Best viewed on desktop or laptop

Mobile might struggle a bit

ARVIND SETHIA - BONUS PROJECT

Fixed Deposits (FD)

Data-led funnel optimization under regulatory constraints

UX execution

LIVE PRODUCT

Role: Lead Designer (Product × Growth × Compliance)North-star metric: FD booking success rate

CONTEXT

AI changed user expectations — but not through in-app chatbots.

This project focused on improving FD booking success rate by repairing high-friction decision moments, using funnel data and continuous iteration — while operating under strict compliance constraints.

PROBLEM

Funnel analysis showed a severe commitment drop, not a discovery issue.

Strong traffic into FD Explore

Only ~15% attempted booking

End-to-end success below 1%

Insight

But as a silent, intelligent collaborator

DESIGN STRATEGY

CC-on-UPI linkage

Optimize for scan-based comparison

Make trust signals explicit

Reduce decision friction, not persuasion

Design with compliance, not around it

KEY INTERVENTIONS

Peripheral (reinforces trust + preference)

Problem:

Compliance-mandated consent appeared at journey entry, acting as a psychological blocker.

Iteration path

Entry-level consent → value-led consent → buried consent

Final state: consent moved closer to booking / before KYC

Outcome:

Consent exits dropped sharply

FD Explore traffic increased ~2–3× month-on-month

Exploration unlocked before commitment

Consent shifted from an entry gate to a confirmation step.

Peripheral (reinforces trust + preference)

Problem:

List-based discovery forced reading, slowed comparison, and lacked trust cues — especially for smaller banks.

Design changes

Shifted from list to card-based layout

Highlighted returns directly in the CTA

Increased bank identity prominence

Added trust signals (physical presence, scale)

Optimized density to surface more options above the fold

Outcome:

Consistent downstream exploration lift

Increase in average FD amount

Reduced avoidance of high-return, lesser-known issuers

Designed the discovery surface as a decision moment, not a catalogue.

Peripheral (reinforces trust + preference)

Design changes

Sliders were slow and error-prone

Calculator buried below content encouraged “play,” not commitment

Design changes

Moved calculator to the top

Replaced sliders with chips and +/-

Enabled real-time return feedback

Outcome:

Faster time-to-decision

Higher booking attempts

Sustained increase in Net FDs

Reduced calculator play; increased commitment.

Peripheral (reinforces trust + preference)

Collaborated with Growth to operationalize campaigns through UX, not overlays.

Repo-rate FOMO

Low-entry FDs (₹5K+) & Short tenure options

Issuer-based rewards

Design changes

PDP banner slot

Repeat-user widget below dashboard

A/B tested carousel vs single banner (single won)

Impact

Supported ₹500cr annual target

Achieved ₹350cr despite rate compression and competition

Growth worked only after core decision friction was fixed.

WHAT THIS PROJECT DEMONSTRATES

Funnel-level diagnosis & prioritization

Structural journey redesign under compliance

Data-led iteration on a live product

Design × Growth collaboration with clear ownership

This case complements strategy-heavy work by showing execution discipline on a live product: real users, real constraints, compounding impact.

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects

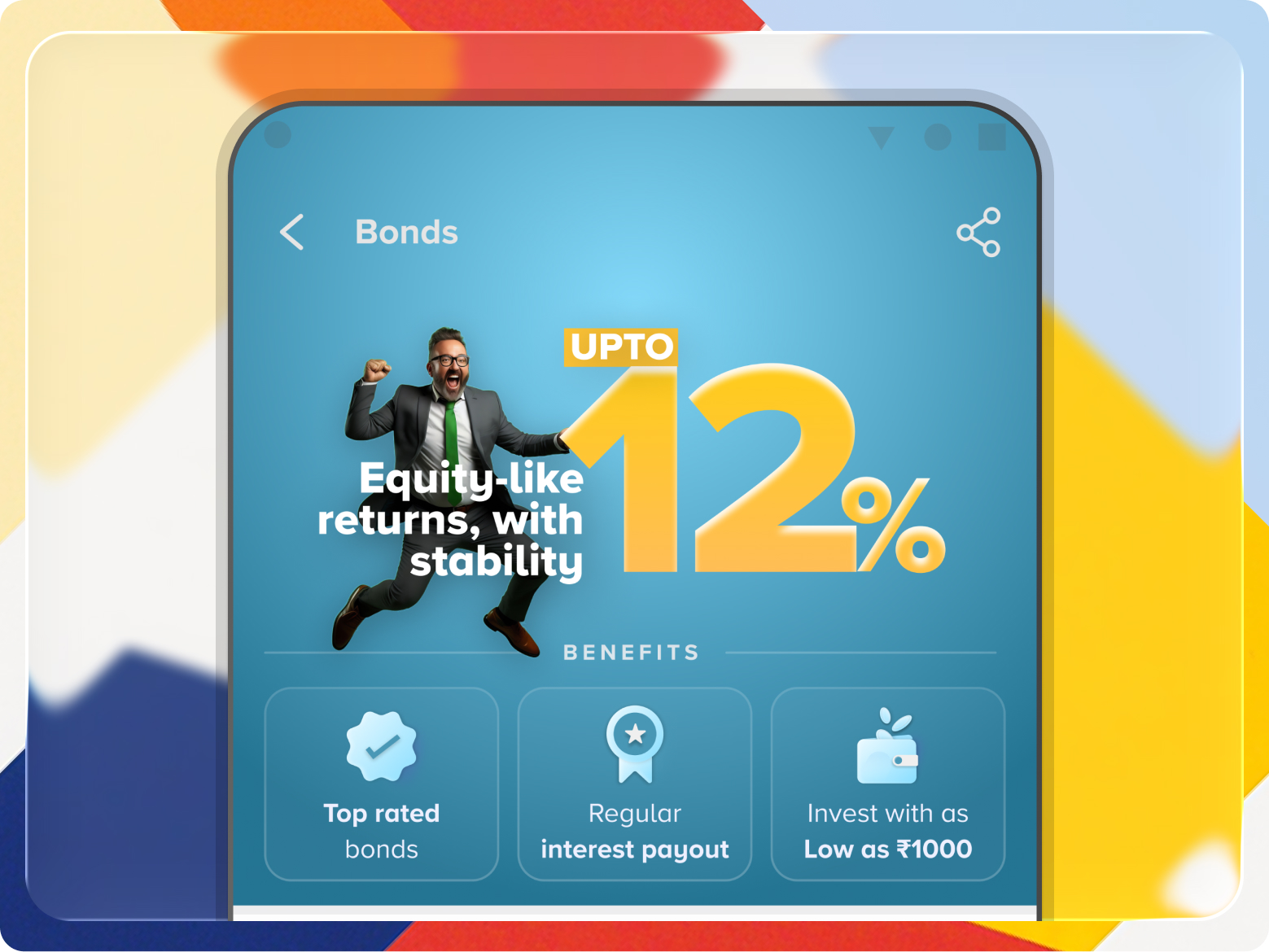

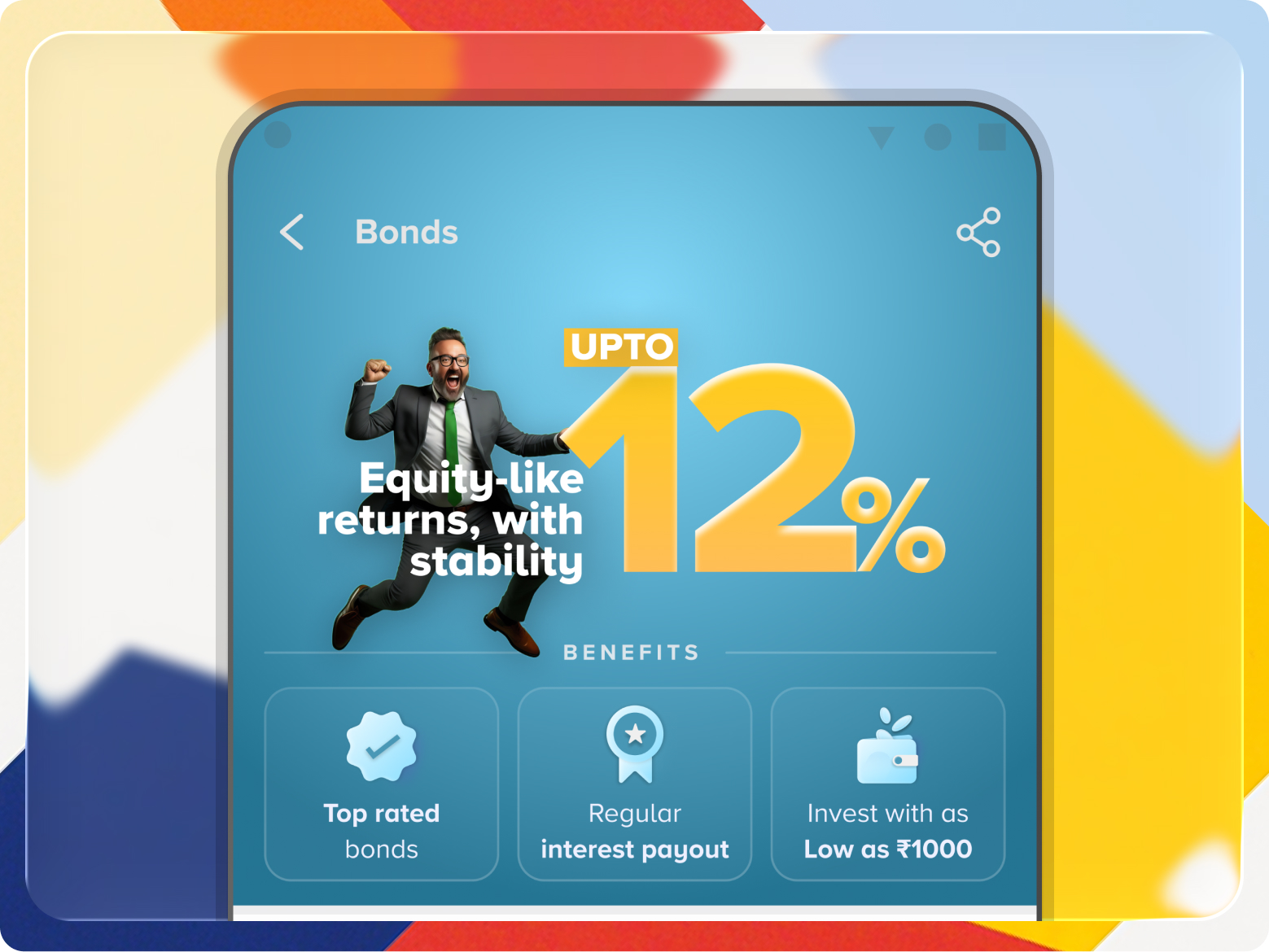

Bonds

Owning the decision surface to drive category adoption

UX/UI Execution

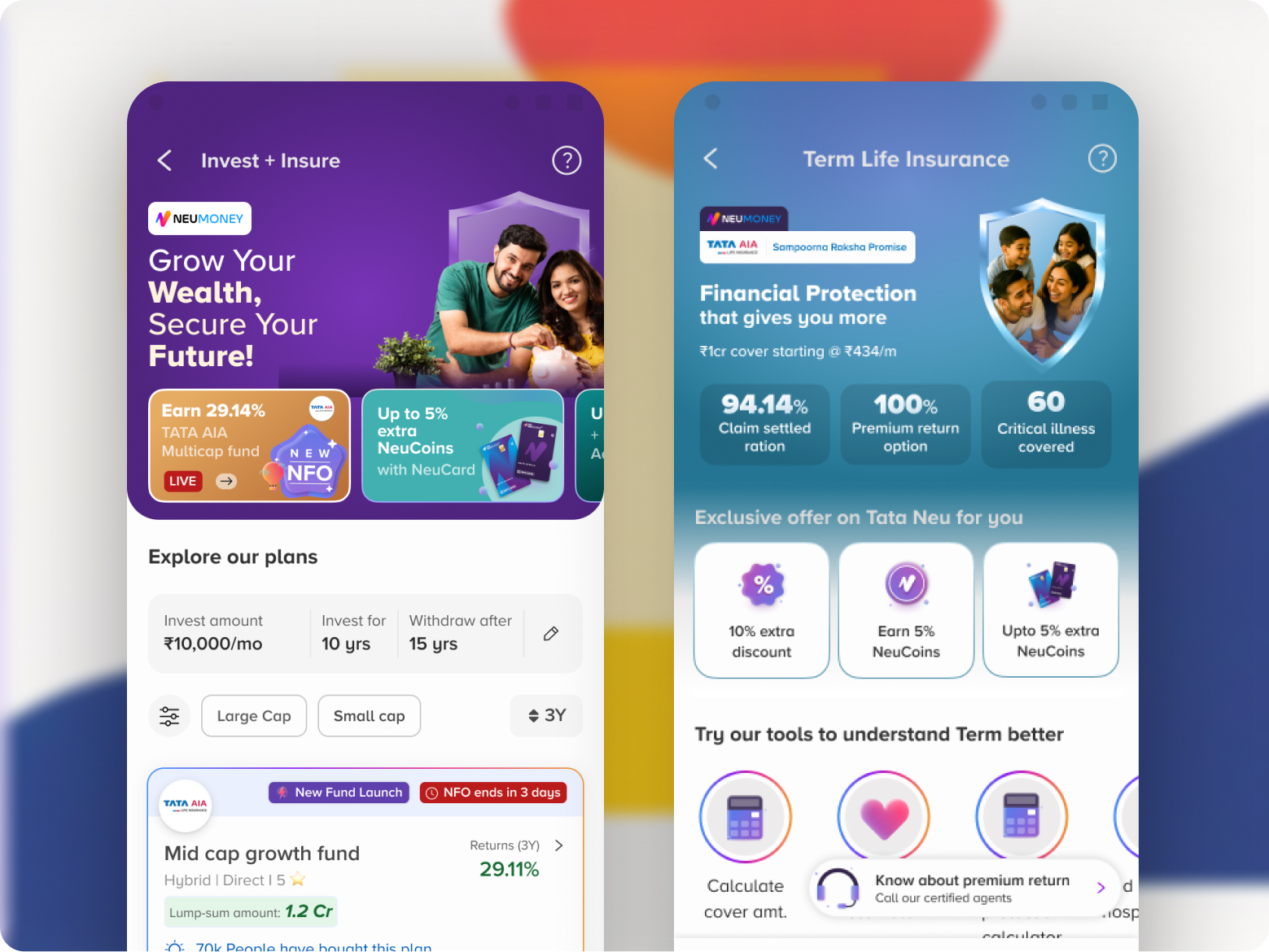

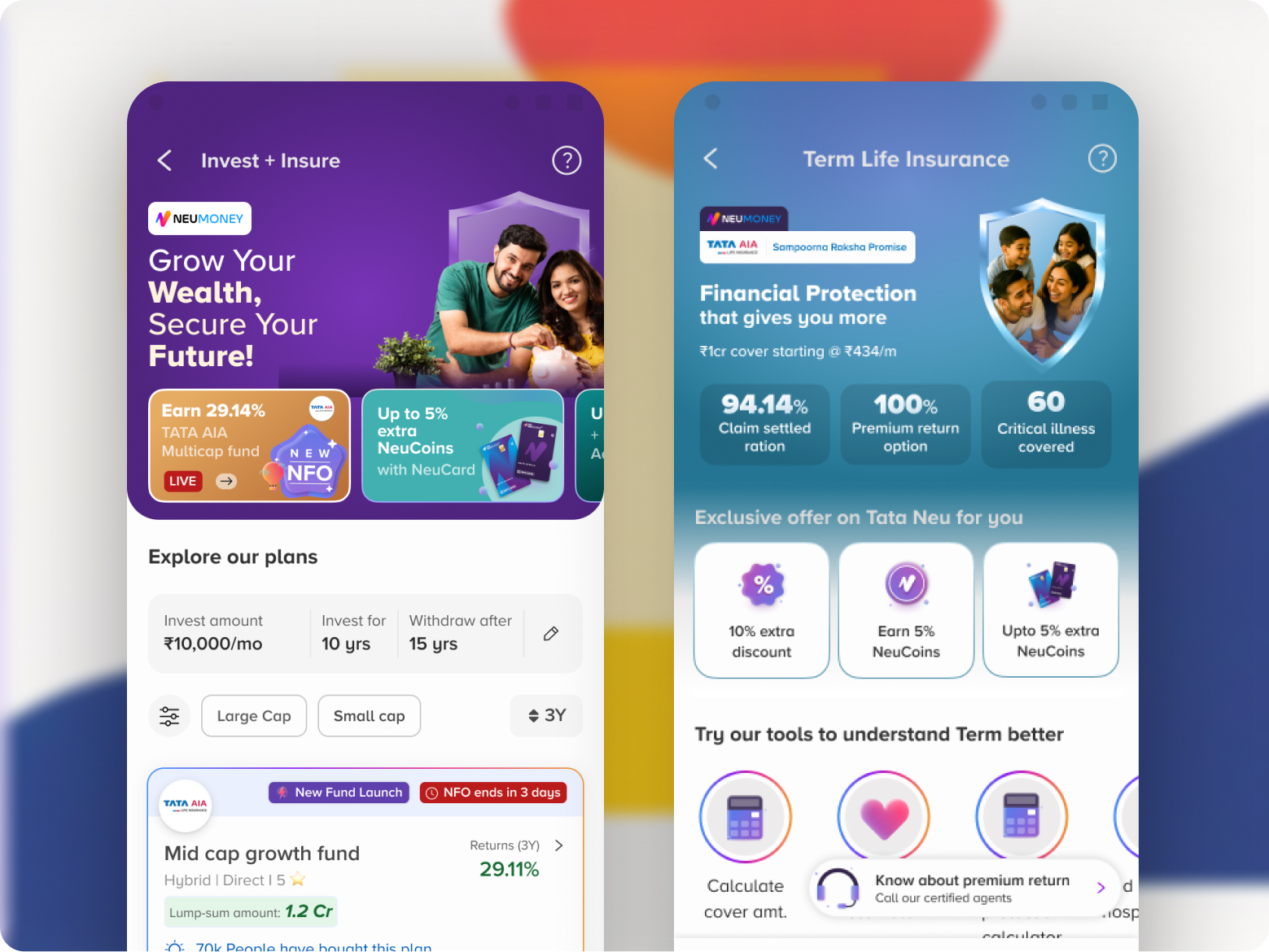

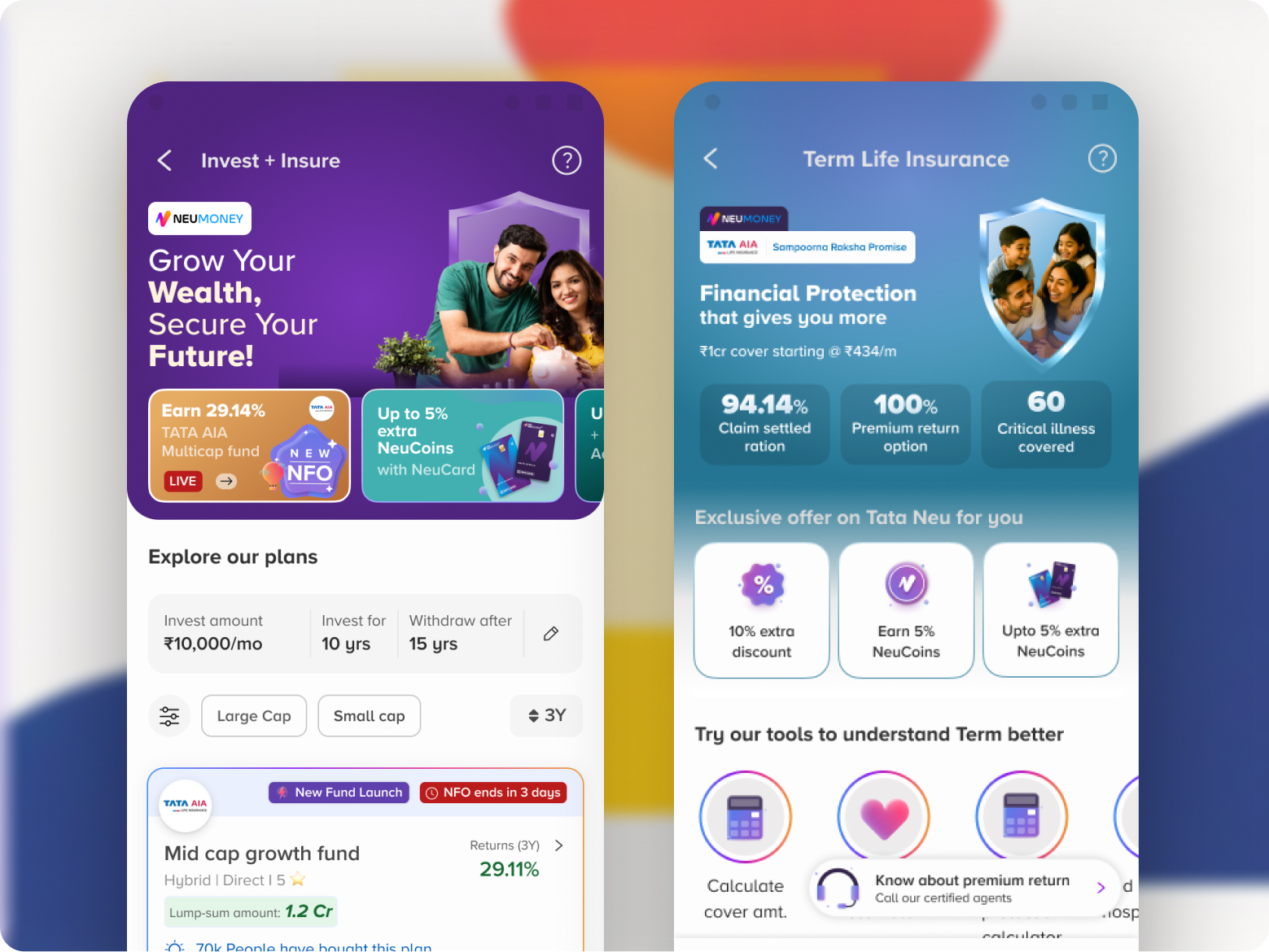

Rebuilding Life Insurance on Tata Neu

From Redirection Chaos to Native, End-to-End Ownership

UX/UI Execution

ARVIND SETHIA - BONUS PROJECT

Fixed Deposits (FD)

Data-led funnel optimization under regulatory constraints

UX execution

LIVE PRODUCT

Role: Lead Designer (Product × Growth × Compliance)North-star metric: FD booking success rate

CONTEXT

AI changed user expectations — but not through in-app chatbots.

This project focused on improving FD booking success rate by repairing high-friction decision moments, using funnel data and continuous iteration — while operating under strict compliance constraints.

PROBLEM

Funnel analysis showed a severe commitment drop, not a discovery issue.

Strong traffic into FD Explore

Only ~15% attempted booking

End-to-end success below 1%

Insight

But as a silent, intelligent collaborator

DESIGN STRATEGY

CC-on-UPI linkage

Optimize for scan-based comparison

Make trust signals explicit

Reduce decision friction, not persuasion

Design with compliance, not around it

KEY INTERVENTIONS

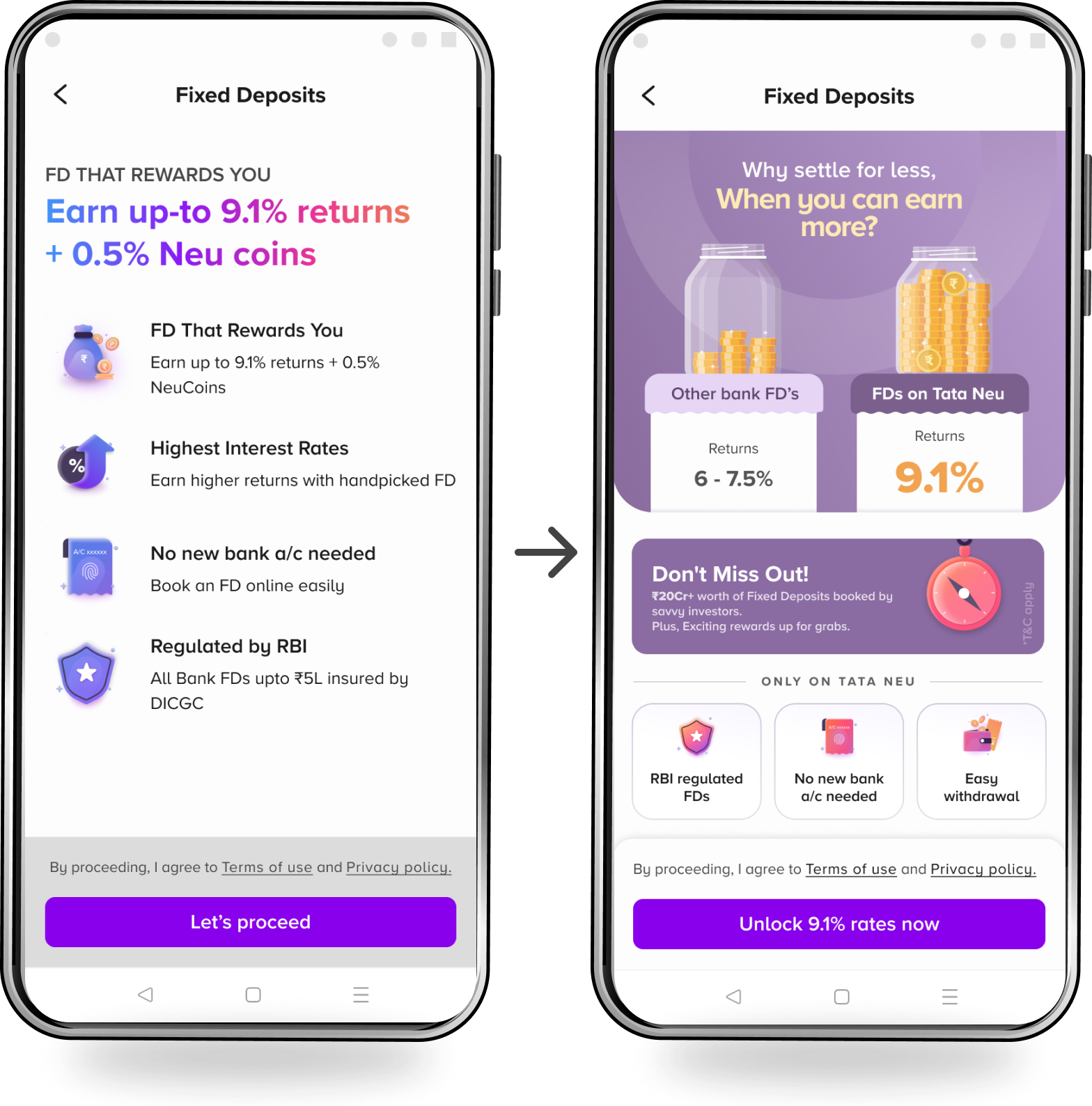

Consent journey restructuring (structural fix)

Problem:

Compliance-mandated consent appeared at journey entry, acting as a psychological blocker.

Iteration path

Entry-level consent → value-led consent → buried consent

Final state: consent moved closer to booking / before KYC

Outcome:

Consent exits dropped sharply

FD Explore traffic increased ~2–3× month-on-month

Exploration unlocked before commitment

Consent shifted from an entry gate to a confirmation step.

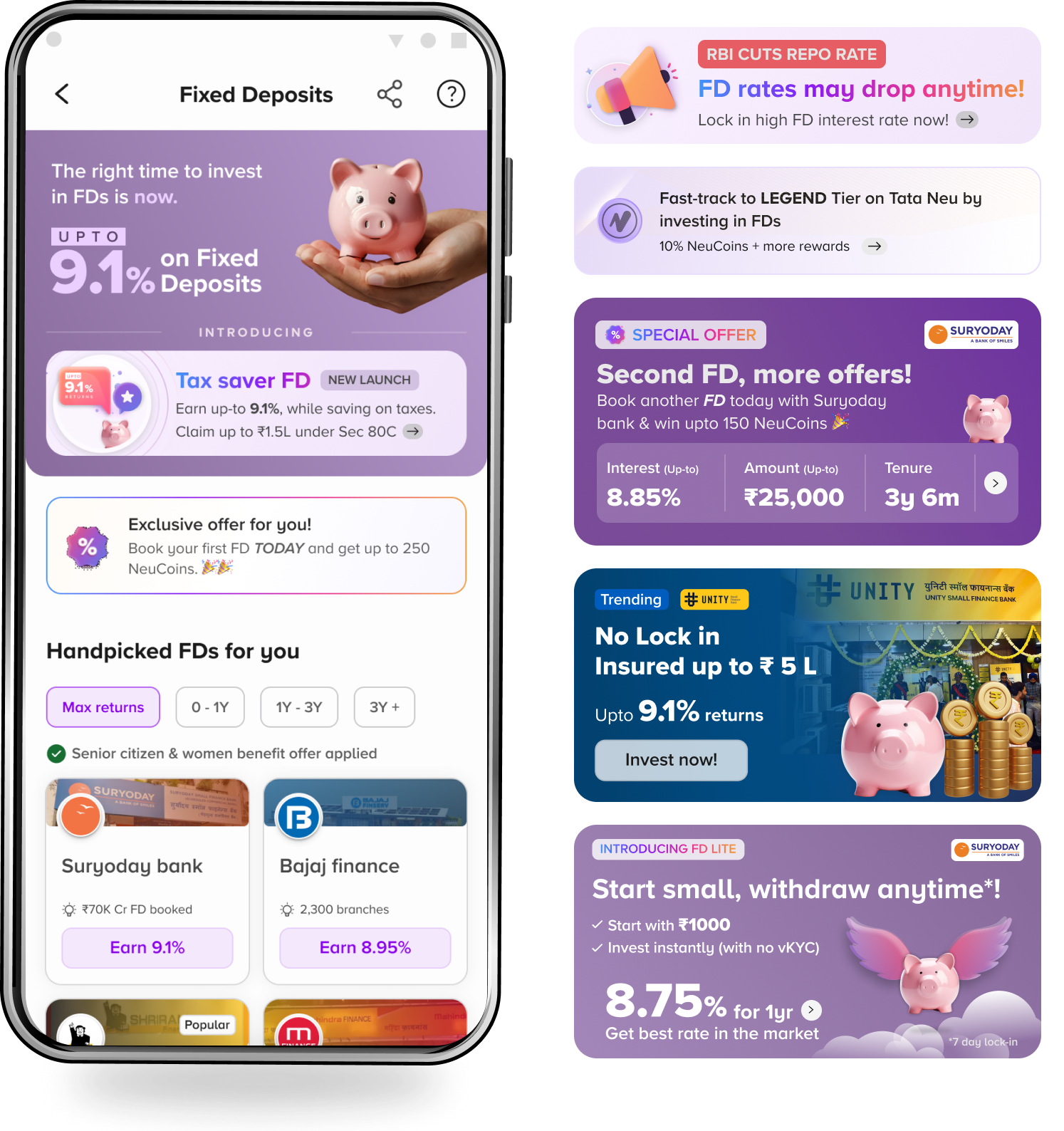

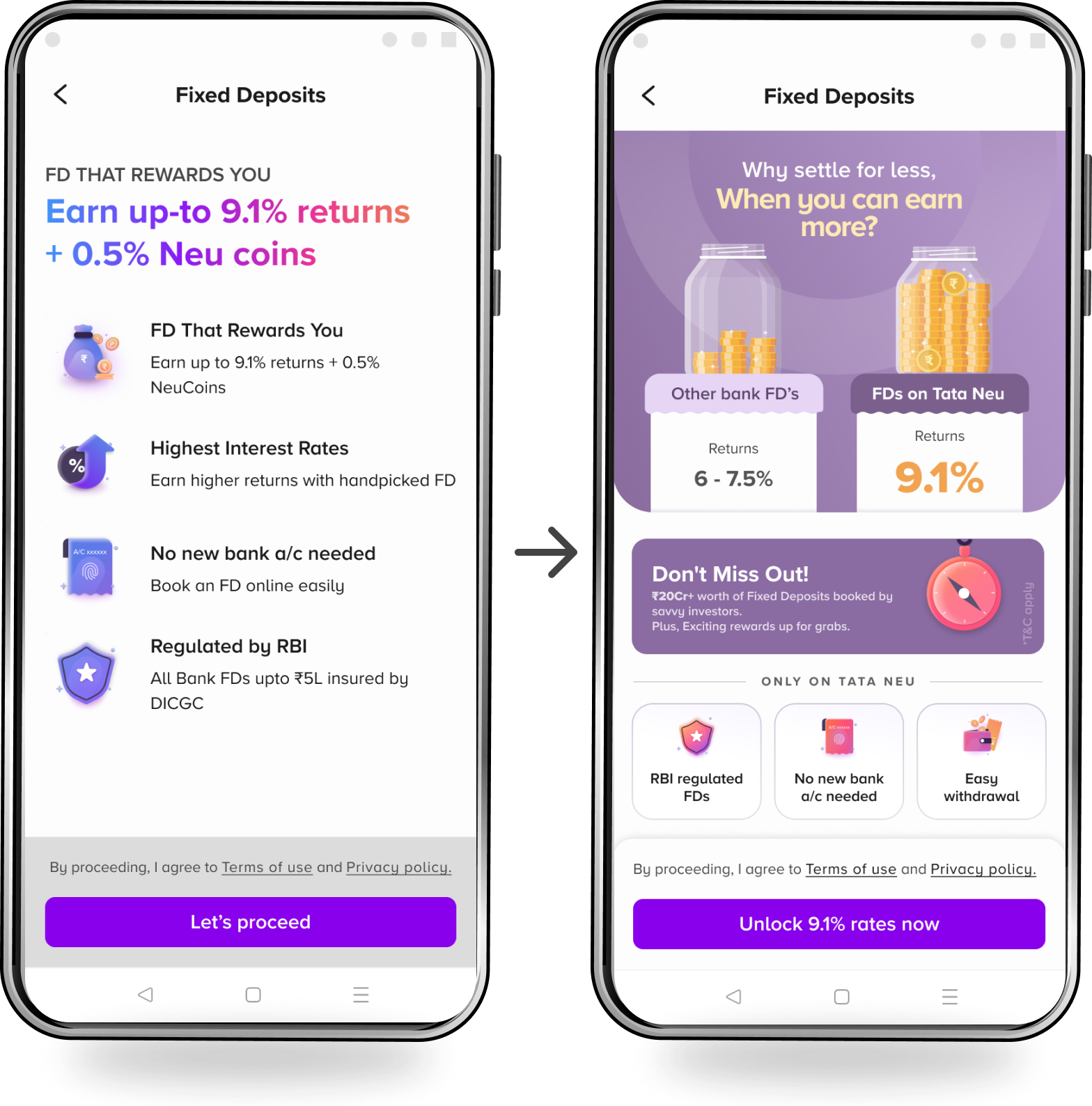

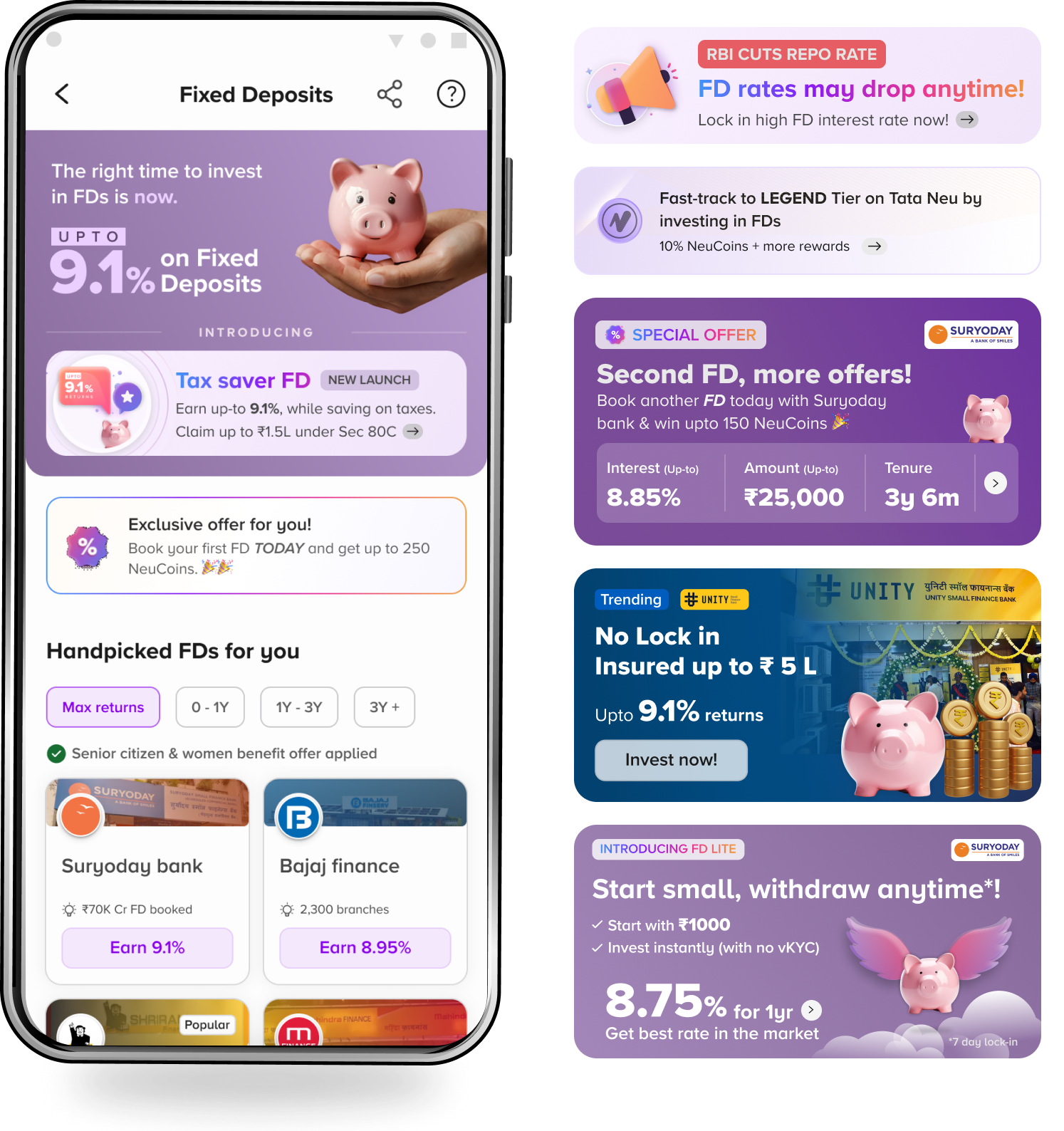

FD Discovery: Designing for confident comparison

Problem:

List-based discovery forced reading, slowed comparison, and lacked trust cues — especially for smaller banks.

Design changes

Shifted from list to card-based layout

Highlighted returns directly in the CTA

Increased bank identity prominence

Added trust signals (physical presence, scale)

Optimized density to surface more options above the fold

Outcome:

Consistent downstream exploration lift

Increase in average FD amount

Reduced avoidance of high-return, lesser-known issuers

Designed the discovery surface as a decision moment, not a catalogue.

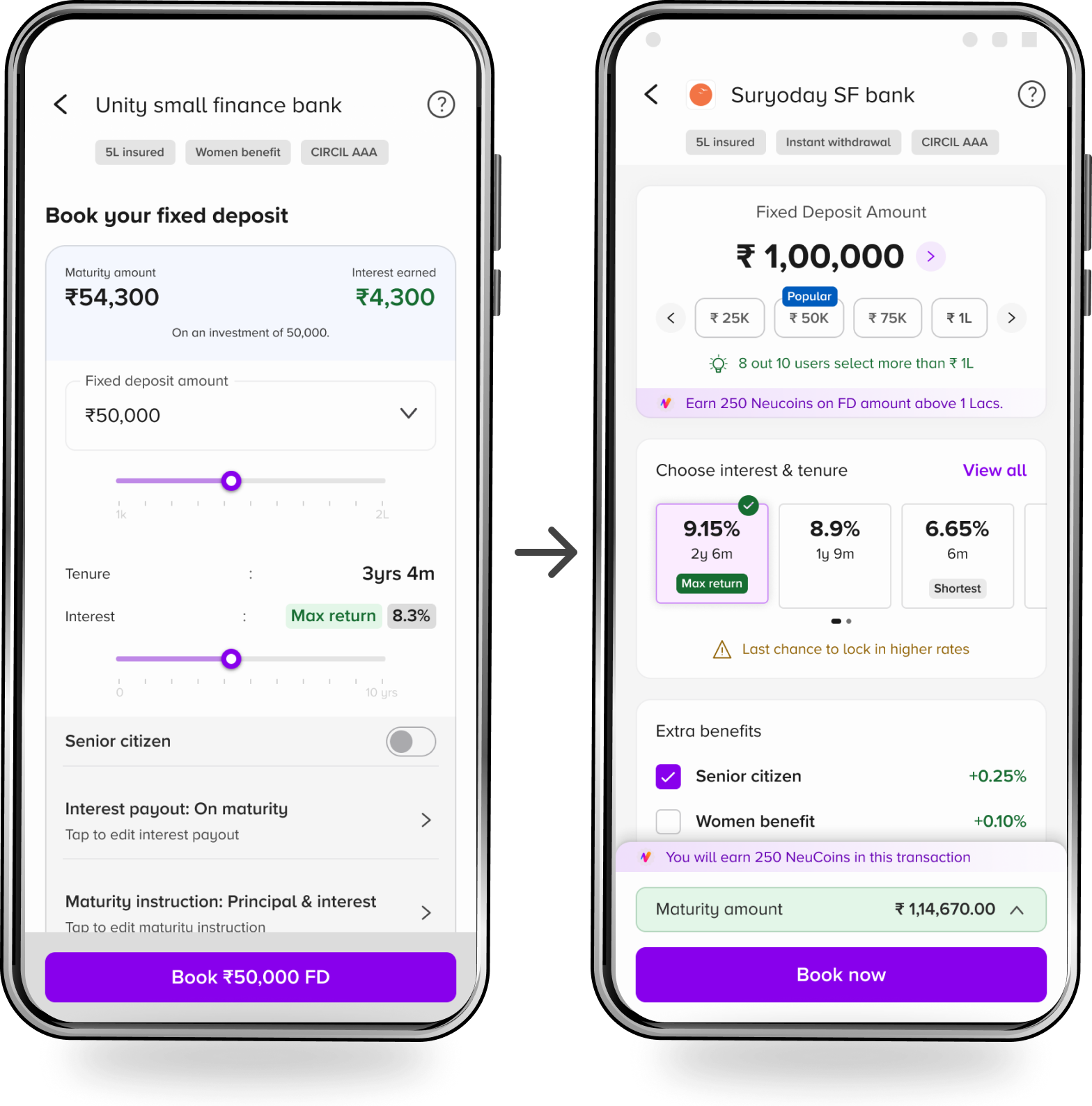

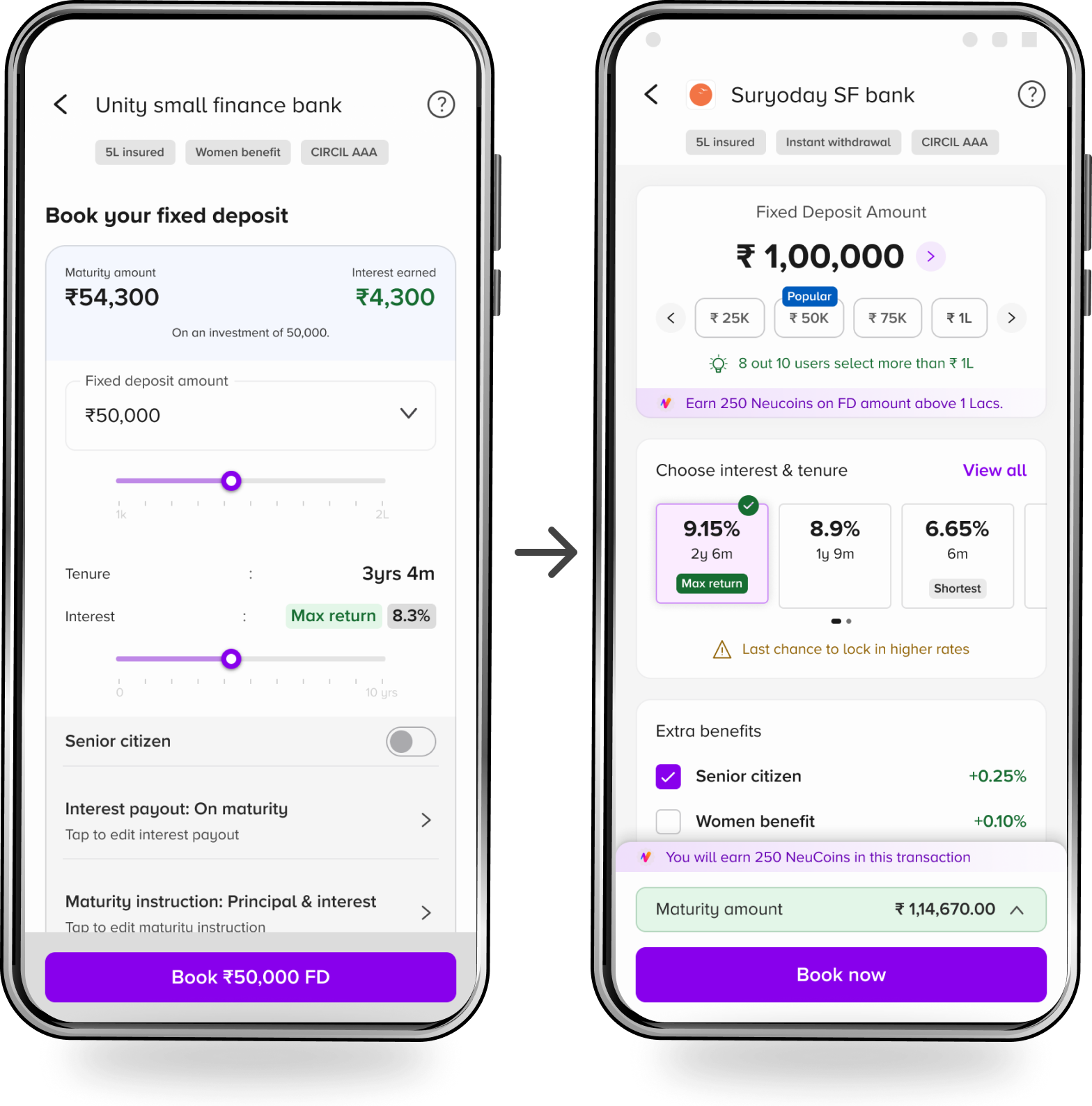

FD Details & Calculator: Reducing decision friction

Design changes

Sliders were slow and error-prone

Calculator buried below content encouraged “play,” not commitment

Design changes

Moved calculator to the top

Replaced sliders with chips and +/-

Enabled real-time return feedback

Outcome:

Faster time-to-decision

Higher booking attempts

Sustained increase in Net FDs

Reduced calculator play; increased commitment.

Growth enablement (design-led)

Collaborated with Growth to operationalize campaigns through UX, not overlays.

Repo-rate FOMO

Low-entry FDs (₹5K+) & Short tenure options

Issuer-based rewards

Design changes

PDP banner slot

Repeat-user widget below dashboard

A/B tested carousel vs single banner (single won)

Impact

Supported ₹500cr annual target

Achieved ₹350cr despite rate compression and competition

Growth worked only after core decision friction was fixed.

WHAT THIS PROJECT DEMONSTRATES

Funnel-level diagnosis & prioritization

Structural journey redesign under compliance

Data-led iteration on a live product

Design × Growth collaboration with clear ownership

This case complements strategy-heavy work by showing execution discipline on a live product: real users, real constraints, compounding impact.

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects

Lorem ipsum title of my project, and a long name

Owning the decision surface to drive category adoption

UX/UI Execution

Lorem ipsum title of my project, and a long name

Designing Term & ULIP journeys to reduce friction, improve clarity, and drive conversion.

UX/UI Execution

ARVIND SETHIA - BONUS PROJECT

Fixed Deposits (FD)

Data-led funnel optimisation under regulatory constraints

UX execution

LIVE PRODUCT

Role: Lead Designer (Product × Growth × Compliance)North-star metric: FD booking success rate

CONTEXT

Fixed Deposits are a mature, low-learning product.

Users don’t need education — they need fast comparison, trust, and confidence to commit.

This project focused on improving FD booking success rate by repairing high-friction decision moments, using funnel data and continuous iteration — while operating under strict compliance constraints.

PROBLEM

Funnel analysis showed a severe commitment drop, not a discovery issue.

Strong traffic into FD Explore

Only ~15% attempted booking

End-to-end success below 1%

Insight

Users were interested, but dropped when forced to commit before they could compare or trust the product.

DESIGN STRATEGY

Fix journey structure before UI

Optimize for scan-based comparison

Make trust signals explicit

Reduce decision friction, not persuasion

Design with compliance, not around it

KEY INTERVENTIONS

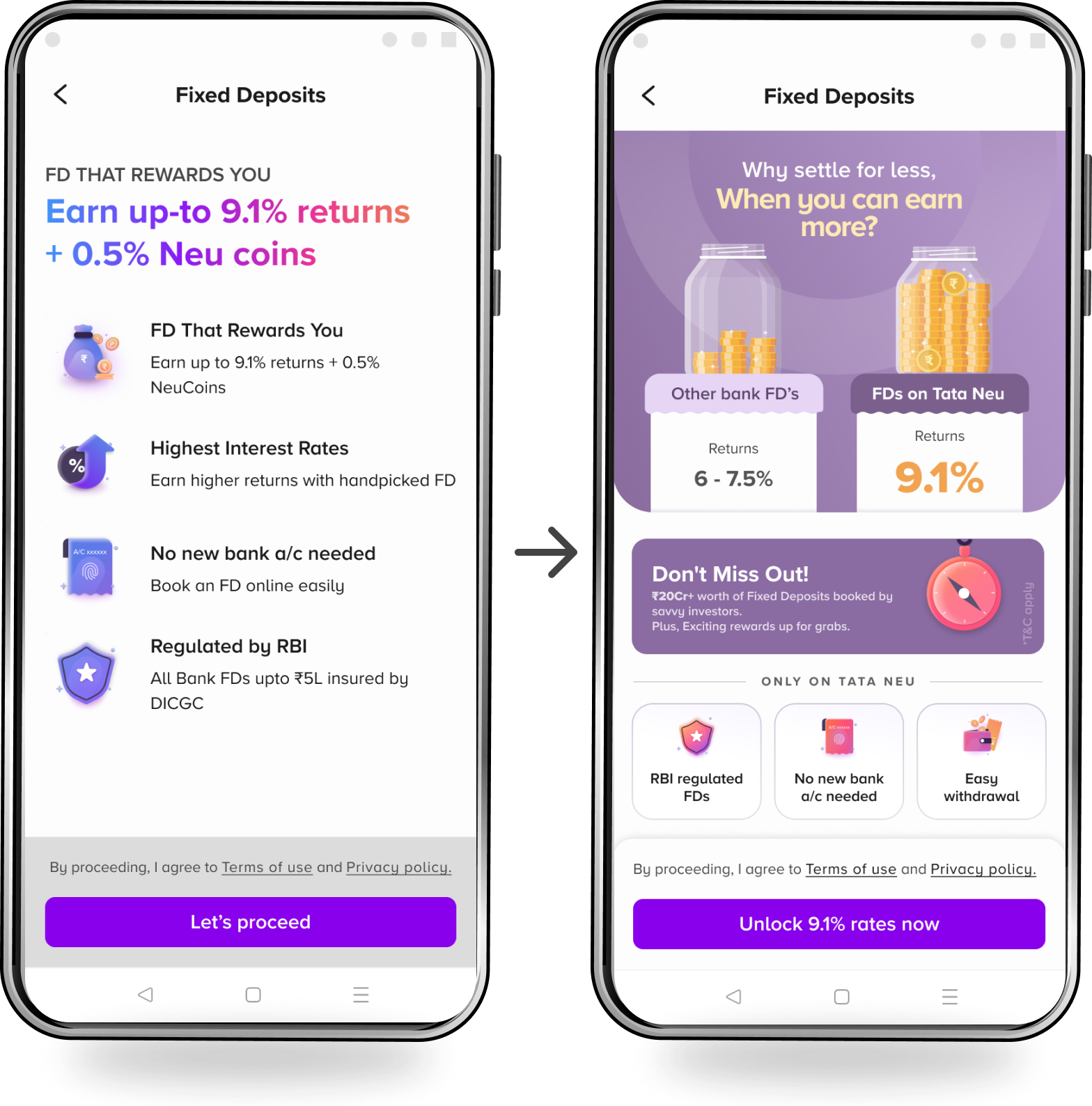

Consent journey restructuring (structural fix)

Problem:

Compliance-mandated consent appeared at journey entry, acting as a psychological blocker.

Iteration path

Entry-level consent → value-led consent → buried consent

Final state: consent moved closer to booking / before KYC

Outcome:

Consent exits dropped sharply

FD Explore traffic increased ~2–3× month-on-month

Exploration unlocked before commitment

Consent shifted from an entry gate to a confirmation step.

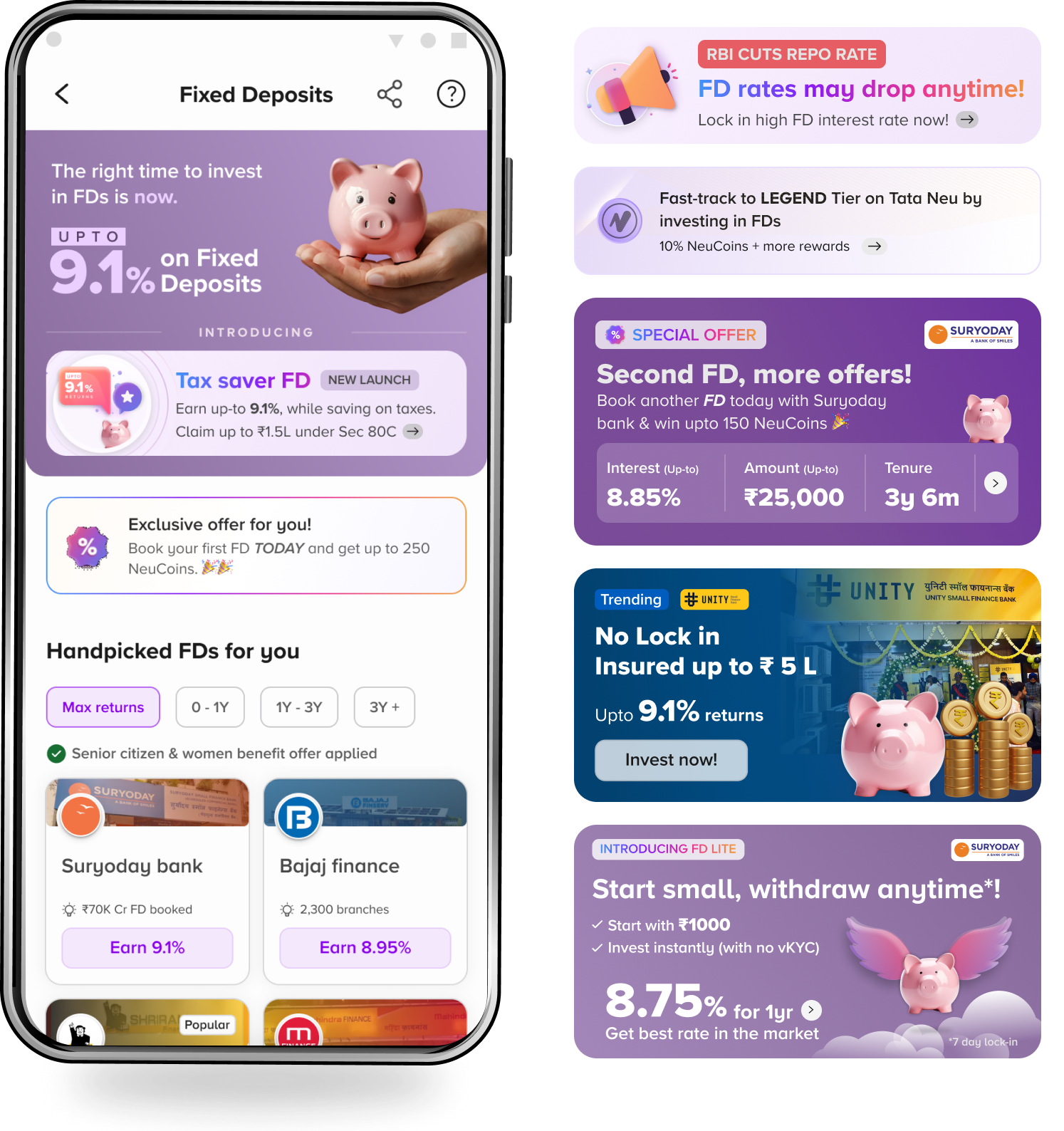

FD Discovery: Designing for confident comparison

Problem:

List-based discovery forced reading, slowed comparison, and lacked trust cues — especially for smaller banks.

Design changes

Shifted from list to card-based layout

Highlighted returns directly in the CTA

Increased bank identity prominence

Added trust signals (physical presence, scale)

Optimised density to surface more options above the fold

Outcome:

Consistent downstream exploration lift

Increase in average FD amount

Reduced avoidance of high-return, lesser-known issuers

Designed the discovery surface as a decision moment, not a catalogue.

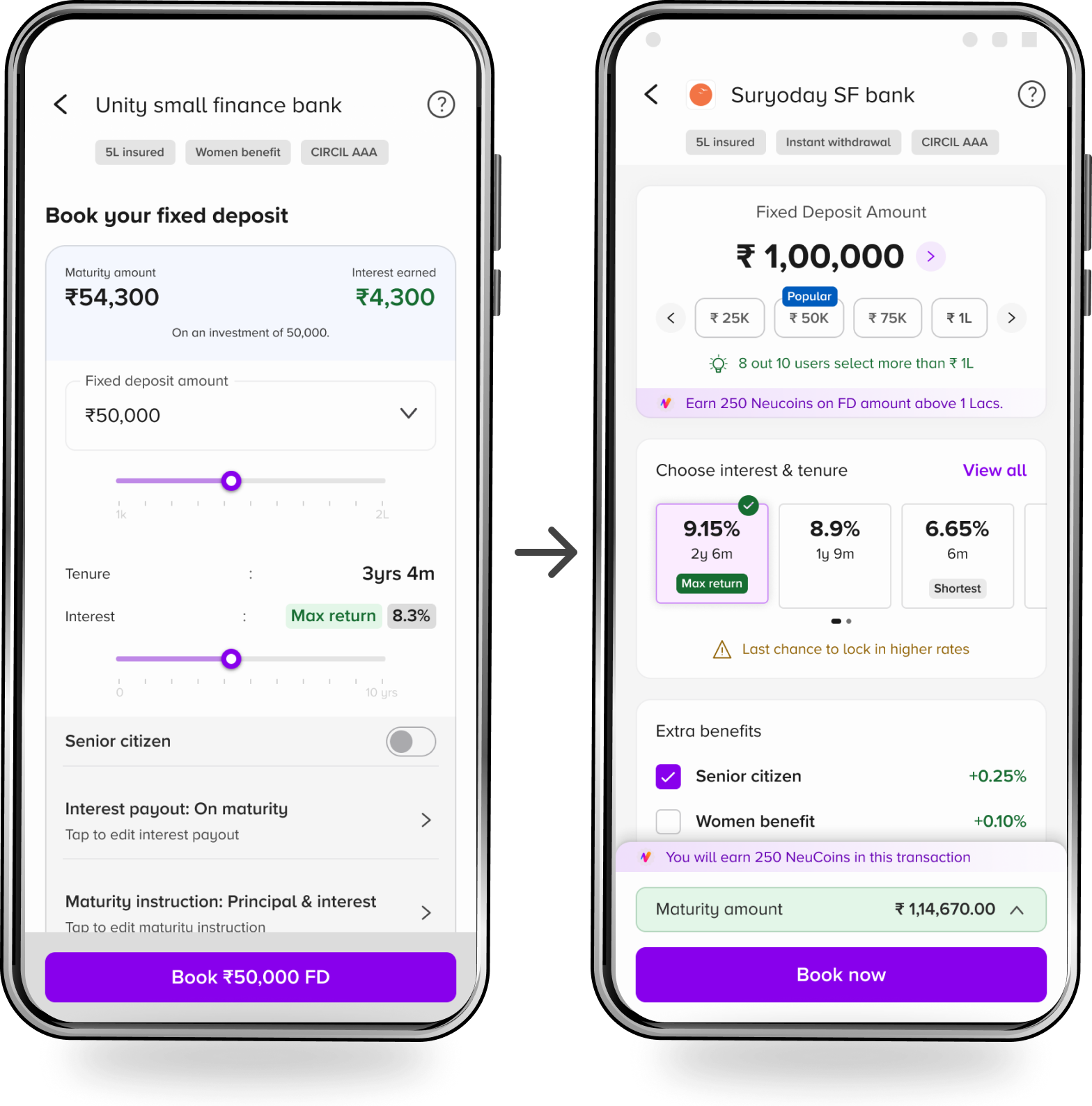

FD Details & Calculator: Reducing decision friction

Problems

Sliders were slow and error-prone

Calculator buried below content encouraged “play,” not commitment

Design changes

Moved calculator to the top

Replaced sliders with chips and +/-

Enabled real-time return feedback

Outcome:

Faster time-to-decision

Higher booking attempts

Sustained increase in Net FDs

Reduced calculator play; increased commitment.

Growth enablement (design-led)

Collaborated with Growth to operationalize campaigns through UX, not overlays.

Repo-rate FOMO

Low-entry FDs (₹5K+) & Short tenure options

Issuer-based rewards

Execution

PDP banner slot

Repeat-user widget below dashboard

A/B tested carousel vs single banner (single won)

Impact

Supported ₹500cr annual target

Achieved ₹350cr despite rate compression and competition

Growth worked only after core decision friction was fixed.

WHAT THIS PROJECT DEMONSTRATES

Funnel-level diagnosis & prioritisation

Structural journey redesign under compliance

Data-led iteration on a live product

Design × Growth collaboration with clear ownership

This case complements strategy-heavy work by showing execution discipline on a live product: real users, real constraints, compounding impact.

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects

Bonds

Owning the decision surface to drive category adoption

UX/UI Execution

Rebuilding Life Insurance on Tata Neu

From Redirection Chaos to Native, End-to-End Ownership

UX/UI Execution