Best viewed on desktop or laptop

Mobile might struggle a bit

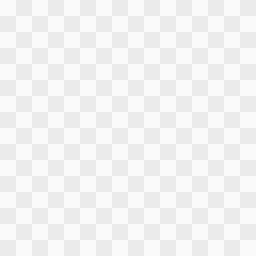

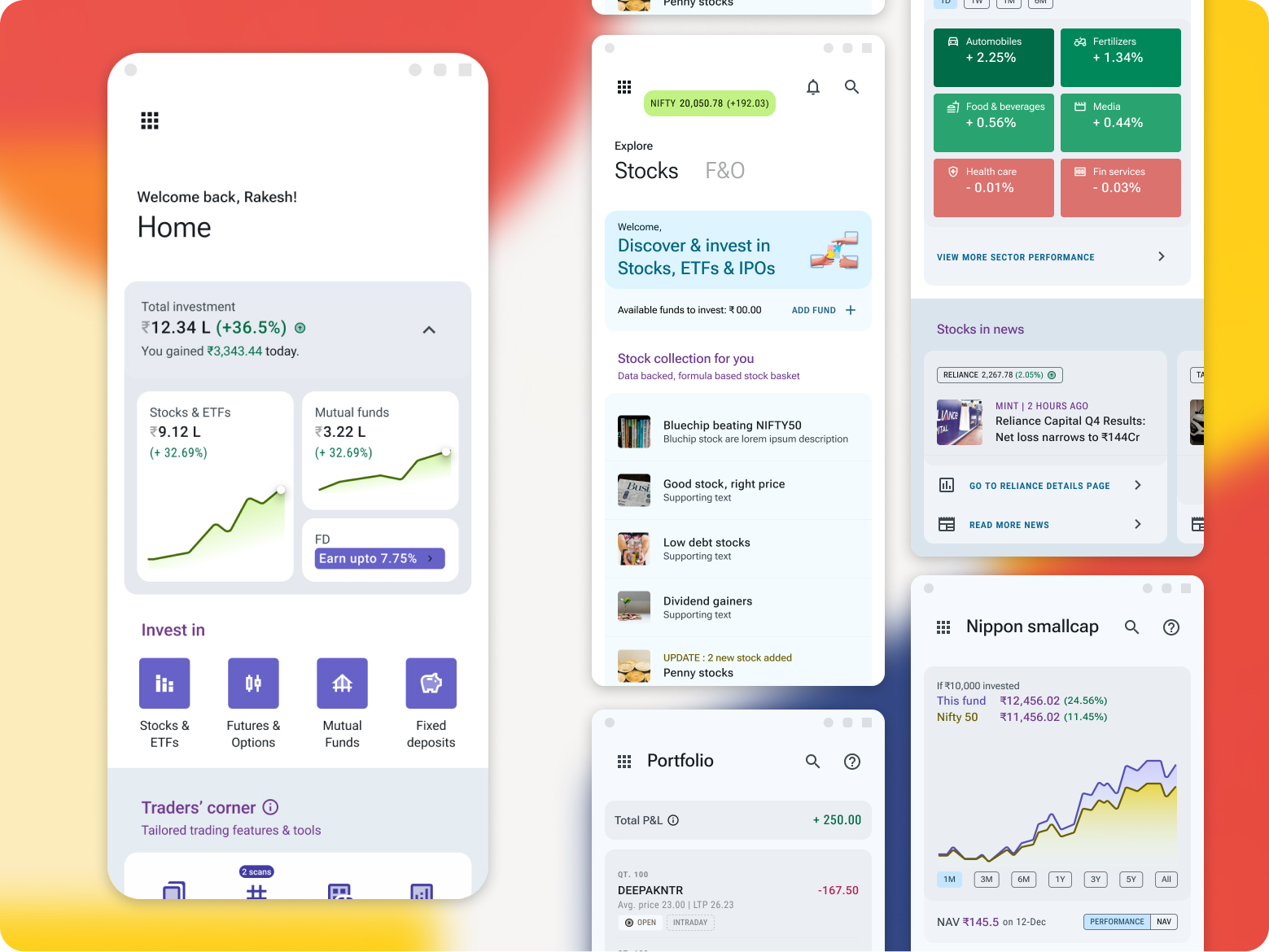

ARVIND SETHIA - MORE PROJECT

Agentic AI for Insurance Documentation

Designing an autonomous, compliance-safe system to reduce friction in insurance issuance

Strategy Design

OVERVIEW

Insurance documentation is one of the highest-friction journeys in Tata Neu — long, error-prone, and heavily dependent on manual intervention.

I designed an agentic onboarding framework that activates after user-authorised KYC, autonomously prepares data, resolves inconsistencies, suppresses irrelevant inputs, and dynamically constructs the shortest valid journey for each user.

The result is a system that reduces effort without adding conversational overhead, while staying fully compliant with insurance regulations.

CONTEXT

AI changed user expectations — but not through in-app chatbots.

Users increasingly rely on general-purpose AI (ChatGPT, Gemini, Perplexity) to understand options and make decisions, then return to apps only to transact.

In-app conversational assistants saw early curiosity but declining long-term engagement, especially in high-stake financial journeys.

This revealed a gap:

1

Users don’t want to talk to AI inside apps

2

They want AI to quietly remove friction inside the task

This insight reframed the problem from:

“Building a better chatbot” → Designing “autonomous intelligence” inside journeys.

PROBLEM

Insurance post-payment documentation (KYC → personal → nominee → health → upload) suffered from:

50+ fields

High mismatch between user input and documents

Frequent underwriting back-and-forth

~35–45% drop-offs at mid-stage

Heavy dependency on call centers

Long issuance SLAs (Service level agreements)

A static form could never solve this. An autonomous agent could.

This project redefines how AI can operate inside financial services:

Not as a chatbot

But as a silent, intelligent collaborator

DESIGN INTENT

Instead of adding conversational AI, I explored Agentic Experience Design:

AI that operates autonomously within the journey- Preparing data, resolving conflicts, and adapting the UI- Without requiring users to interact with it explicitly.

The focus was on:

1

Low-stake first → build trust safely

2

Silent when possible, visible when needed

3

Contextual intelligence, not global chatbot

4

Dynamic UI instead of static forms

5

Users always retain final control

Study | Sep 2025

Coming soon

AI casestudy

We also did indepth understanding of ‘Conversational UI’.

Details in this blog

AGENT SYSTEM ARCHITECTURE (HIGH LEVEL)

KYC Inputs - User-Initiated KYC (Compliance Gate)

Review layer

Agent layer

Fetches

Synthesises

Predicts

KYC rules

Conflict resolution

Confidence thresholds

Underwriting logic

Constructs screens on the fly;

suppresses irrelevant fields

OCR

Formatting corrections, mismatch detection

Policy engine

Dynamic UI builder

Verification layer

User overrides, revalidation, trust & transparency

The agent activates only after explicit user consent and KYC authentication.

WHAT I DESIGNED

Peripheral (reinforces trust + preference)

Identity verification is explicitly user-driven and compliance-bound.

Users complete KYC via: Digilocker, PAN or AADHAR with OTP verification or Manual document upload

Until KYC is completed, the agent remains inactive by design.

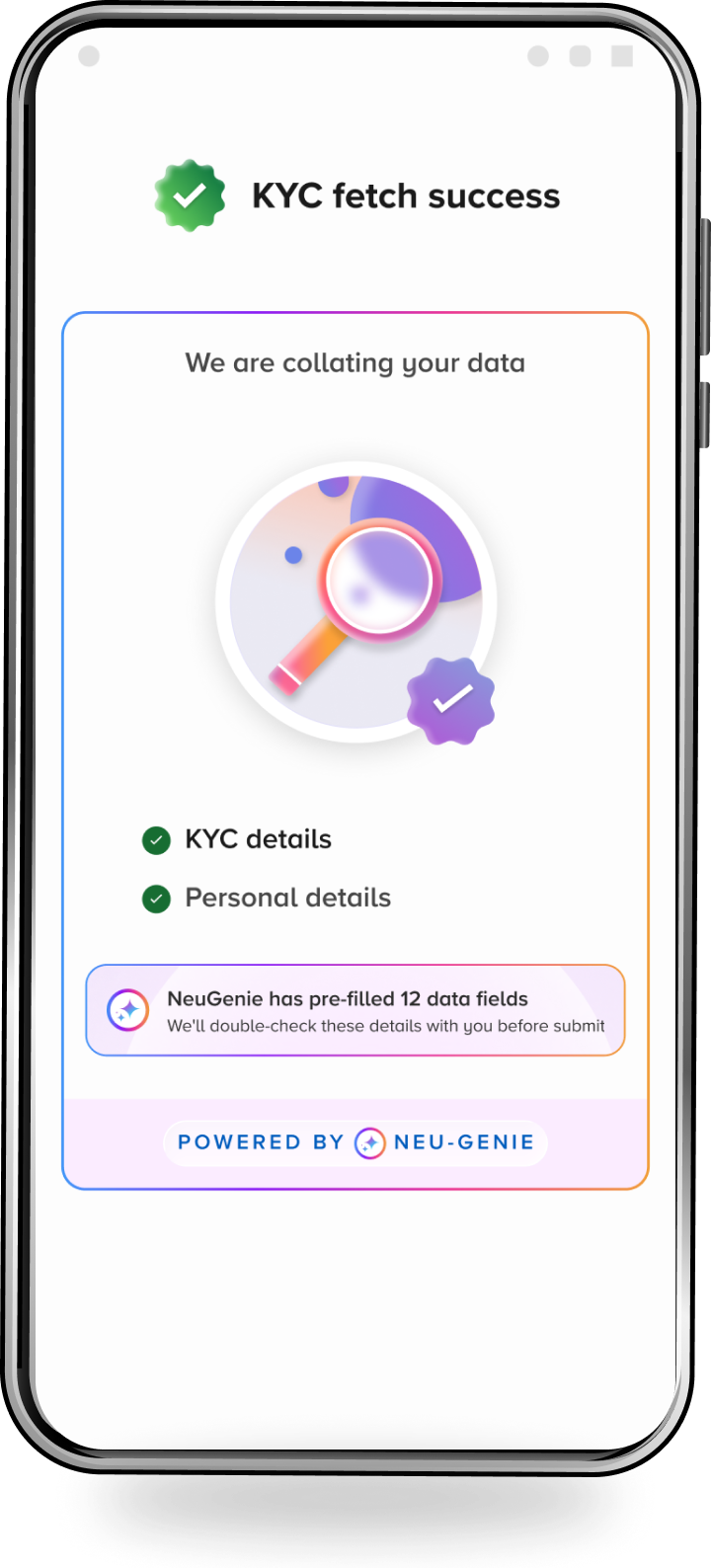

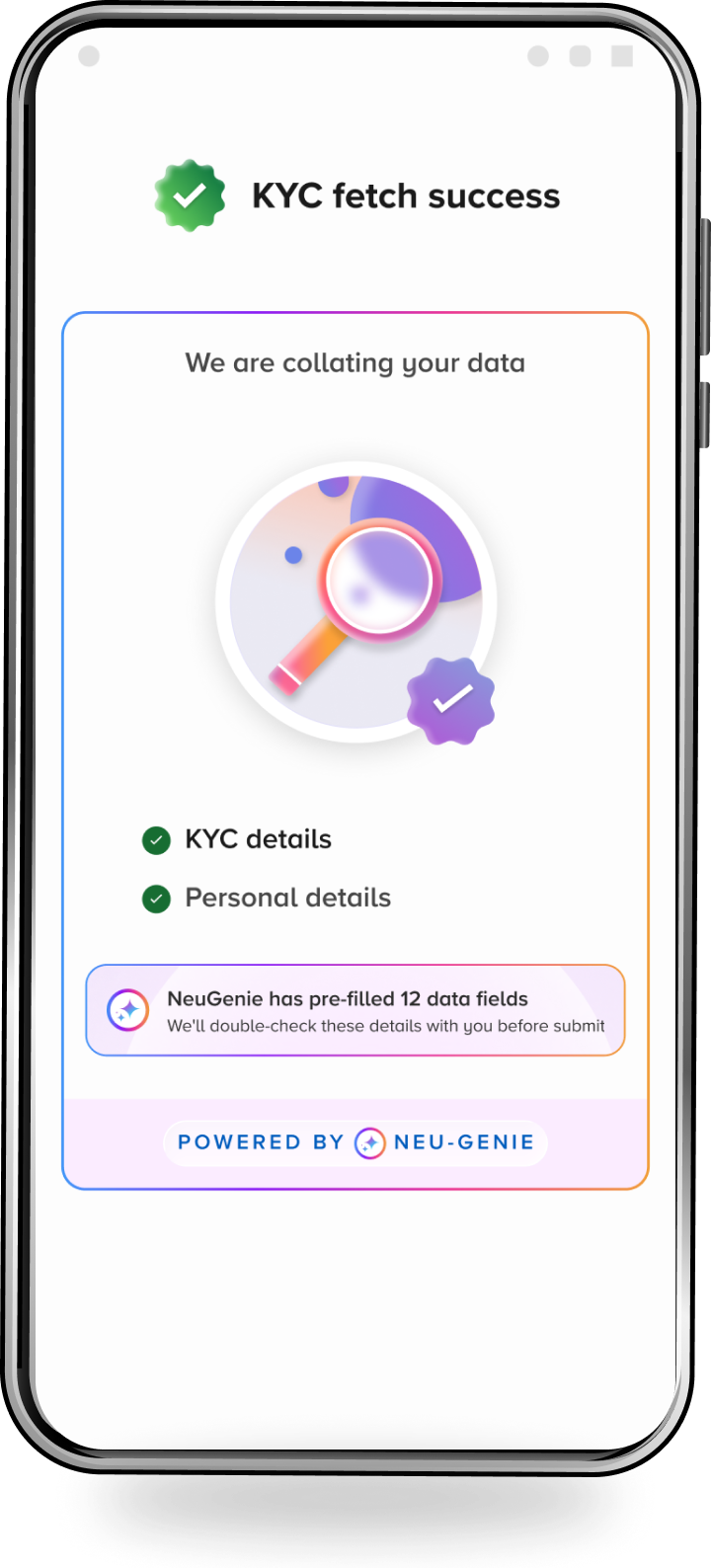

Once KYC is authenticated and consent is established, the agent:

retrieves verified identity attributes

reconciles data across sources

normalises formatting (name, address, DOB)

resolves low-confidence issues silently

flags only material mismatches for user confirmation

evaluates downstream dependencies

determines the smallest valid journey required

Outcome:

30–60% of downstream fields are resolved before the next UI step appears.

Peripheral (reinforces trust + preference)

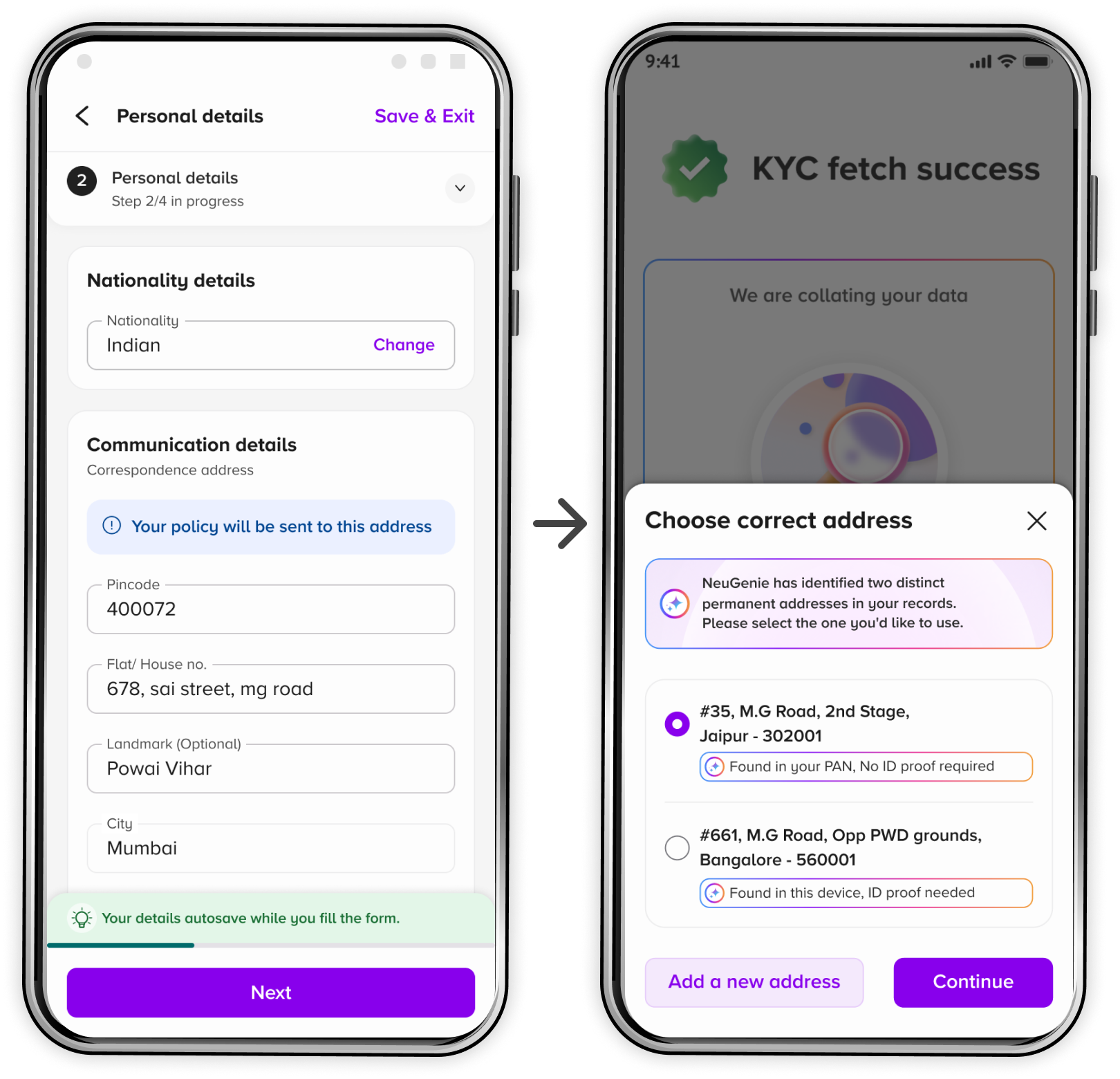

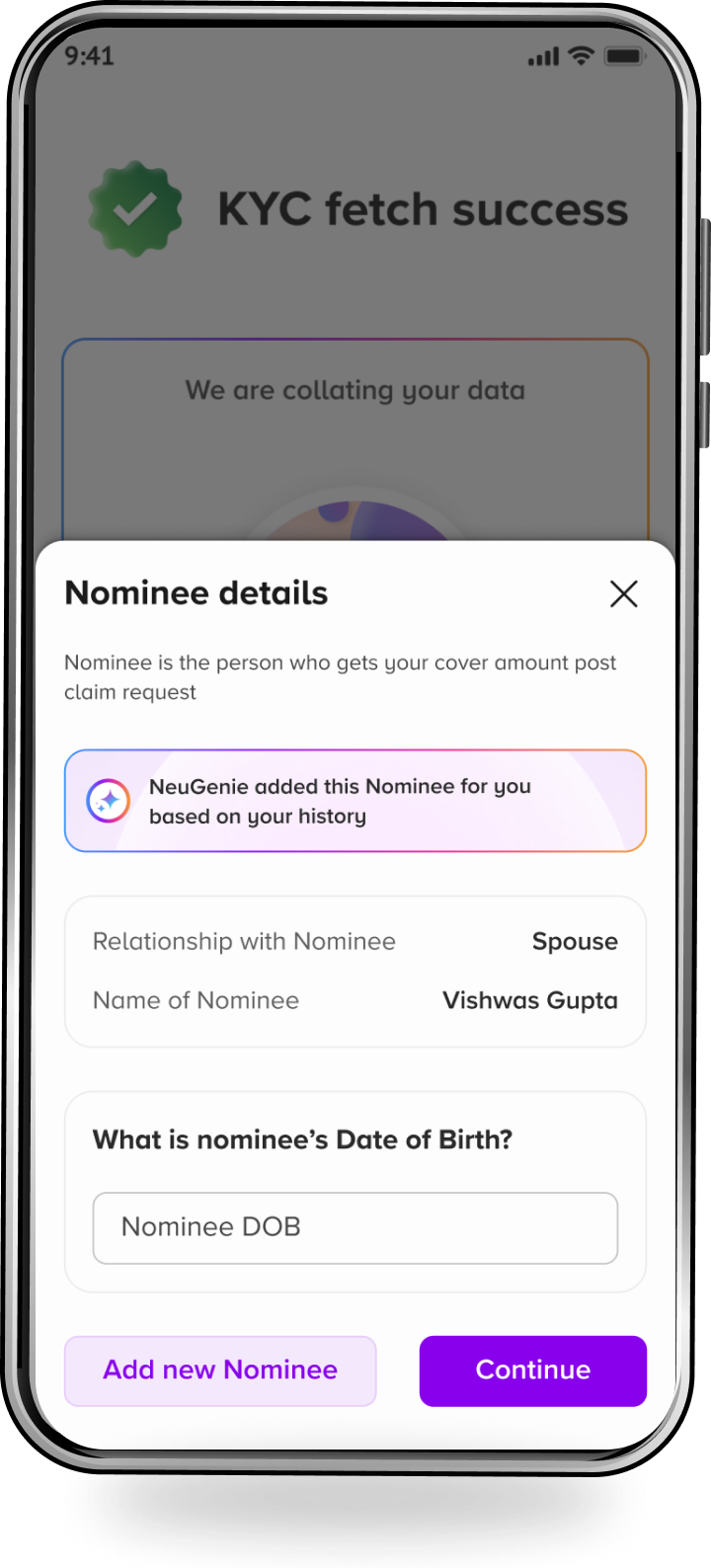

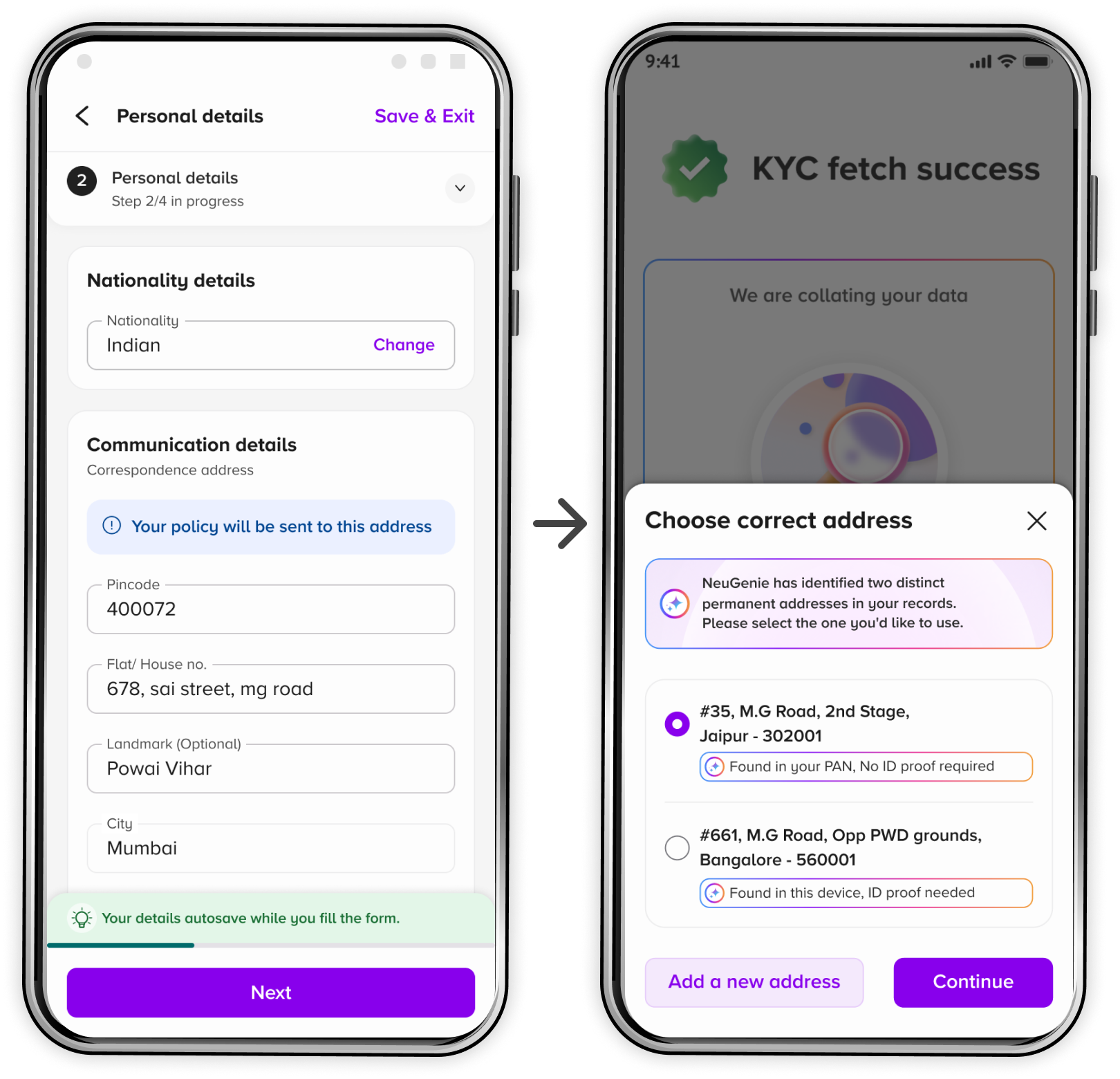

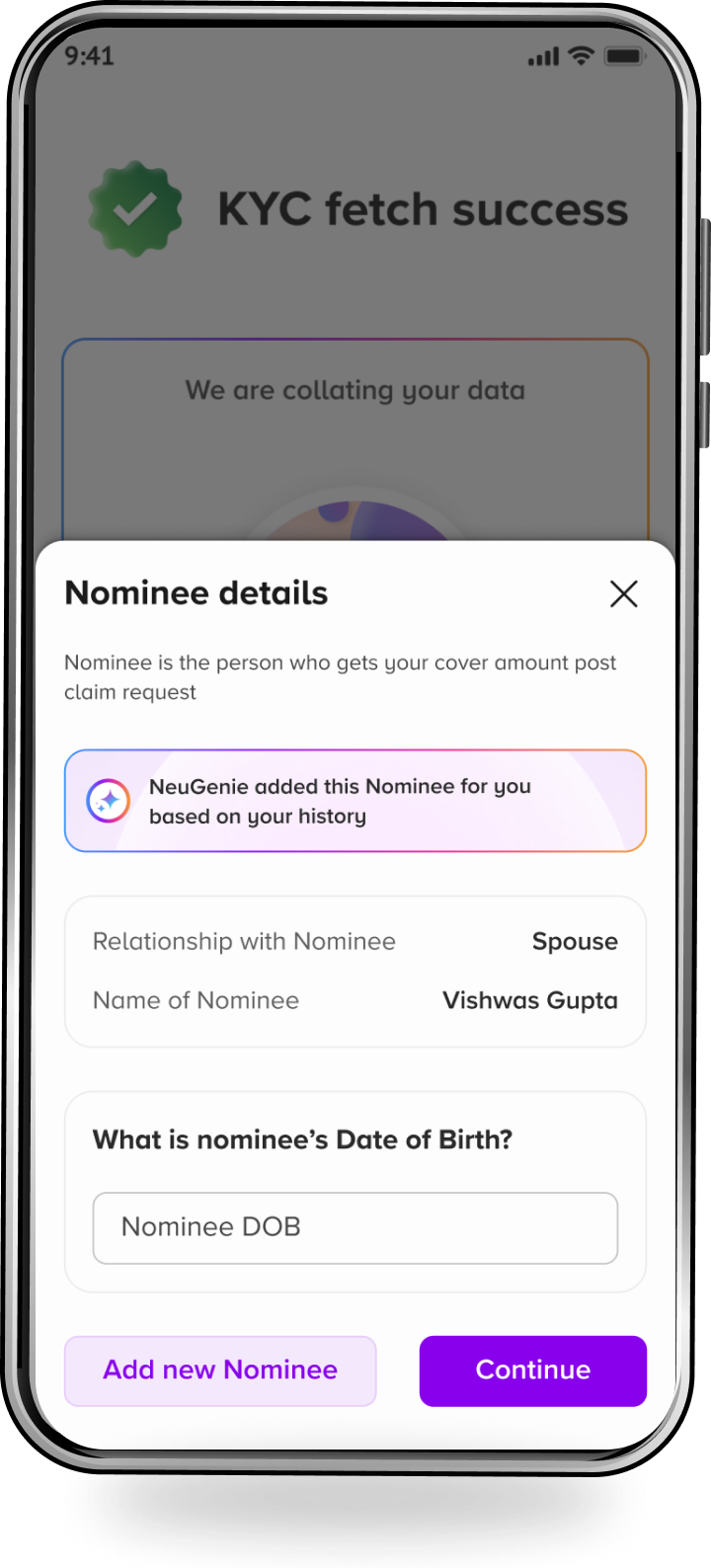

After KYC, the journey is no longer linear.

The agent builds a unique flow for each user:

Scenario A: Data Available

auto-filled personal details

auto-selected nominee

reduced health questions

minimized document requirements

Scenario B: No Data Available

DOB

Work type

Nominee relation

From these, the agent derives 20+ dependent fields.

Outcome:

Different users see different journeys — all valid, all shorter.

Peripheral (reinforces trust + preference)

The agent continuously checks for inconsistencies across: KYC data, User inputs, Document outputs

Scenario A: Silent actions (no UI)

Formatting corrections

Casing & spacing normalisation

Duplicate field resolution

Scenario B: Visible actions (UI surfaced)

Identity mismatches

Address conflicts

Contradictory declarations

User input is requested only when confidence drops below threshold or compliance requires confirmation.

Outcome:

Fewer errors, fewer underwriting rejections, fewer follow-ups.

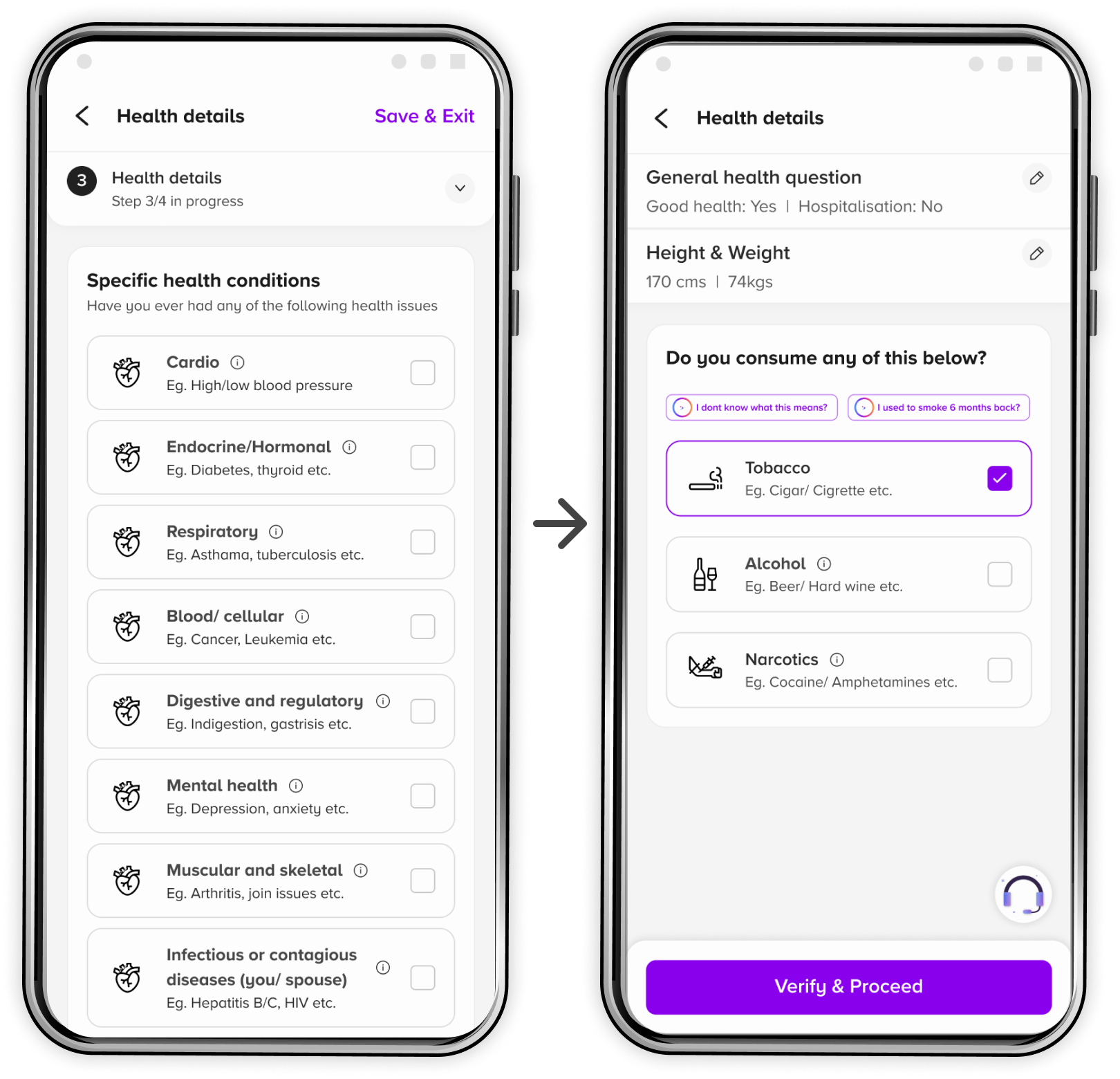

Peripheral (reinforces trust + preference)

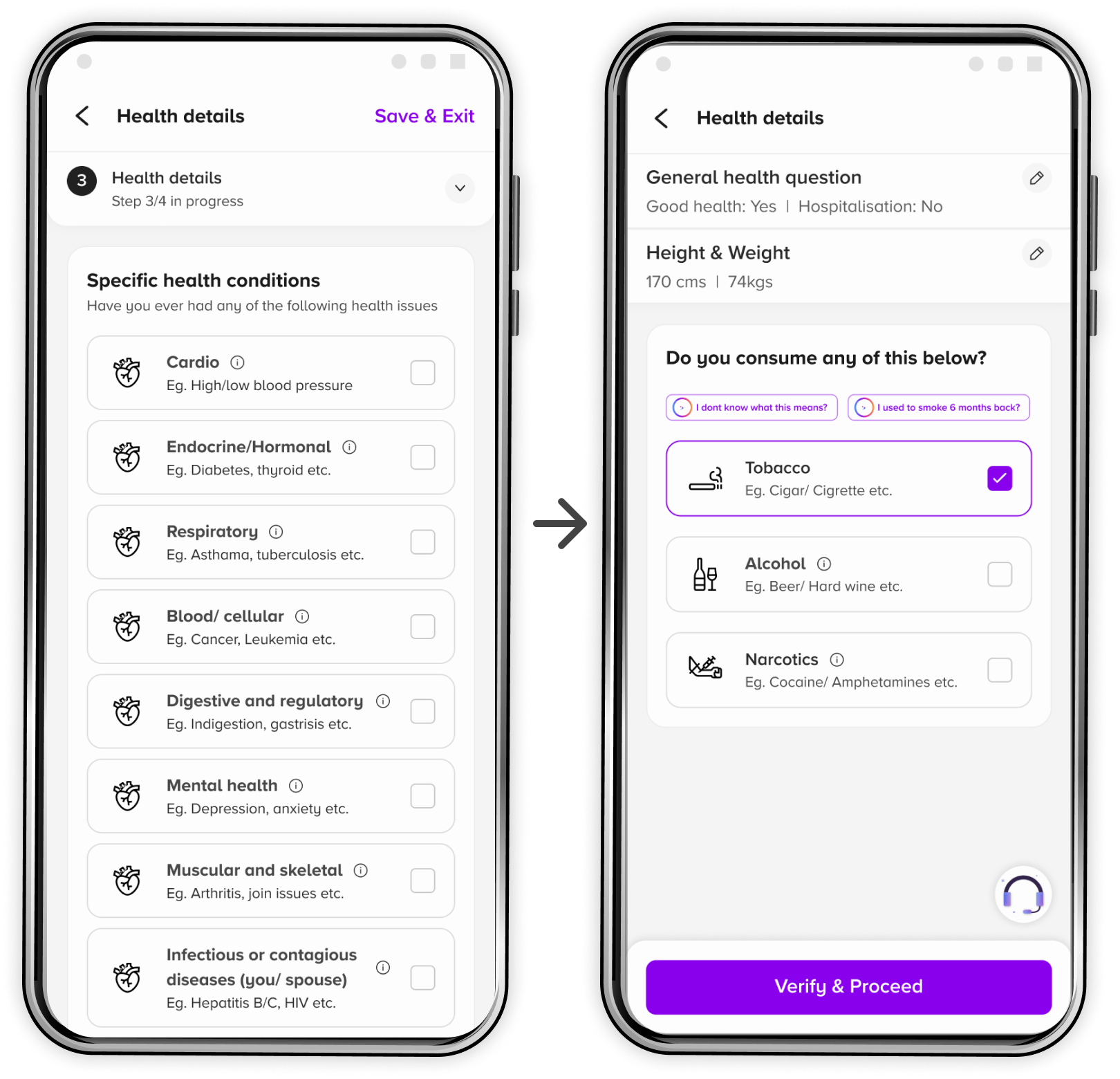

Health underwriting was redesigned from a static questionnaire into a risk-adaptive system.

Based on age, past policy metadata, and contradiction signals:

Low-risk users see 5–6 questions

Medium-risk users see 8–10 questions

Full questionnaires are shown only when justified

Irrelevant sections are suppressed automatically.

Outcome:

Significant reduction in cognitive load without compromising underwriting accuracy.

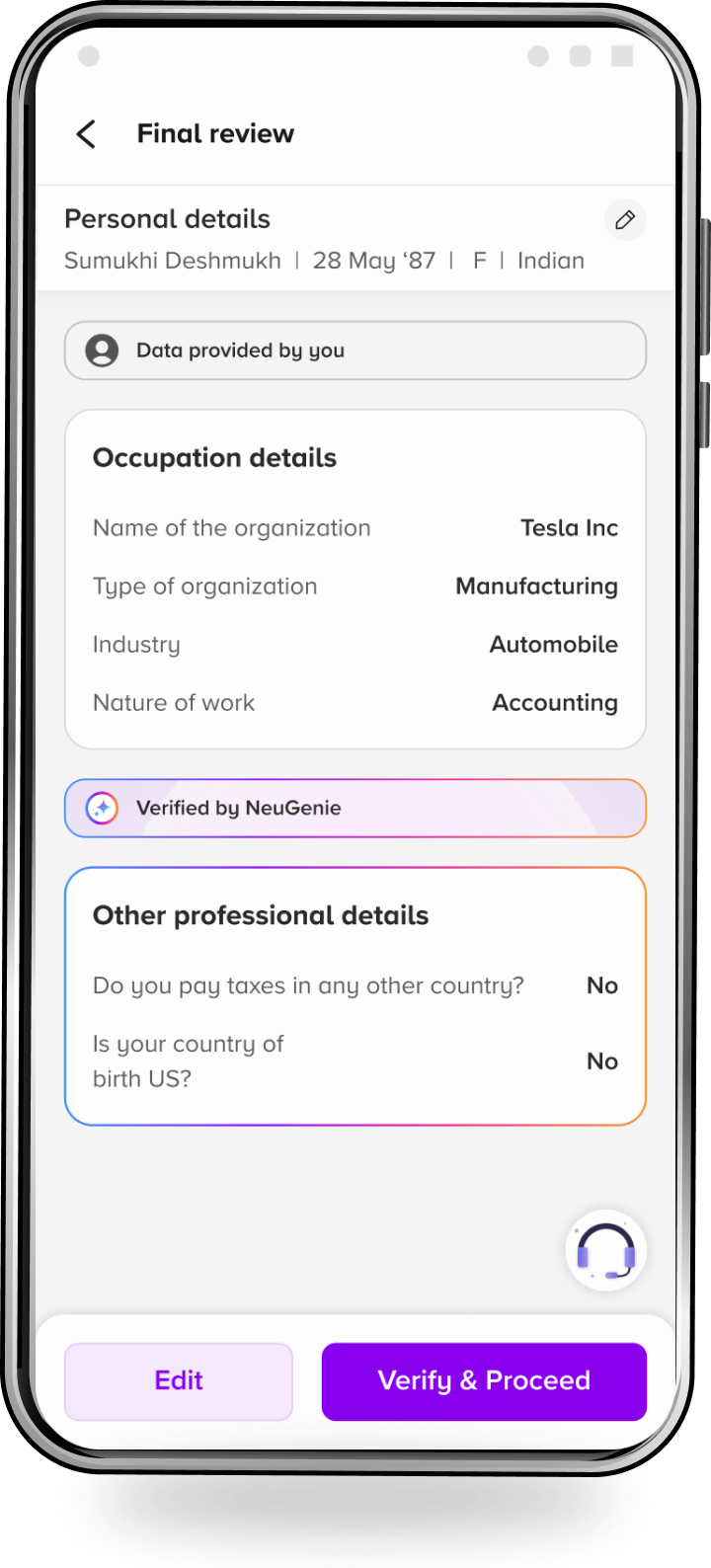

Peripheral (reinforces trust + preference)

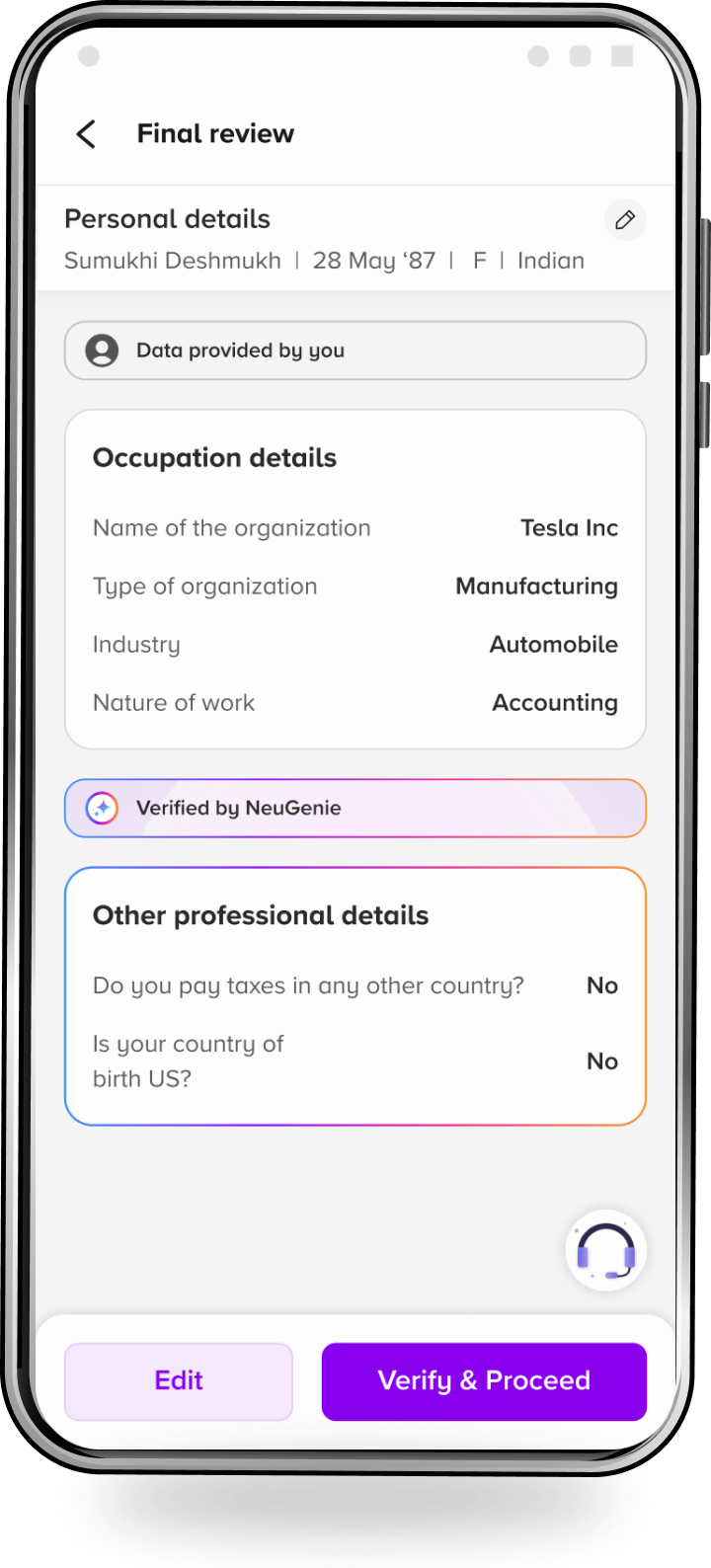

Before submission, users are shown a single consolidated review:

All auto-filled data

All agent-resolved fields

Clear distinction between verified vs user-entered information

Users can manually edit any field.

If edits impact verification or underwriting:

Dependencies are re-evaluated

Only newly required inputs are surfaced

Outcome:

High trust, full user control, and regulatory safety — without reintroducing friction.

IMPACT (DIRECTIONAL)

While this project focused on system design and feasibility, it demonstrates potential to:

40–70%

Reduced journey length

50%

Fewer fields per user

30–40%

Reduced underwriting mismatches

Lower call-centre dependency

Improve DIY completion confidence

Shorten issuance SLAs

REFLECTION / SCALE

What This Project Demonstrates

Systems thinking over UI optimisation

Designing within regulatory constraints

Agentic frameworks instead of feature-level AI

Cross-functional alignment (AI, data, product, compliance)

Reusable intelligence across financial journeys

Looking Ahead

The same agentic framework can extend to:

Loans and credit onboarding

UPI recovery and dispute flows

Investment onboarding

Insurance claims

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects

ARVIND SETHIA - MORE PROJECT

Agentic AI for Insurance Documentation

Designing an autonomous, compliance-safe system to reduce friction in insurance issuance

AI /EMERGING

OVERVIEW

Insurance documentation is one of the highest-friction journeys in Tata Neu — long, error-prone, and heavily dependent on manual intervention.

I designed an agentic onboarding framework that activates after user-authorised KYC, autonomously prepares data, resolves inconsistencies, suppresses irrelevant inputs, and dynamically constructs the shortest valid journey for each user.

The result is a system that reduces effort without adding conversational overhead, while staying fully compliant with insurance regulations.

CONTEXT

AI changed user expectations — but not through in-app chatbots.

Users increasingly rely on general-purpose AI (ChatGPT, Gemini, Perplexity) to understand options and make decisions, then return to apps only to transact.

In-app conversational assistants saw early curiosity but declining long-term engagement, especially in high-stake financial journeys.

This revealed a gap:

1

Users don’t want to talk to AI inside apps

2

They want AI to quietly remove friction inside the task

This insight reframed the problem from:

“Building a better chatbot” → Designing “autonomous intelligence” inside journeys.

PROBLEM

Insurance post-payment documentation (KYC → personal → nominee → health → upload) suffered from:

50+ fields

High mismatch between user input and documents

Frequent underwriting back-and-forth

~35–45% drop-offs at mid-stage

Heavy dependency on call centers

Long issuance SLAs (Service level agreements)

A static form could never solve this. An autonomous agent could.

This project redefines how AI can operate inside financial services:

Not as a chatbot

But as a silent, intelligent collaborator

DESIGN INTENT

Instead of adding conversational AI, I explored Agentic Experience Design:

AI that operates autonomously within the journey- Preparing data, resolving conflicts, and adapting the UI- Without requiring users to interact with it explicitly.

The focus was on:

1

Low-stake first → build trust safely

2

Silent when possible, visible when needed

3

Contextual intelligence, not global chatbot

4

Dynamic UI instead of static forms

5

Users always retain final control

Study | Sep 2025

Coming soon

AI casestudy

We also did indepth understanding of ‘Conversational UI’.

Details in this blog

AGENT SYSTEM ARCHITECTURE (HIGH LEVEL)

KYC Inputs - User-Initiated KYC (Compliance Gate)

Review layer

Agent layer

Fetches

Synthesises

Predicts

KYC rules

Conflict resolution

Confidence thresholds

Underwriting logic

Constructs screens on the fly;

suppresses irrelevant fields

OCR

Formatting corrections, mismatch detection

Policy engine

Dynamic UI builder

Verification layer

User overrides, revalidation, trust & transparency

The agent activates only after explicit user consent and KYC authentication.

WHAT I DESIGNED

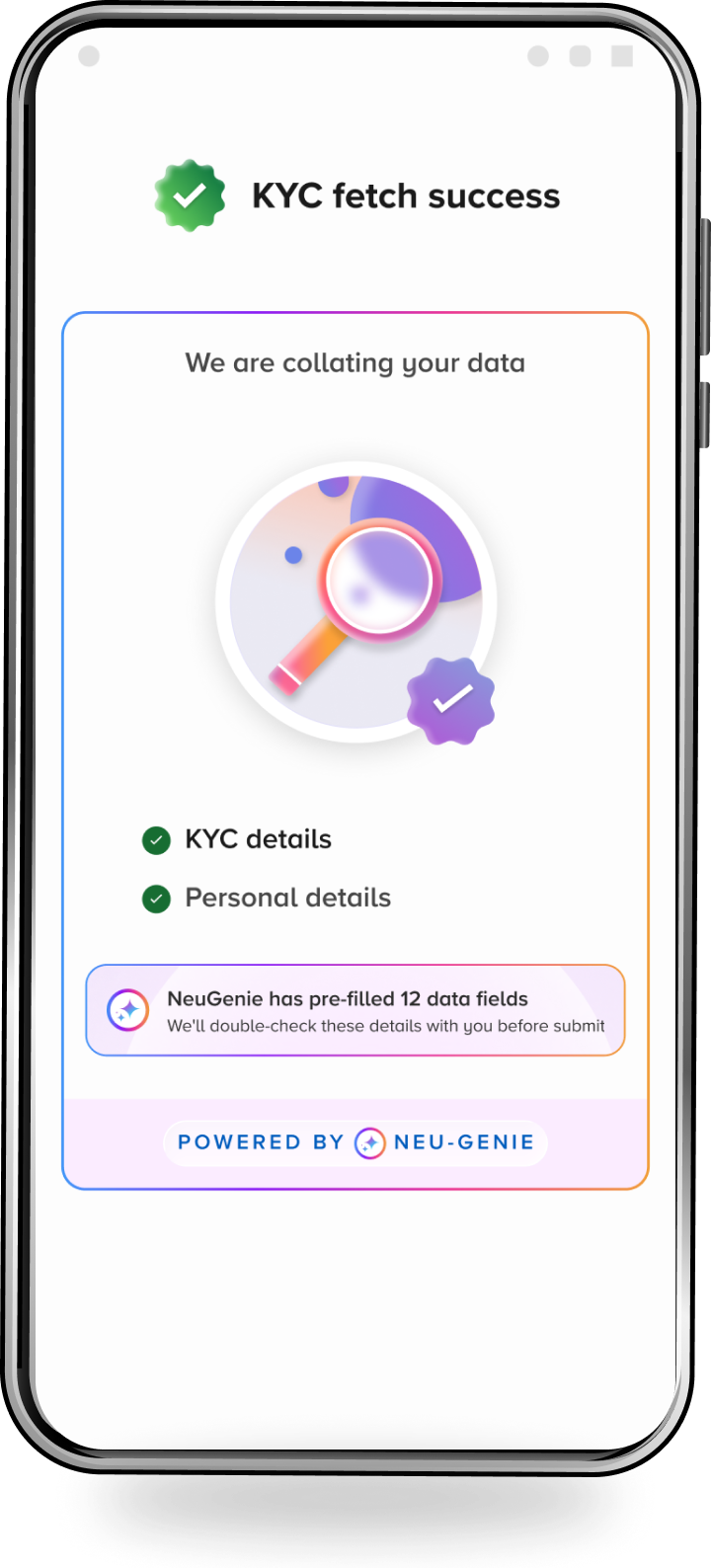

User-Initiated KYC & Agentic Data Preparation

Identity verification is explicitly user-driven and compliance-bound.

Users complete KYC via: Digilocker, PAN or AADHAR with OTP verification or Manual document upload

Until KYC is completed, the agent remains inactive by design.

Once KYC is authenticated and consent is established, the agent:

retrieves verified identity attributes

reconciles data across sources

normalises formatting (name, address, DOB)

resolves low-confidence issues silently

flags only material mismatches for user confirmation

evaluates downstream dependencies

determines the smallest valid journey required

Outcome:

30–60% of downstream fields are resolved before the next UI step appears.

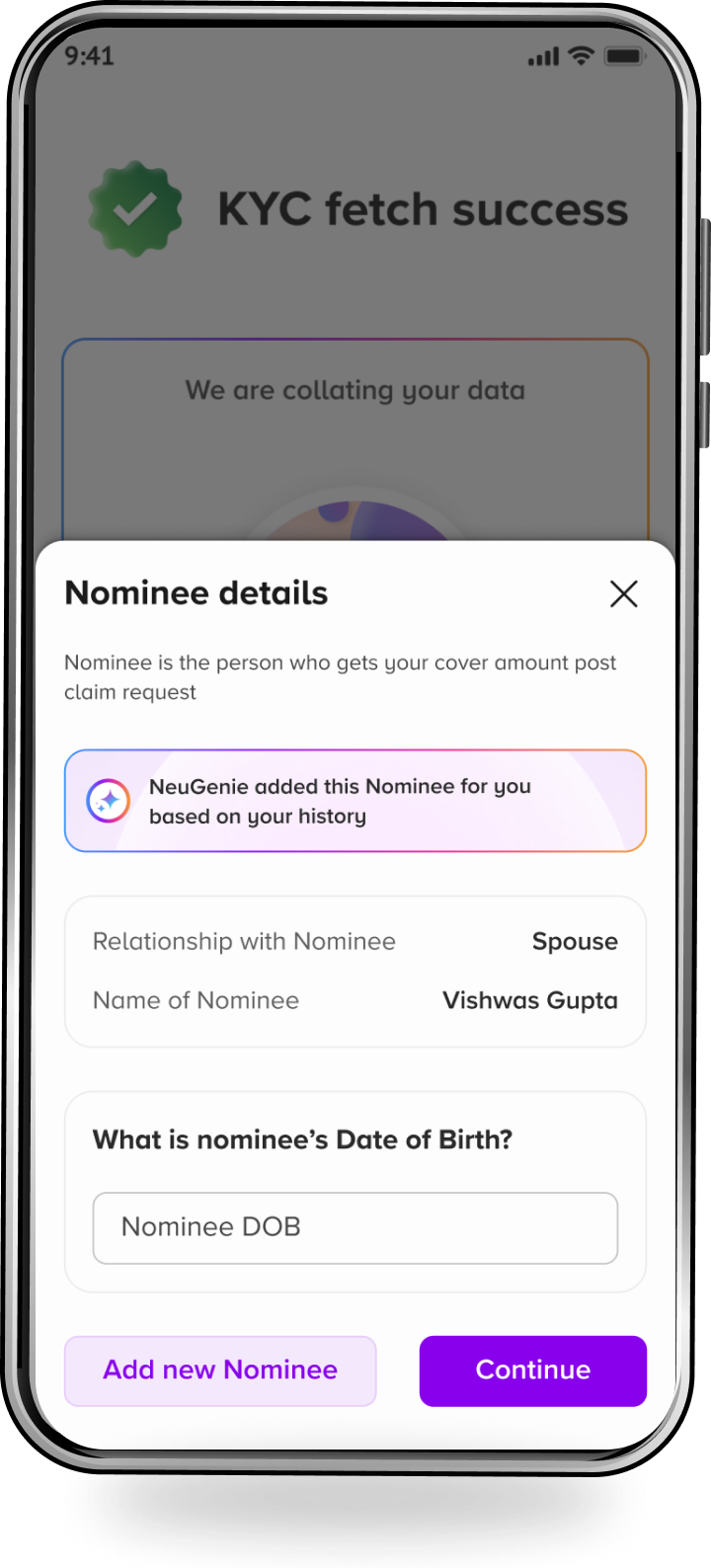

Dynamic Journey Construction

After KYC, the journey is no longer linear.

The agent builds a unique flow for each user:

Scenario A: Data Available

auto-filled personal details

auto-selected nominee

reduced health questions

minimized document requirements

Scenario B: No Data Available

DOB

Work type

Nominee relation

From these, the agent derives 20+ dependent fields.

Outcome:

Different users see different journeys — all valid, all shorter.

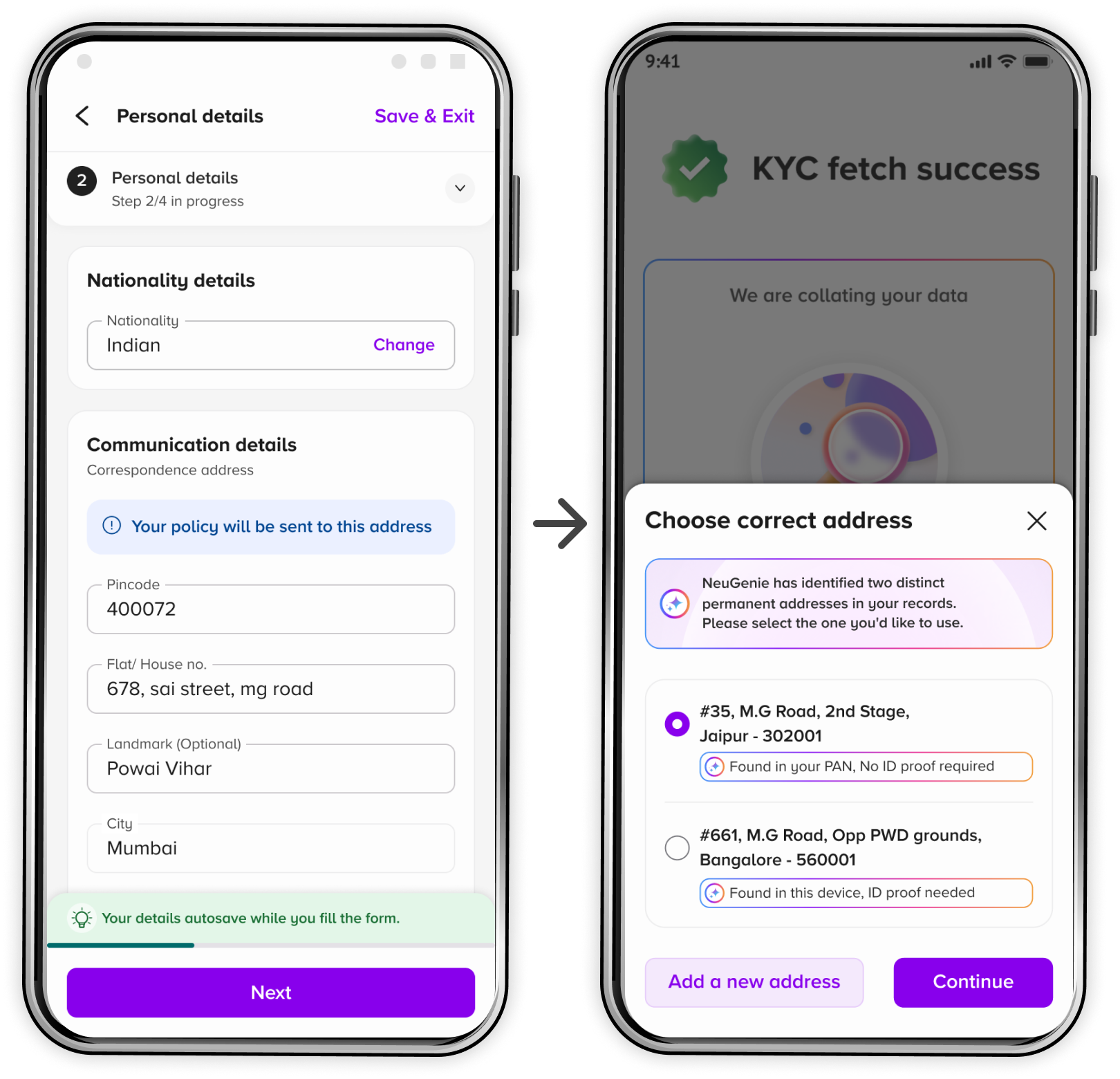

Conflict Resolution & Error Prevention

The agent continuously checks for inconsistencies across: KYC data, User inputs, Document outputs

Scenario A: Silent actions (no UI)

Formatting corrections

Casing & spacing normalisation

Duplicate field resolution

Scenario B: Visible actions (UI surfaced)

Identity mismatches

Address conflicts

Contradictory declarations

User input is requested only when confidence drops below threshold or compliance requires confirmation.

Outcome:

Fewer errors, fewer underwriting rejections, fewer follow-ups.

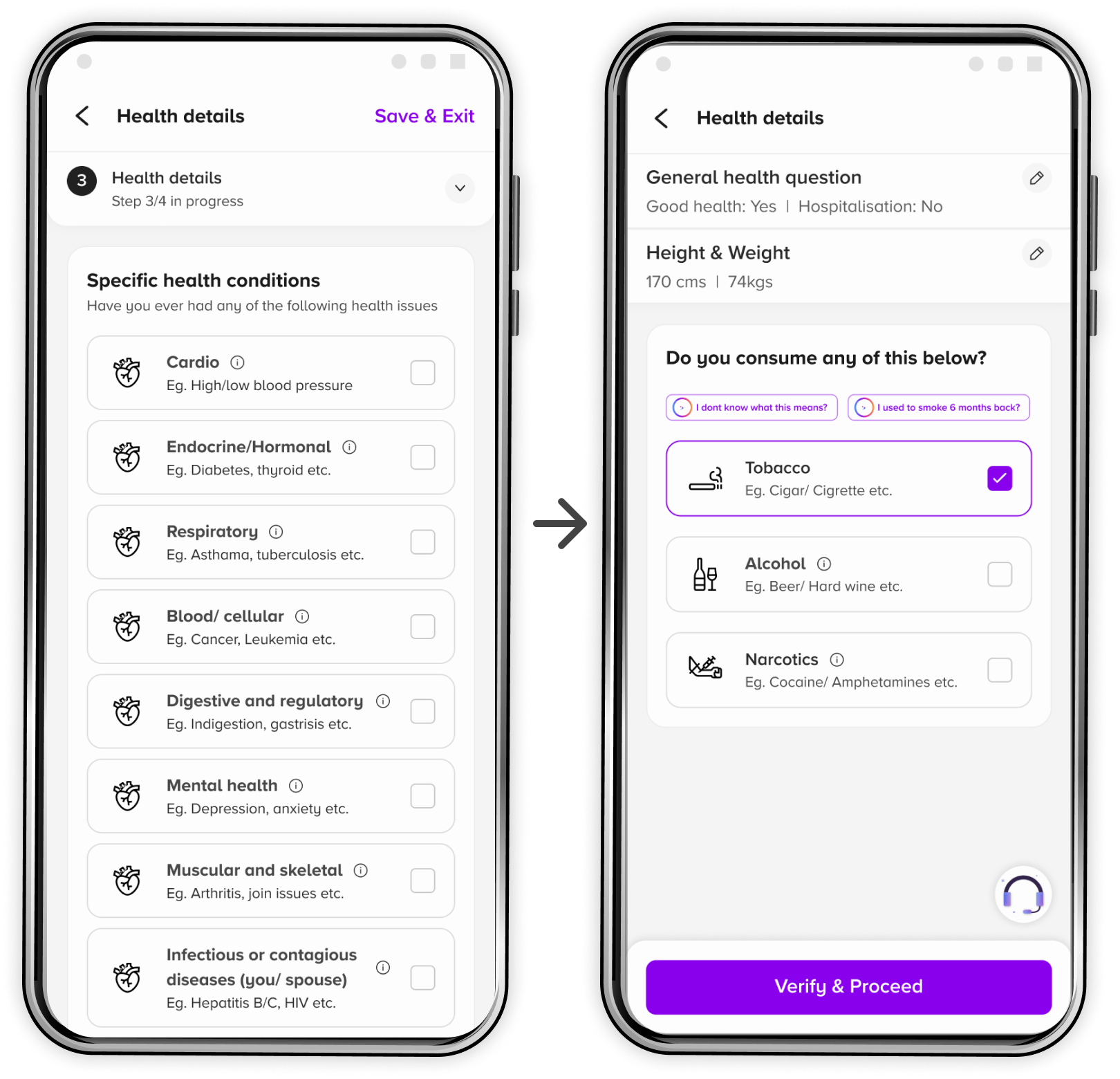

Agent-Driven Health Underwriting Simplification

Health underwriting was redesigned from a static questionnaire into a risk-adaptive system.

Based on age, past policy metadata, and contradiction signals:

Low-risk users see 5–6 questions

Medium-risk users see 8–10 questions

Full questionnaires are shown only when justified

Irrelevant sections are suppressed automatically.

Outcome:

Significant reduction in cognitive load without compromising underwriting accuracy.

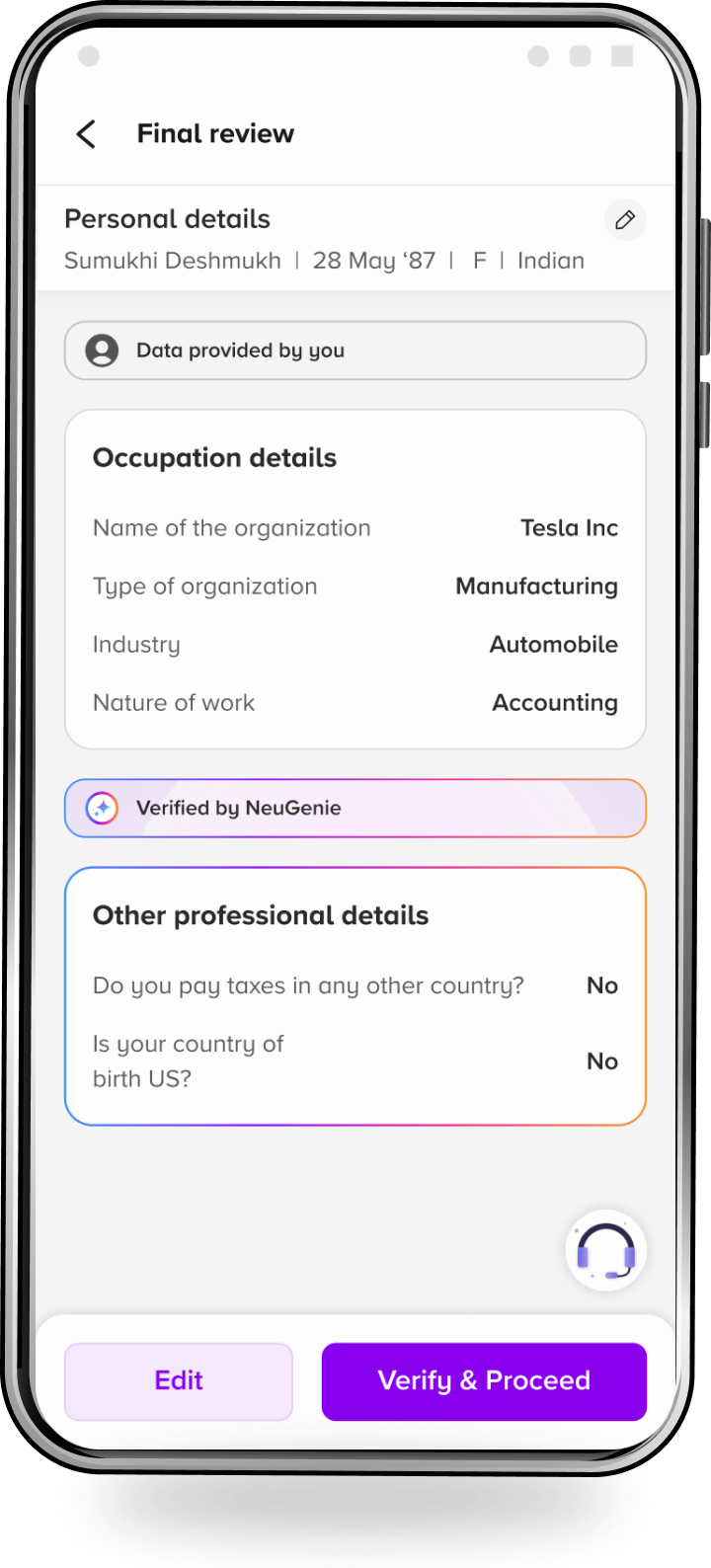

Final Review & User Control

Before submission, users are shown a single consolidated review:

All auto-filled data

All agent-resolved fields

Clear distinction between verified vs user-entered information

Users can manually edit any field.

If edits impact verification or underwriting:

Dependencies are re-evaluated

Only newly required inputs are surfaced

Outcome:

High trust, full user control, and regulatory safety — without reintroducing friction.

IMPACT (DIRECTIONAL)

While this project focused on system design and feasibility, it demonstrates potential to:

40–70%

Reduced journey length

50%

Fewer fields per user

30–40%

Reduced underwriting mismatches

Lower call-centre dependency

Improve DIY completion confidence

Shorten issuance SLAs

REFLECTION / SCALE

What This Project Demonstrates

Systems thinking over UI optimisation

Designing within regulatory constraints

Agentic frameworks instead of feature-level AI

Cross-functional alignment (AI, data, product, compliance)

Reusable intelligence across financial journeys

Looking Ahead

The same agentic framework can extend to:

Loans and credit onboarding

UPI recovery and dispute flows

Investment onboarding

Insurance claims

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects

ARVIND SETHIA - MORE PROJECT

Agentic AI for Insurance Documentation

Designing an autonomous, compliance-safe system to reduce friction in insurance issuance

AI /EMERGING

OVERVIEW

Insurance documentation is one of the highest-friction journeys in Tata Neu — long, error-prone, and heavily dependent on manual intervention.

I designed an agentic onboarding framework that activates after user-authorised KYC, autonomously prepares data, resolves inconsistencies, suppresses irrelevant inputs, and dynamically constructs the shortest valid journey for each user.

The result is a system that reduces effort without adding conversational overhead, while staying fully compliant with insurance regulations.

CONTEXT

AI adoption changed how users seek information — but not how they complete transactions.

Users increasingly rely on general-purpose AI (ChatGPT, Gemini, Perplexity) to understand options and make decisions, then return to apps only to transact.

In-app conversational assistants saw early curiosity but declining long-term engagement, especially in high-stake financial journeys.

This revealed a gap:

1

Users don’t want to talk to AI inside apps

2

They want AI to quietly remove friction inside the task

This insight reframed the problem from:

“Building a better chatbot” → Designing “autonomous intelligence” inside journeys.

PROBLEM

Insurance post-payment documentation (KYC → personal → nominee → health → upload) suffered from:

50+ fields

High mismatch between user input and documents

Frequent underwriting back-and-forth

~35–45% drop-offs at mid-stage

Heavy dependency on call centers

Long issuance SLAs (Service level agreements)

Static forms and conversational UI patterns were not solving these systemic issues.

This project redefines how AI can operate inside financial services:

Not as a chatbot

But as a silent, intelligent collaborator

DESIGN INTENT

Instead of adding conversational AI, I explored Agentic Experience Design:

AI that operates autonomously within the journey- Preparing data, resolving conflicts, and adapting the UI- Without requiring users to interact with it explicitly.

The focus was on:

1

Low-stake first → build trust safely

2

Silent when possible, visible when needed

3

Contextual intelligence, not global chatbot

4

Dynamic UI instead of static forms

5

Users always retain final control

Study | Sep 2025

Coming soon

AI casestudy

We also did indepth understanding of ‘Conversational UI’.

Details in this blog

AGENT SYSTEM ARCHITECTURE (HIGH LEVEL)

The solution is built as a layered system

KYC Inputs - User-Initiated KYC (Compliance Gate)

Review layer

Agent layer

Fetches

Synthesises

Predicts

KYC rules

Conflict resolution

Confidence thresholds

Underwriting logic

Constructs screens on the fly;

suppresses irrelevant fields

Convert text from scanned document,

Formatting corrections, mismatch detection

Policy engine

Dynamic UI builder

Verification layer

User overrides, revalidation, trust & transparency

The agent activates only after explicit user consent and KYC authentication.

WHAT I DESIGNED

User-Initiated KYC & Agentic Data Preparation

Identity verification is explicitly user-driven and compliance-bound.

Users complete KYC via: Digilocker, PAN or AADHAR with OTP verification or Manual document upload

Until KYC is completed, the agent remains inactive by design.

Once KYC is authenticated and consent is established, the agent:

retrieves verified identity attributes

reconciles data across sources

normalises formatting (name, address, DOB)

resolves low-confidence issues silently

flags only material mismatches for user confirmation

evaluates downstream dependencies

determines the smallest valid journey required

Outcome:

30–60% of downstream fields are resolved before the next UI step appears.

Dynamic Journey Construction

After KYC, the journey is no longer linear.

The agent builds a unique flow for each user:

Scenario A: Data Available

auto-filled personal details

auto-selected nominee

reduced health questions

minimized document requirements

Scenario B: No Data Available

DOB

Work type

Nominee relation

From these, the agent derives 20+ dependent fields.

Outcome:

Different users see different journeys — all valid, all shorter.

Conflict Resolution & Error Prevention

The agent continuously checks for inconsistencies across: KYC data, User inputs, Document outputs

Scenario A: Silent actions (no UI)

Formatting corrections

Casing & spacing normalisation

Duplicate field resolution

Scenario B: Visible actions (UI surfaced)

Identity mismatches

Address conflicts

Contradictory declarations

User input is requested only when confidence drops below threshold or compliance requires confirmation.

Outcome:

Fewer errors, fewer underwriting rejections, fewer follow-ups.

Agent-Driven Health Underwriting Simplification

Health underwriting was redesigned from a static questionnaire into a risk-adaptive system.

Based on age, past policy metadata, and contradiction signals:

Low-risk users see 5–6 questions

Medium-risk users see 8–10 questions

Full questionnaires are shown only when justified

Irrelevant sections are suppressed automatically.

Outcome:

Significant reduction in cognitive load without compromising underwriting accuracy.

Final Review & User Control

Before submission, users are shown a single consolidated review:

All auto-filled data

All agent-resolved fields

Clear distinction between verified vs user-entered information

Users can manually edit any field.

If edits impact verification or underwriting:

Dependencies are re-evaluated

Only newly required inputs are surfaced

Outcome:

High trust, full user control, and regulatory safety — without reintroducing friction.

IMPACT (DIRECTIONAL)

While this project focused on system design and feasibility, it demonstrates potential to:

40–70%

Reduced journey length

50%

Fewer fields per user

30–40%

Reduced underwriting mismatches

Lower call-centre dependency

Improve DIY completion confidence

Shorten issuance SLAs

REFLECTION / SCALE

What This Project Demonstrates

Systems thinking over UI optimisation

Designing within regulatory constraints

Agentic frameworks instead of feature-level AI

Cross-functional alignment (AI, data, product, compliance)

Reusable intelligence across financial journeys

Looking Ahead

The same agentic framework can extend to:

Loans and credit onboarding

UPI recovery and dispute flows

Investment onboarding

Insurance claims

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects