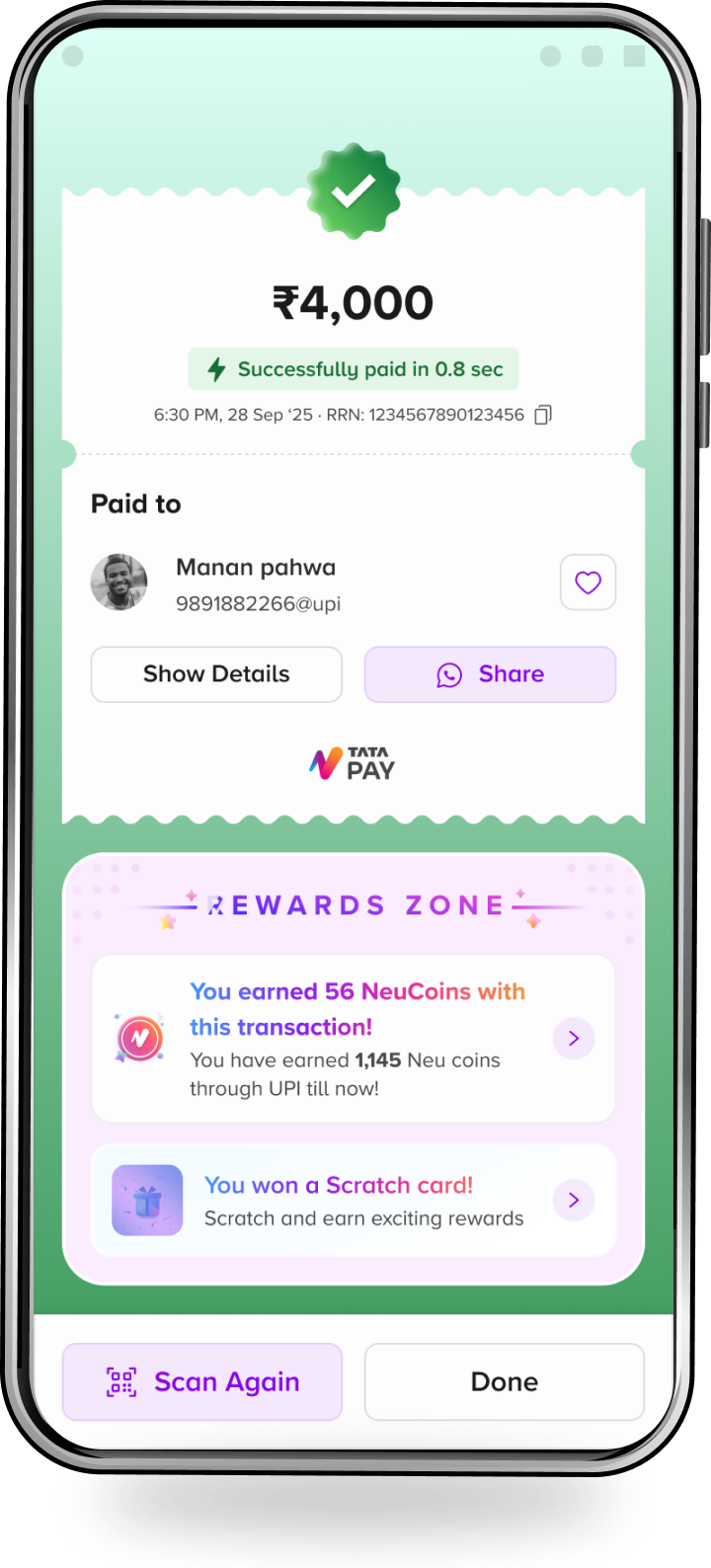

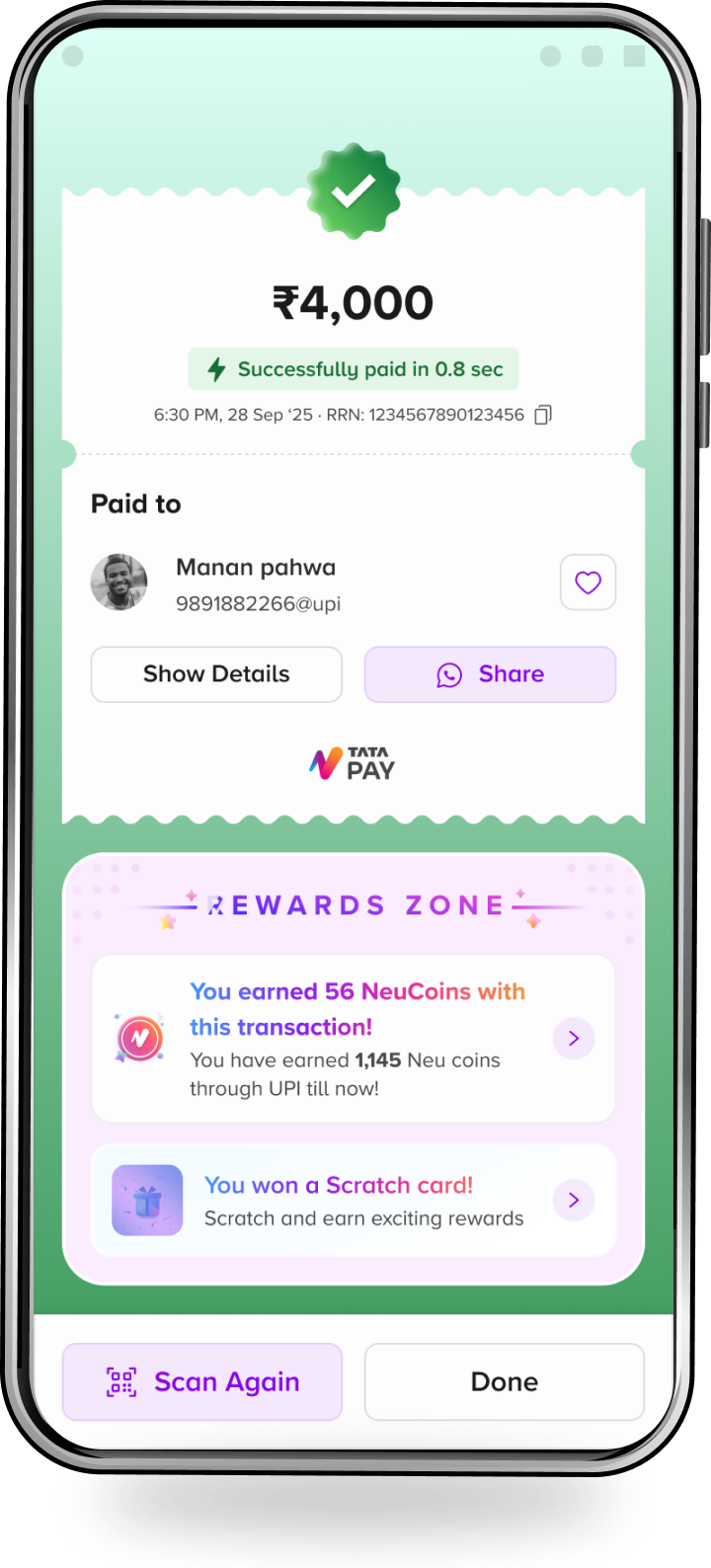

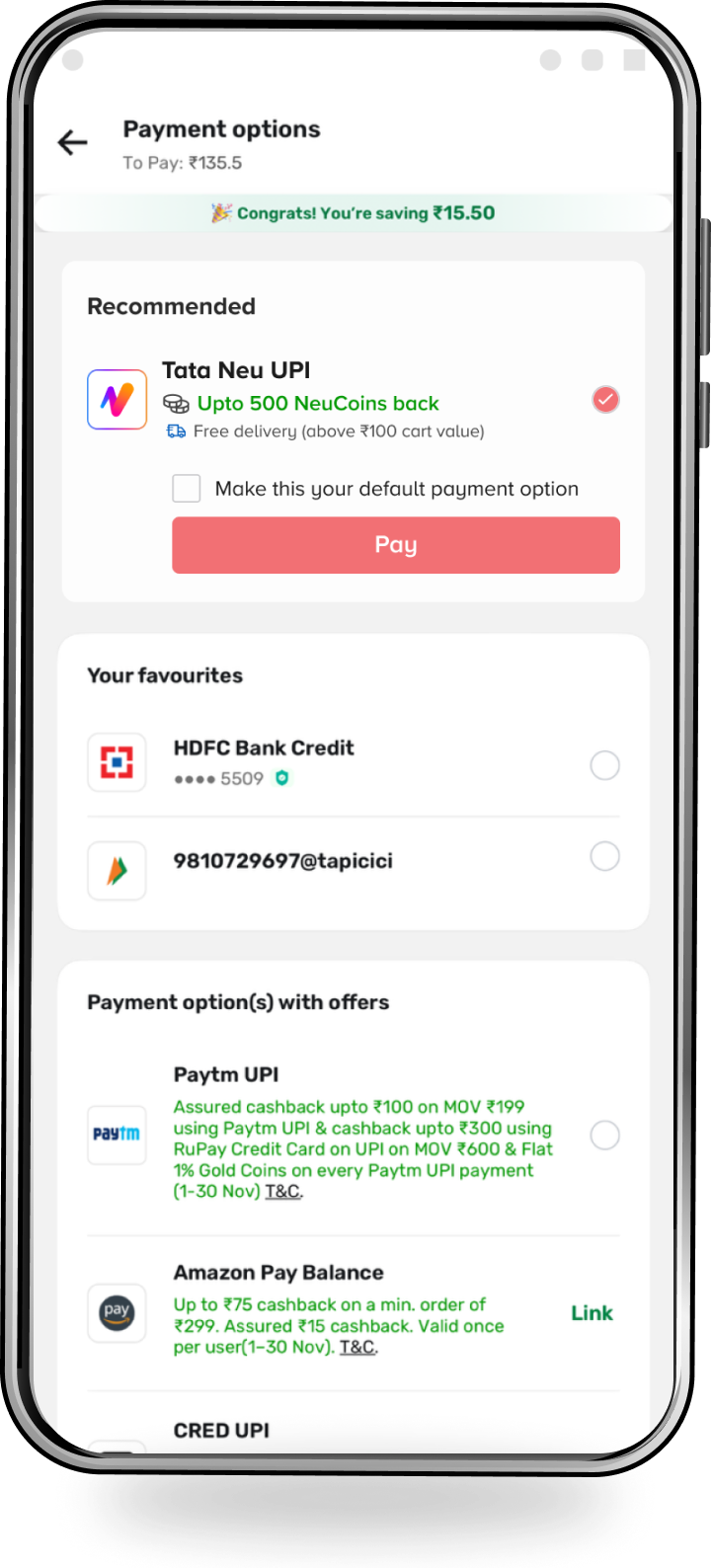

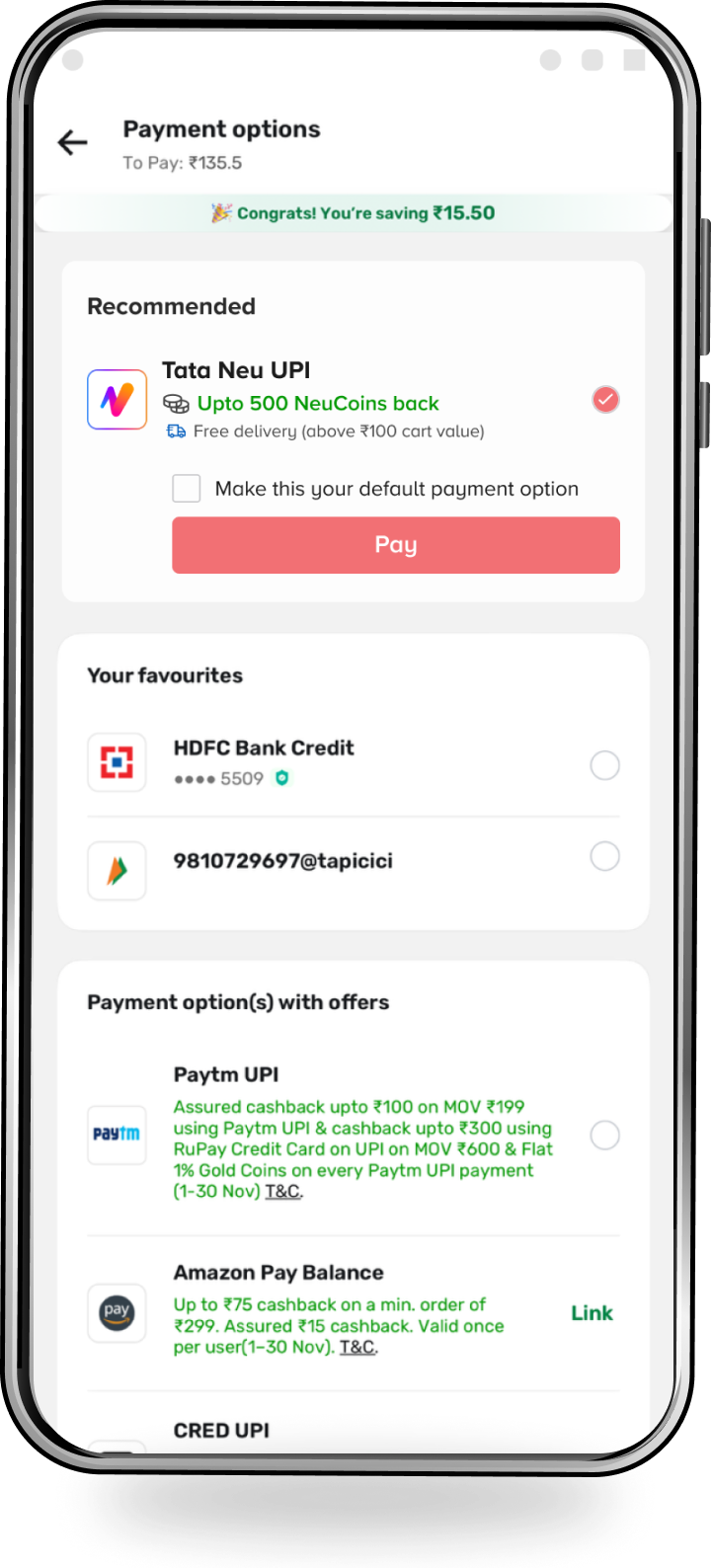

Reward reinforced in post payment

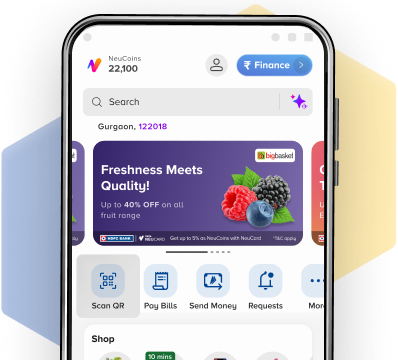

BEFORE → AFTER TRANSFORMATION

BEFORE

AFTER

Slow, unreliable

Predictable, fast, transparent

UPI hidden under commerce

UPI-first discovery

No reward

Real NeuCoins with clear value

Weak trust

Strong reliability & safety cues

No habit loop

Daily incentive loop + ecosystem value

“This redesign didn’t beautify UPI. It repositioned it.”

ROLLOUT & MATRICES - JAN ‘26

Tracking the only metrics that matter:

“The redesign is engineered to produce behavioural change, not UI delight.

CC-on-UPI linkage

First-week frequency

Reward redemption

UPI Daily-Active-Users contribution

Ecosystem transaction lift

Repeat payment retention

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects

ARVIND SETHIA - FEATURED PROJECT

Tata Neu UPI

Repositioning UPI for a Credit-First, Reward-Led India

UX execution

THE PROBLEM

1

Low success rate:People abandoned Tata Neu for GPay/PhonePe

2

Slow app experience: Contradicted what UPI must be

3

Scan & Pay buried:

Users couldn’t even find the core feature

4

Brand perception weak: “too slow, not a UPI app, don’t trust it”

“UPI was buried under commerce modules. Zero visibility, zero habit.”

THE STRATEGIC INSIGHT

A new reliable banking partner fixed the underlying performance issues.

At the same time, NPCI enabled Credit Card on UPI.

Tata Neu had 2M+ existing credit card users — an advantage no one else had at this scale.

OPPORTUNITY

Win not on generic UPI.

Win on:

Credit-first value +

Meaningful rewards.

THE DESIGN NORTH STAR

“The most rewarding credit-first UPI experience in India.”

A shift from paying → Earning.

From utility → Engagement engine.

From buried feature → Primary entry point.

This north star aligned Product, Business, Tech, and Design.

“Rebuilt the identity: Not cutting corners in Reliability, Speed in interaction, Value in every payment.”

WHAT I LED

Design Leadership

- Ran a 3-hour alignment workshop (18 cross-functional leaders).

- Co-led hypothesis-driven UPI research (21 hypotheses, 3 archetypes validated).

- Defined target user mix: Careful Explorers (60%) + Switchers (40%).

- Established the Core–Peripheral–Magic framework adopted across teams.

- Reset homepage & navigation priorities to bring UPI to the foreground.

- Directed end-to-end UX, UI, Visual, Motion for the entire redesign. (1team of 3TDesign lead- 1 (Myself), UX/UI Designer - 1, VD - )

- Ensured reward system clarity and alignment between product, loyalty, and tech.

FRAMEWORK: Core → Peripheral → Magic

Core (must-have for adoption)

- Upfront Discoverability

- Immediate Scan & Pay

- Dedicated UPI widget

- Reliable Transaction Loop

- Clear pending → processing → success states

- Fast perceived feedback

- Meaningful Reward Clarity

- Direct NeuCoins with visible value

- No random scratch card

Peripheral (reinforces trust + preference)

Speed

Sense of Security

Payment insights (Expenses & Rewards)

Bold visuals

Magic (unique to Tata Neu)

Credit-Driven Reward Flywheel

- CC-on-UPI benefit surfaced before payment

- Higher NeuCoin earnings for CC-linked transactions

- Tier progression → habit formation

Ecosystem Advantage

- Utility of rewards across Croma, BigBasket, Cliq, 1mg

- Unified value visualization

KEY DESIGNS

Why are we doing this and for whom

Meaningful reward clarity - Onboarding

Scan & Pay with a delightful twist

Reward reinforced in post payment

BEFORE → AFTER TRANSFORMATION

BEFORE

AFTER

Slow, unreliable

Predictable, fast, transparent

UPI hidden under commerce

UPI-first discovery

No reward

Real NeuCoins with clear value

Weak trust

Strong reliability & safety cues

No habit loop

Daily incentive loop + ecosystem value

“This redesign didn’t beautify UPI. It repositioned it.”

ROLLOUT & MATRICES - JAN ‘26

Tracking the only metrics that matter:

CC-on-UPI linkage

First-week frequency

Reward redemption

UPI Daily-Active-Users contribution

Ecosystem transaction lift

Repeat payment retention

“The redesign is engineered to produce behavioural change, not UI delight.

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects

ARVIND SETHIA - MORE PROJECT

Tata Neu UPI

Repositioning UPI for a Credit-First, Reward-Led India

BEHAVIOURAL UX

THE PROBLEM

1

Low success rate:People abandoned Tata Neu for GPay/PhonePe

2

Slow app experience: Contradicted what UPI must be

3

Scan & Pay buried:

Users couldn’t even find the core feature

4

Brand perception weak:

“too slow, not a UPI app, don’t trust it”

“UPI was buried under commerce modules. Zero visibility, zero habit.”

THE STRATEGIC INSIGHT

A new reliable banking partner fixed the underlying performance issues.

At the same time, NPCI enabled Credit Card on UPI.

Tata Neu had 2M+ existing credit card users — an advantage no one else had at this scale.

OPPORTUNITY

Win not on generic UPI.

Win on:

Credit-first value +

Meaningful rewards.

THE DESIGN NORTH STAR

“The most rewarding credit-first UPI experience in India.”

A shift from paying → Earning.

From utility → Engagement engine.

From buried feature → Primary entry point.

This north star aligned Product, Business, Tech, and Design.

“Rebuilt the identity: Not cutting corners in Reliability, Speed in interaction, Value in every payment.”

WHAT I LED

Design Leadership

- Ran a 3-hour alignment workshop (18 cross-functional leaders).

- Co-led hypothesis-driven UPI research (21 hypotheses, 3 archetypes validated).

- Defined target user mix: Careful Explorers (60%) + Switchers (40%).

- Established the Core–Peripheral–Magic framework adopted across teams.

- Reset homepage & navigation priorities to bring UPI to the foreground.

- Directed end-to-end UX, UI, Visual, Motion for the entire redesign. (Total team of 3: Design lead- 1 (Myself), UX/UI Designer - 1, VD - 1 )

- Ensured reward system clarity and alignment between product, loyalty, and tech.

FRAMEWORK: Core → Peripheral → Magic

Core (must-have for adoption)

- Upfront Discoverability

- Immediate Scan & Pay

- Dedicated UPI widget

- Reliable Transaction Loop

- Clear pending → processing → success states

- Fast perceived feedback

- Meaningful Reward Clarity

- Direct NeuCoins with visible value

- No random scratch card

Peripheral (reinforces trust + preference)

Speed

Sense of Security

Payment insights (Expenses & Rewards)

Bold visuals

Magic (unique to Tata Neu)

Credit-Driven Reward Flywheel

- CC-on-UPI benefit surfaced before payment

- Higher NeuCoin earnings for CC-linked transactions

- Tier progression → habit formation

Ecosystem Advantage

- Utility of rewards across Croma, BigBasket, Cliq, 1mg

- Unified value visualization

KEY DESIGNS

Play the video, to experience the flow

Meaningful reward clarity - Onboarding

Scan & Pay with a delightful twist

Reward reinforced in post payment

BEFORE → AFTER TRANSFORMATION

BEFORE

AFTER

Slow, unreliable

Predictable, fast, transparent

UPI hidden under commerce

UPI-first discovery

No reward

Real NeuCoins with clear value

Weak trust

Strong reliability & safety cues

No habit loop

Daily incentive loop + ecosystem value

“This redesign didn’t beautify UPI. It repositioned it.”

ROLLOUT & MATRICES - JAN ‘26

Tracking the only metrics that matter:

CC-on-UPI linkage

First-week frequency

Reward redemption

UPI Daily-Active-Users contribution

Ecosystem transaction lift

Repeat payment retention

“The redesign is engineered to produce behavioural change, not UI delight.

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects