Best viewed on desktop or laptop

Mobile might struggle a bit

ARVIND SETHIA - BONUS PROJECT

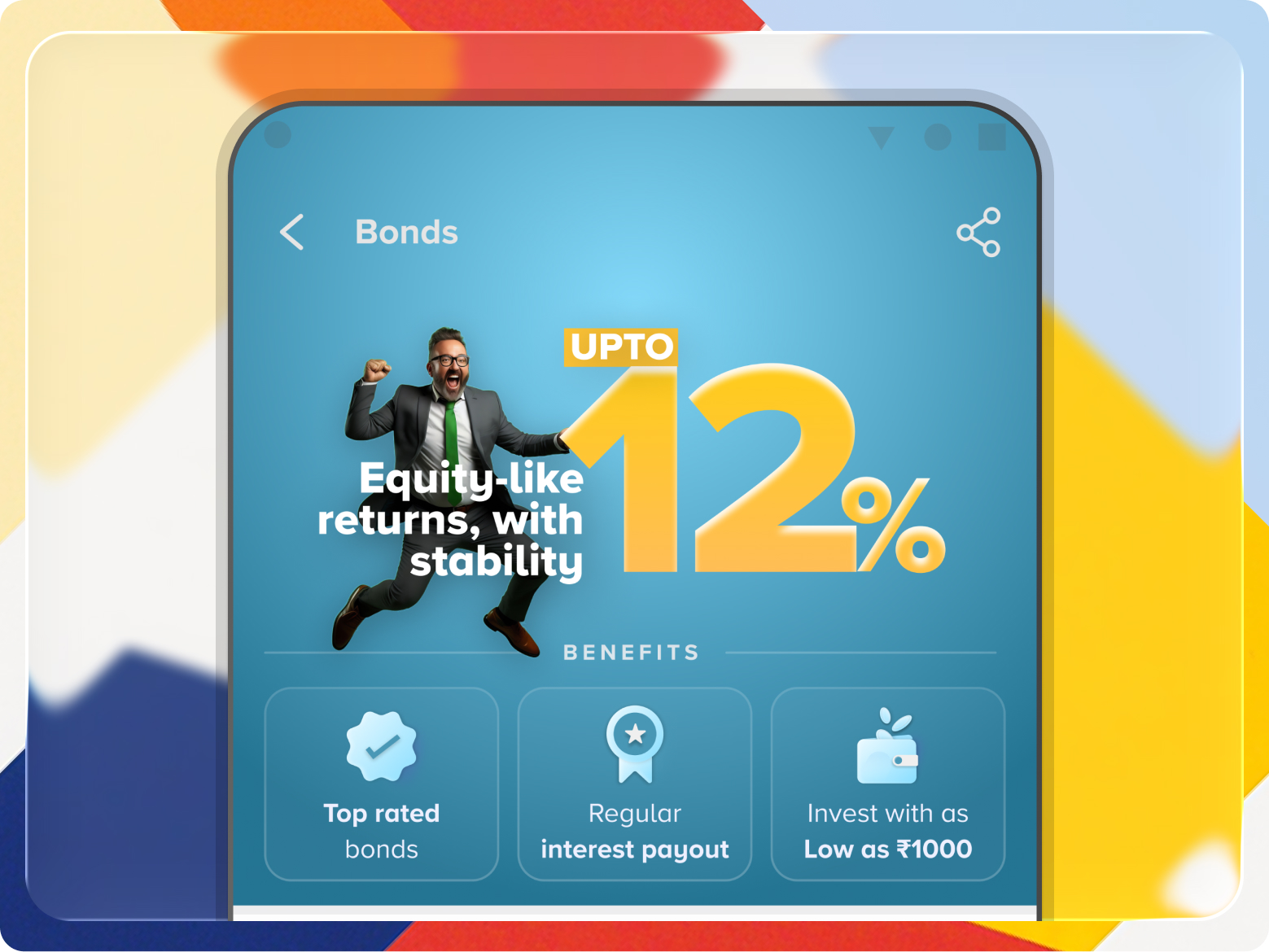

Bonds

Owning the decision surface to drive category adoption

UX execution

LIVE PRODUCT

Role: Lead Designer (Product × Growth)Focus: Adoption, trust, conversion, platform ownership

CONTEXT

AI changed user expectations — but not through in-app chatbots.

Lower awareness

Lower trust

Higher perceived risk

Initially, users were redirected to partner platforms, breaking continuity and trust.This limited our ability to influence conversion, learning, and growth.

Opportunity was clear:

If Tata Neu wanted to grow Bonds meaningfully, we had to own the decision surface, not outsource it.

PROBLEM

Users dropped sharply when redirected to partner journeys

No control over comparison, trust cues, or persuasion

Growth initiatives had limited leverage without native UX

Insight

But as a silent, intelligent collaborator

DESIGN STRATEGY

CC-on-UPI linkage

Optimize for comparison and credibility, not education overload

Apply learnings from FD selectively (scan, clarity, trust)

Enable Growth through design-owned surfaces

KEY INTERVENTIONS

Peripheral (reinforces trust + preference)

Problem:

Redirected partner journeys broke trust and intent.

Design changes

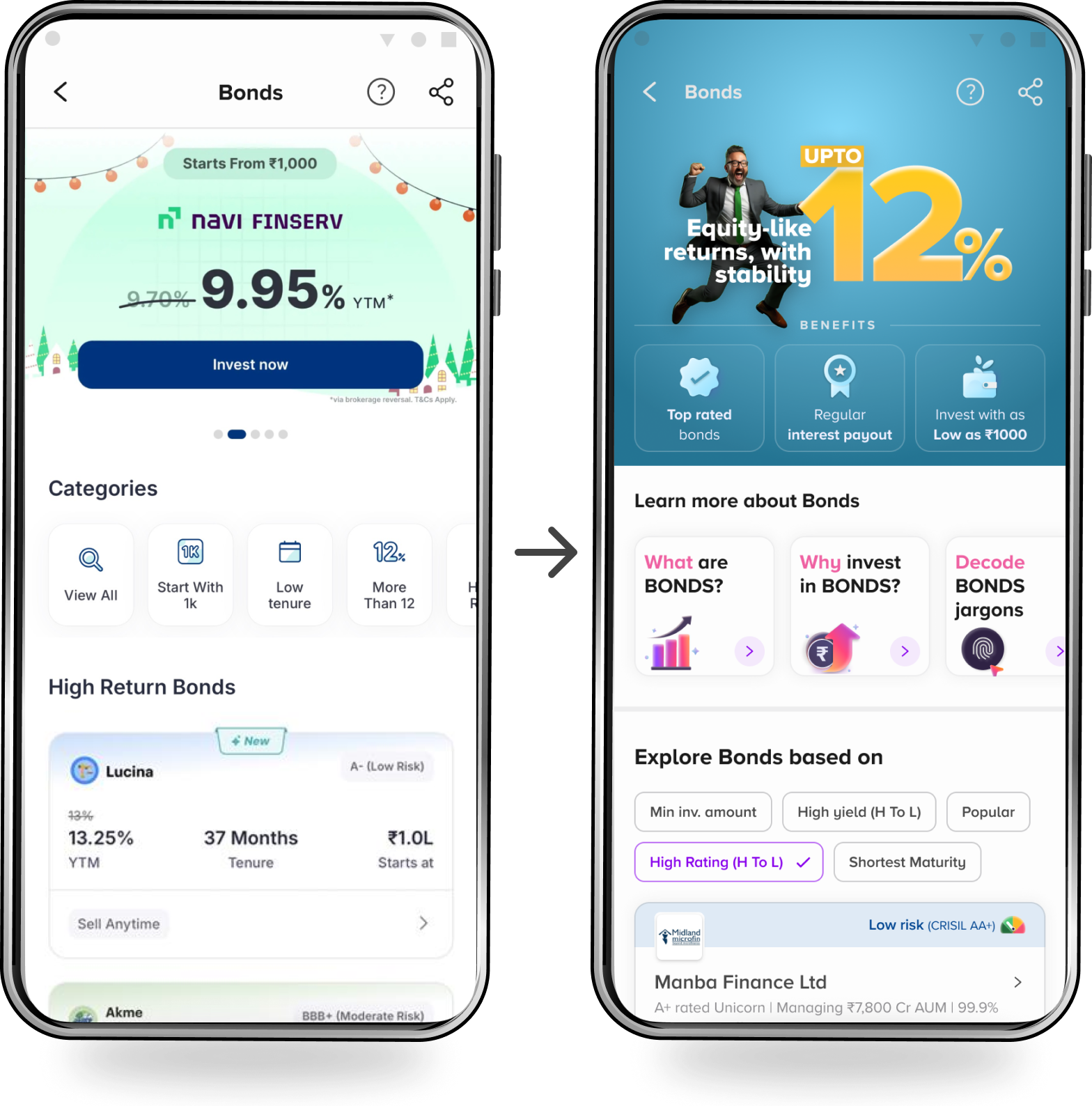

Designed and launched a native Bonds PDP (May)

Owned comparison, issuer credibility, and decision flow

Controlled narrative from discovery to action

Outcome:

Conversion improved from ~11% → ~25%

Nearly 2× increase in engagement post-launch

Owning the PDP unlocked both trust and conversion.

Peripheral (reinforces trust + preference)

Problem:

Bonds felt complex and intimidating when presented as dense lists.

Design changes

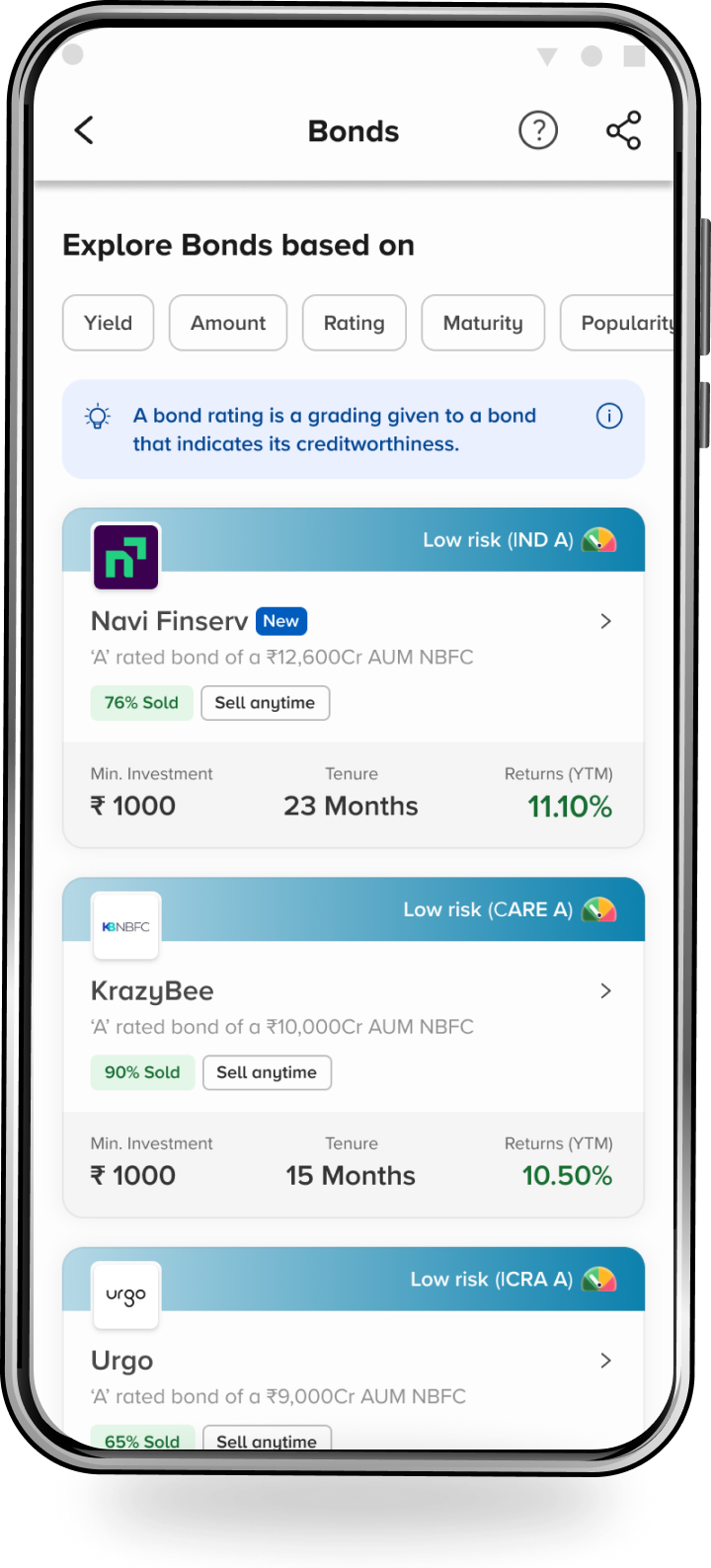

Introduced card-based bond discovery

Surfaced key decision variables upfront

Reduced cognitive load without oversimplifying risk

Learning applied (from FD)

Scan-based comparison works even for complex products

Education should support decisions — not precede them

Outcome:

Improved exploration depth

Higher PDP engagement without increasing bounce

Peripheral (reinforces trust + preference)

Problem:

Growth initiatives had low visibility and weak context earlier.

Design changes

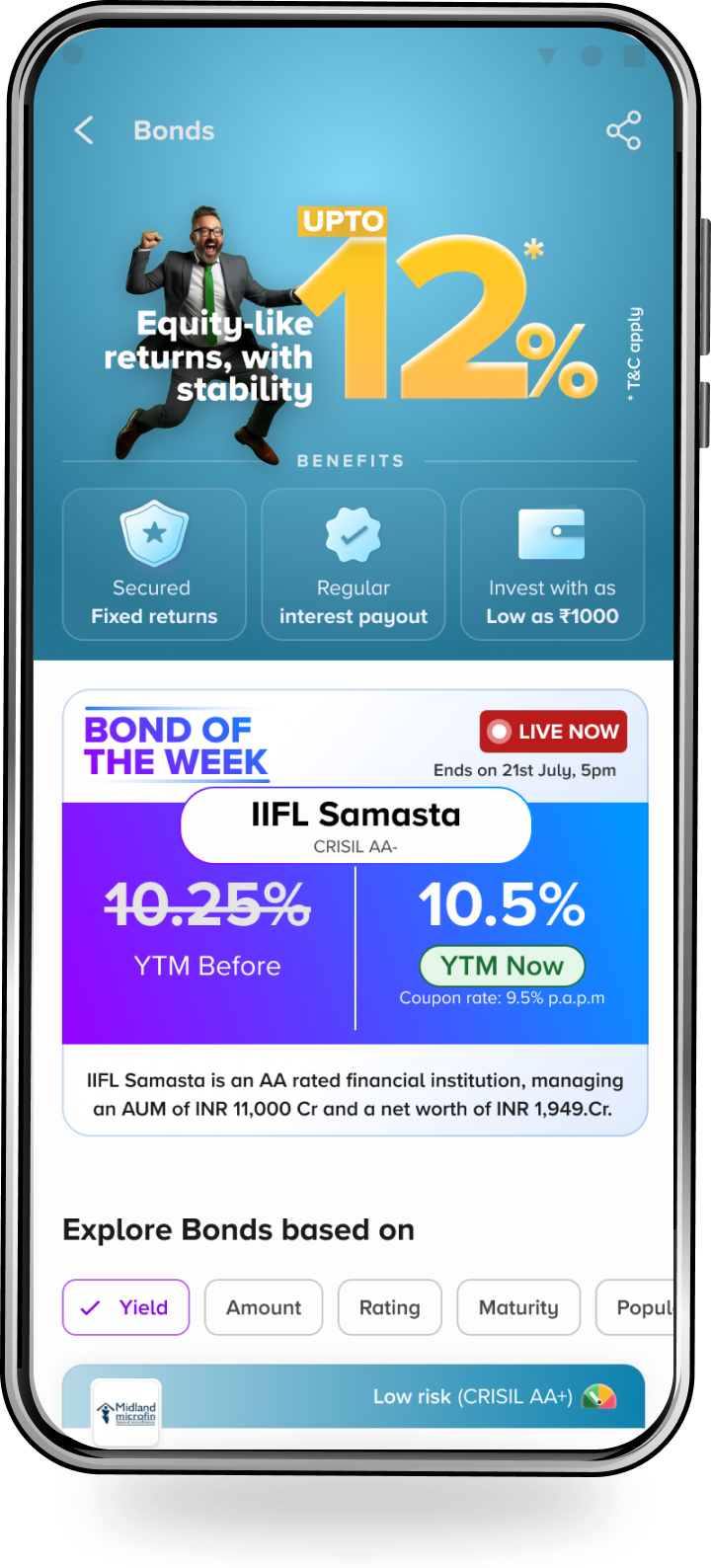

Created a dedicated, high-visibility banner slot on Bonds surfaces

Positioned “Bond of the Week” as a focused decision nudge, not noise

Outcome:

~25% of AUM in first two months came directly from this banner

Growth worked because UX gave it a credible, contextual surface.

BUSINESS IMPACT

Funnel-level diagnosis & prioritization

This in a category dominated by incumbents

Significantly stronger relative position compared to FDs (sub-1% share)

Platform ownership + focused UX can outperform scale disadvantages.

WHAT THIS PROJECT DEMONSTRATES

Funnel-level diagnosis & prioritization

Ability to design for category adoption, not just conversion

Reuse of proven design principles across products — with restraint

Strong Design × Growth partnership with measurable outcomes

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects

Lorem ipsum title of my project, and a long name

Designing a SEBI-Compliant Investment App from Scratch

Behavioural UX

Lorem ipsum title of my project, and a long name

Data-led funnel optimisation under regulatory constraints

UX/UI Execution

ARVIND SETHIA - BONUS PROJECT

Bonds

Owning the decision surface to drive category adoption

UX execution

LIVE PRODUCT

Role: Lead Designer (Product × Growth)Focus: Adoption, trust, conversion, platform ownership

CONTEXT

AI changed user expectations — but not through in-app chatbots.

Lower awareness

Lower trust

Higher perceived risk

Initially, users were redirected to partner platforms, breaking continuity and trust.This limited our ability to influence conversion, learning, and growth.

Opportunity was clear:

If Tata Neu wanted to grow Bonds meaningfully, we had to own the decision surface, not outsource it.

PROBLEM

Users dropped sharply when redirected to partner journeys

No control over comparison, trust cues, or persuasion

Growth initiatives had limited leverage without native UX

Insight

But as a silent, intelligent collaborator

DESIGN STRATEGY

CC-on-UPI linkage

Optimize for comparison and credibility, not education overload

Apply learnings from FD selectively (scan, clarity, trust)

Enable Growth through design-owned surfaces

KEY INTERVENTIONS

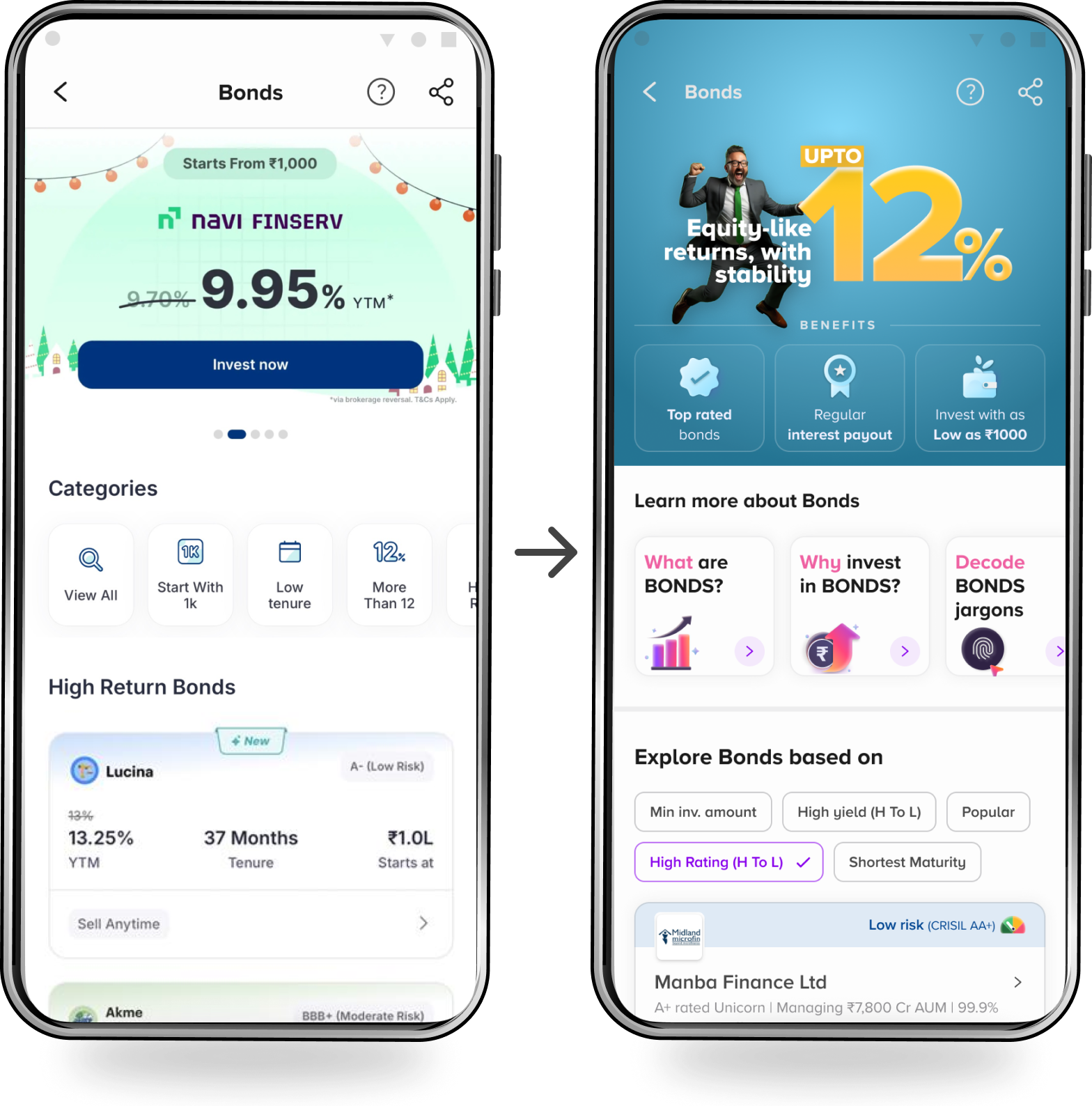

Native Bonds PDP (Platform ownership)

Problem:

Redirected partner journeys broke trust and intent.

Design changes

Designed and launched a native Bonds PDP (May)

Owned comparison, issuer credibility, and decision flow

Controlled narrative from discovery to action

Outcome:

Conversion improved from ~11% → ~25%

Nearly 2× increase in engagement post-launch

Owning the PDP unlocked both trust and conversion.

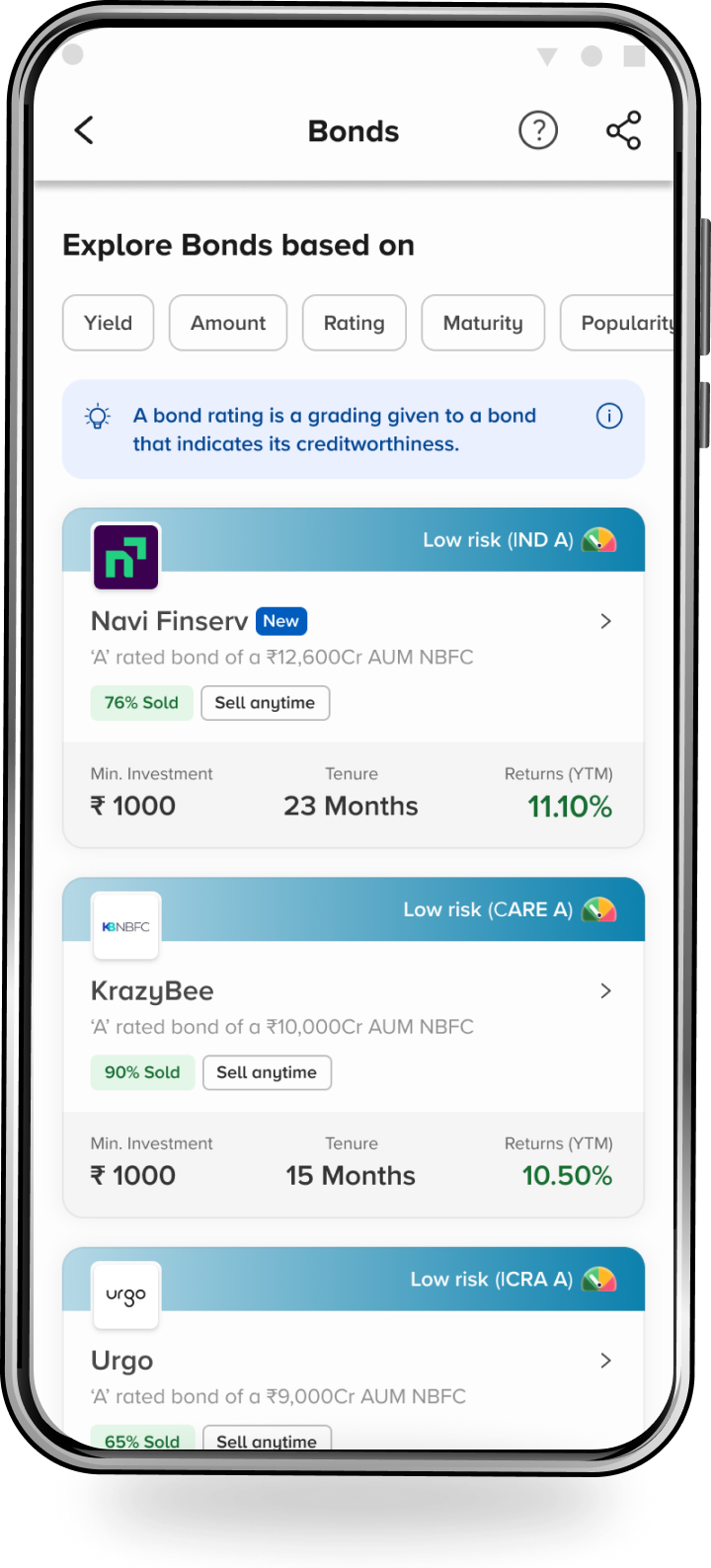

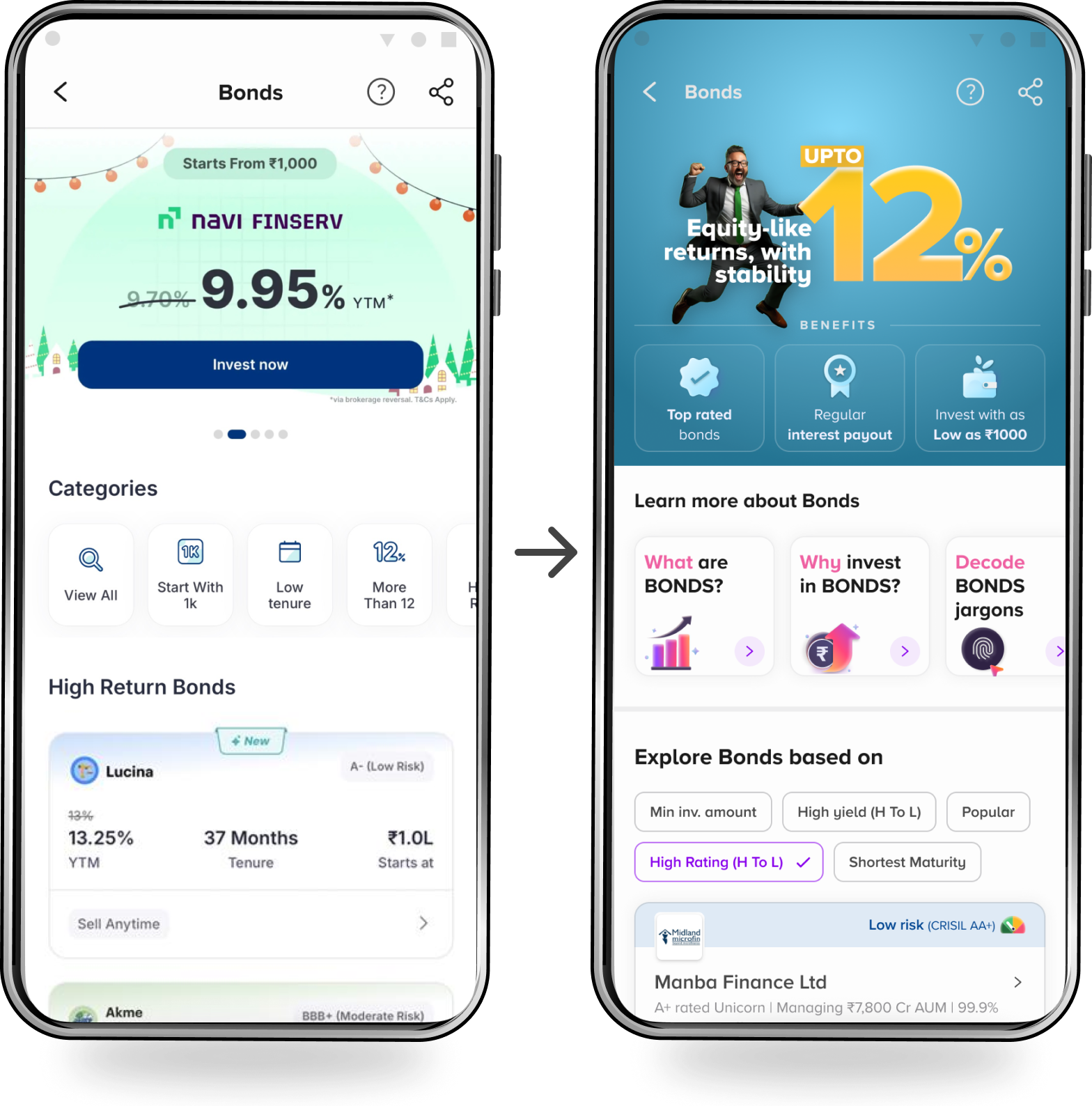

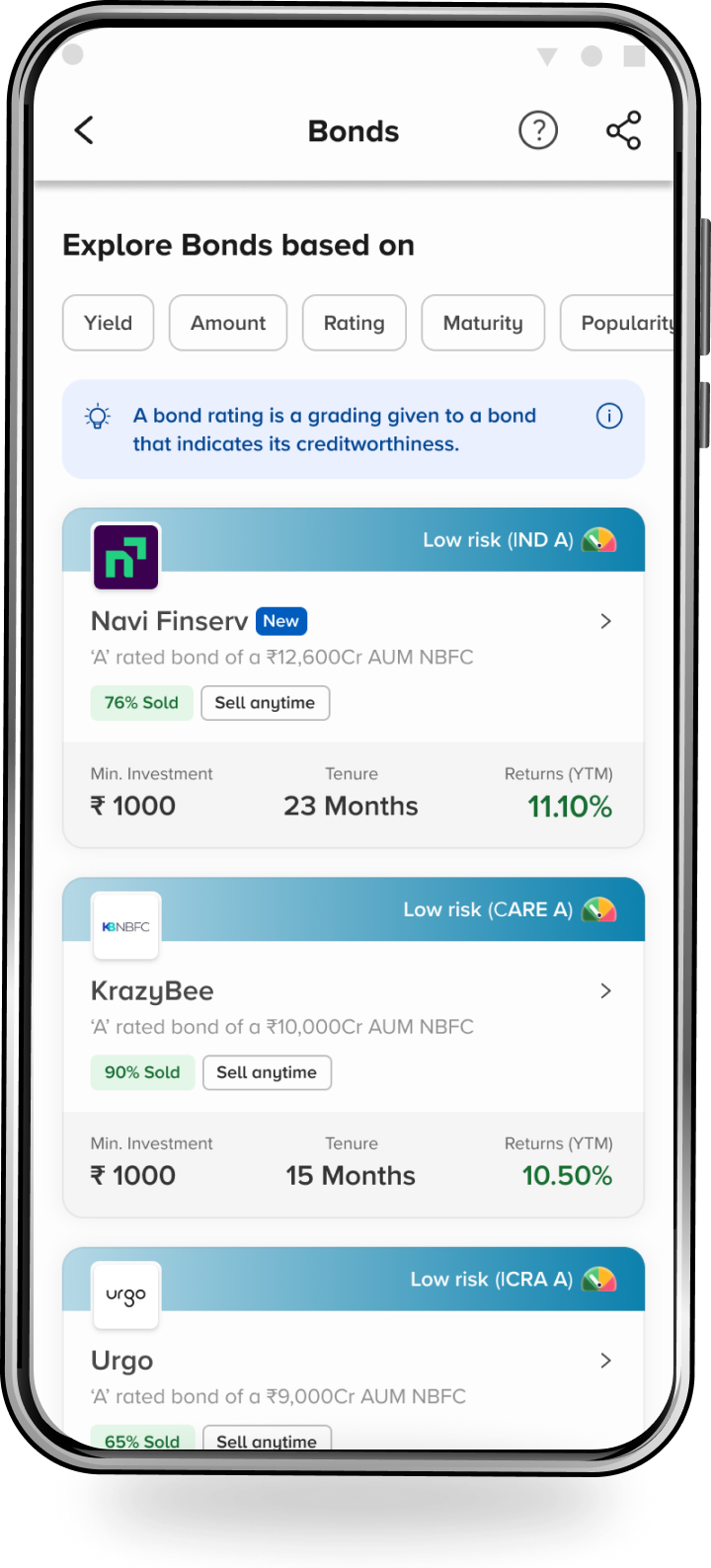

Discovery & comparison: Cards over lists

Problem:

Bonds felt complex and intimidating when presented as dense lists.

Design changes

Introduced card-based bond discovery

Surfaced key decision variables upfront

Reduced cognitive load without oversimplifying risk

Learning applied (from FD)

Scan-based comparison works even for complex products

Education should support decisions — not precede them

Outcome:

Improved exploration depth

Higher PDP engagement without increasing bounce

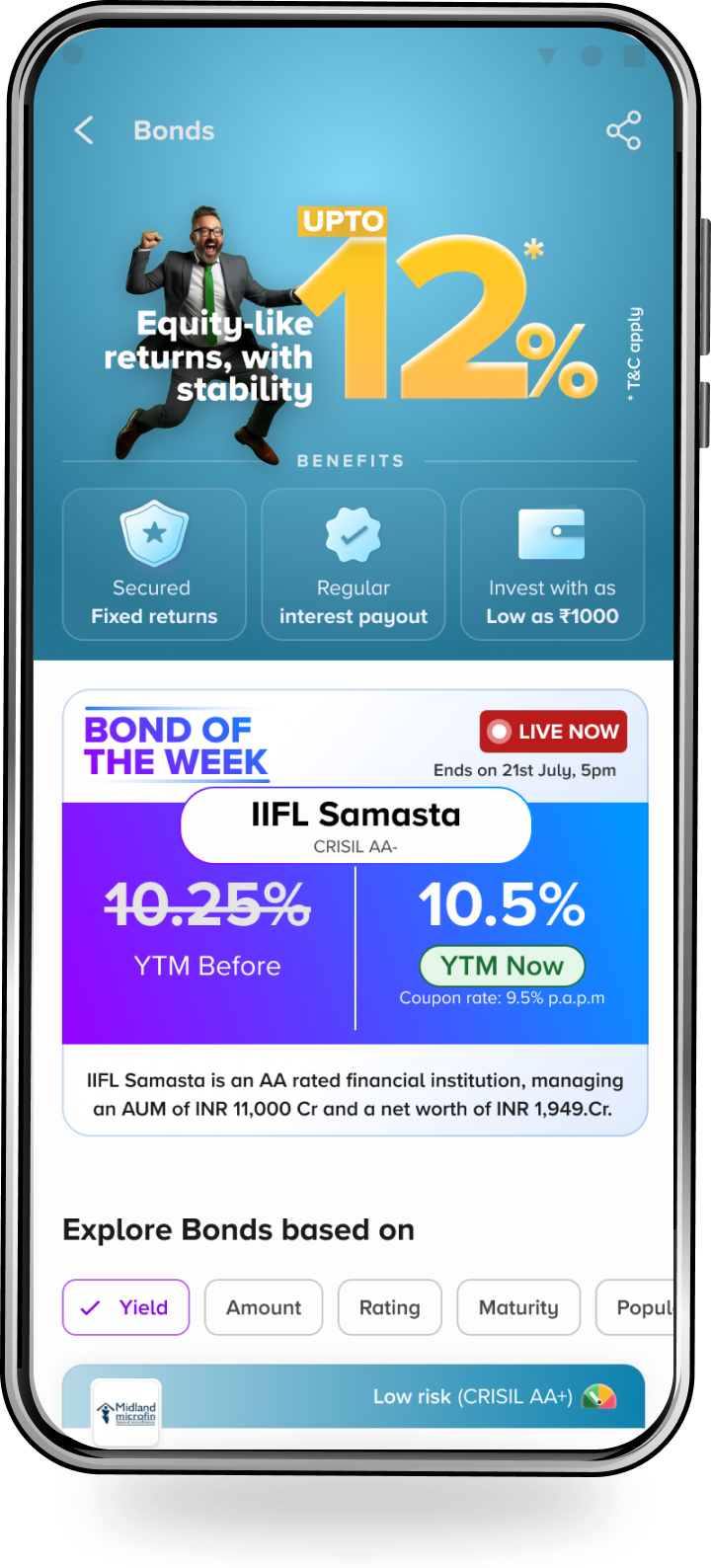

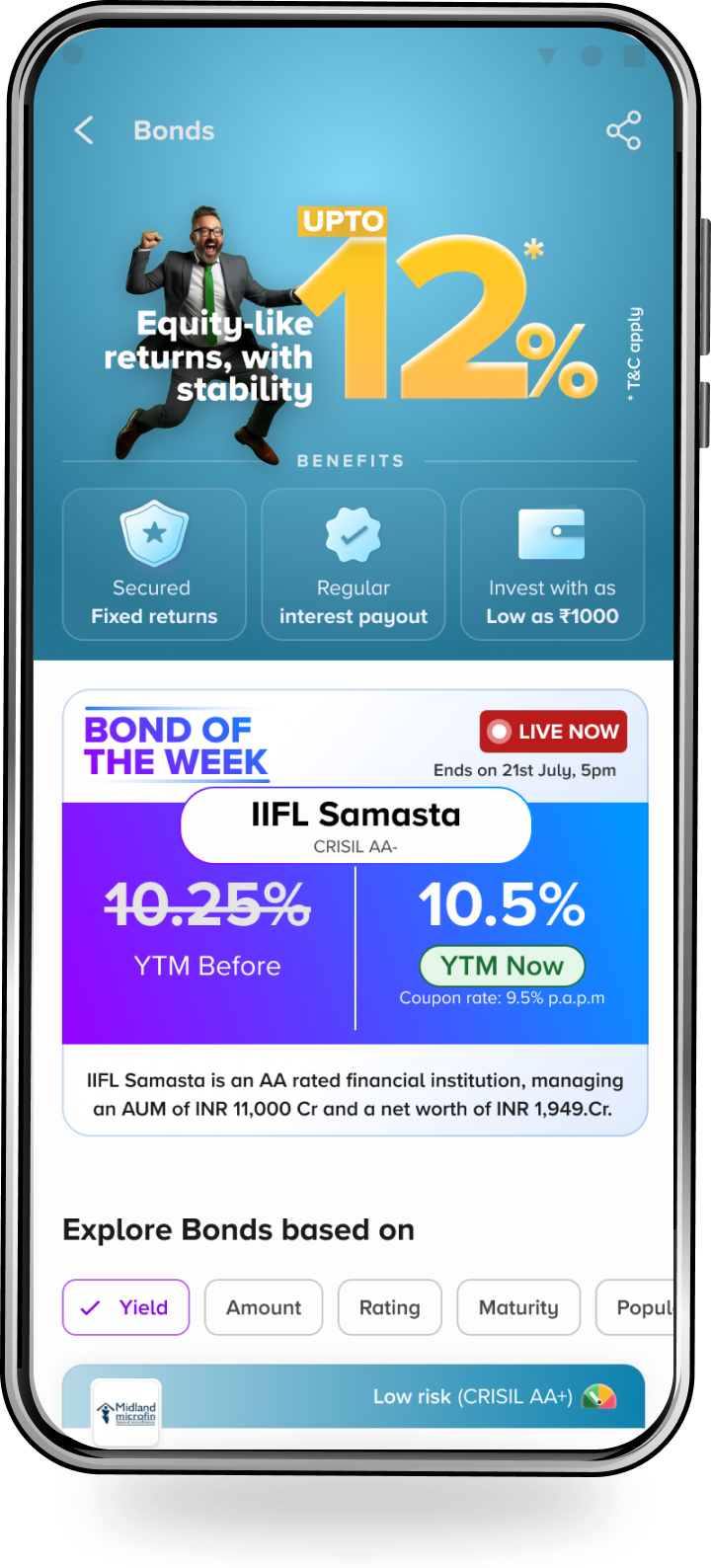

Growth surfaced through UX: “Bond of the Week”

Problem:

Growth initiatives had low visibility and weak context earlier.

Design changes

Created a dedicated, high-visibility banner slot on Bonds surfaces

Positioned “Bond of the Week” as a focused decision nudge, not noise

Outcome:

~25% of AUM in first two months came directly from this banner

Growth worked because UX gave it a credible, contextual surface.

BUSINESS IMPACT

Funnel-level diagnosis & prioritization

This in a category dominated by incumbents

Significantly stronger relative position compared to FDs (sub-1% share)

Platform ownership + focused UX can outperform scale disadvantages.

WHAT THIS PROJECT DEMONSTRATES

Funnel-level diagnosis & prioritization

Ability to design for category adoption, not just conversion

Reuse of proven design principles across products — with restraint

Strong Design × Growth partnership with measurable outcomes

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects

Lorem ipsum title of my project, and a long name

Repositioning UPI for a Credit-First, Reward-Led India

Behavioural UX

Lorem ipsum title of my project, and a long name

Designing Term & ULIP journeys to reduce friction, improve clarity, and drive conversion.

UX/UI Execution

ARVIND SETHIA - BONUS PROJECT

Bonds

Owning the decision surface to drive category adoption

UX execution

LIVE PRODUCT

Role: Lead Designer (Product × Growth)Focus: Adoption, trust, conversion, platform ownership

CONTEXT

Bonds are structurally harder than Fixed Deposits:

Lower awareness

Lower trust

Higher perceived risk

Initially, users were redirected to partner platforms, breaking continuity and trust.This limited our ability to influence conversion, learning, and growth.

Opportunity was clear:

If Tata Neu wanted to grow Bonds meaningfully, we had to own the decision surface, not outsource it.

PROBLEM

Users dropped sharply when redirected to partner journeys

No control over comparison, trust cues, or persuasion

Growth initiatives had limited leverage without native UX

Insight

Redirection was not a technical shortcut — it was a strategic bottleneck.

DESIGN STRATEGY

Bring Bonds decision-making natively into the app

Optimize for comparison and credibility, not education overload

Apply learnings from FD selectively (scan, clarity, trust)

Enable Growth through design-owned surfaces

KEY INTERVENTIONS

Native Bonds PDP (Platform ownership)

Problem:

Redirected partner journeys broke trust and intent.

Design changes

Designed and launched a native Bonds PDP (May)

Owned comparison, issuer credibility, and decision flow

Controlled narrative from discovery to action

Outcome:

Conversion improved from ~11% → ~25%

Nearly 2× increase in engagement post-launch

Owning the PDP unlocked both trust and conversion.

Discovery & comparison: Cards over lists

Problem:

Bonds felt complex and intimidating when presented as dense lists.

Design changes

Introduced card-based bond discovery

Surfaced key decision variables upfront

Reduced cognitive load without oversimplifying risk

Learning applied (from FD)

Scan-based comparison works even for complex products

Education should support decisions — not precede them

Outcome:

Improved exploration depth

Higher PDP engagement without increasing bounce

Growth surfaced through UX: “Bond of the Week”

Problem:

Growth initiatives had low visibility and weak context earlier.

Design changes

Created a dedicated, high-visibility banner slot on Bonds surfaces

Positioned “Bond of the Week” as a focused decision nudge, not noise

Outcome:

~25% of AUM in first two months came directly from this banner

Growth worked because UX gave it a credible, contextual surface.

BUSINESS IMPACT

Tata Neu achieved ~2% Bonds market share in India within <1 year

This in a category dominated by incumbents

Significantly stronger relative position compared to FDs (sub-1% share)

Platform ownership + focused UX can outperform scale disadvantages.

WHAT THIS PROJECT DEMONSTRATES

Strategic judgment on when to own vs outsource

Ability to design for category adoption, not just conversion

Reuse of proven design principles across products — with restraint

Strong Design × Growth partnership with measurable outcomes

MORE PROJECTS TO EXPLORE

Similar work and additional learning in other projects

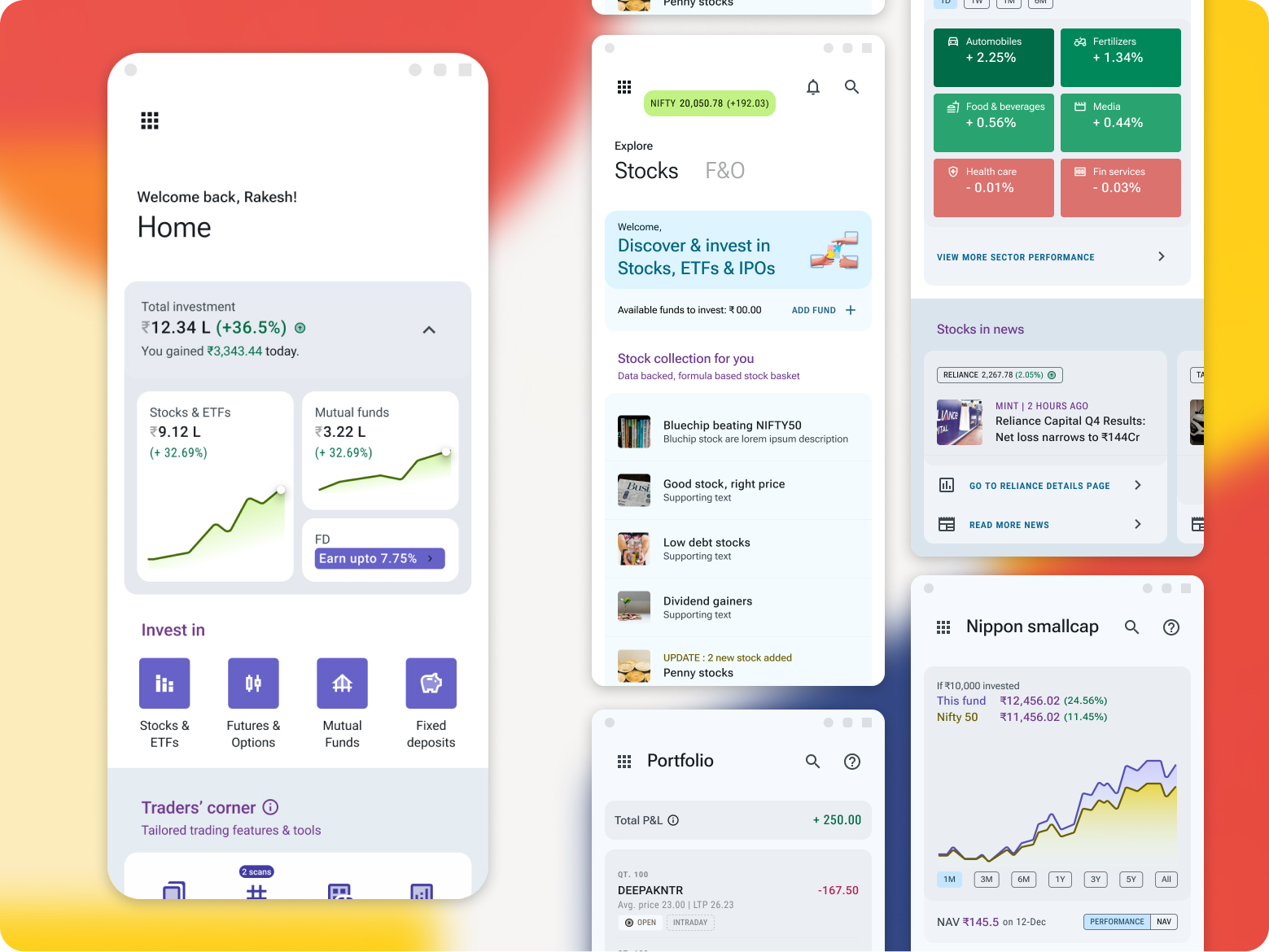

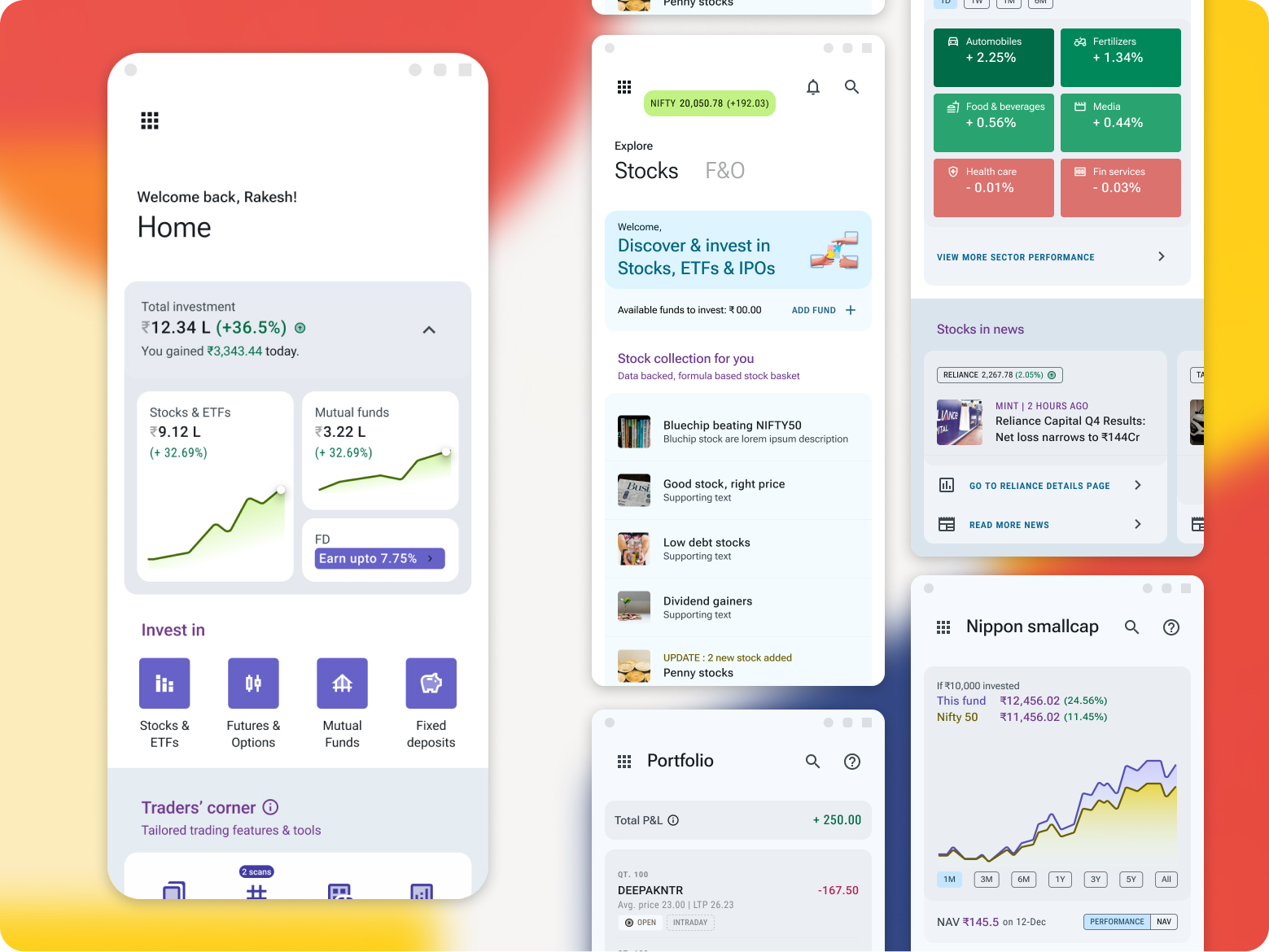

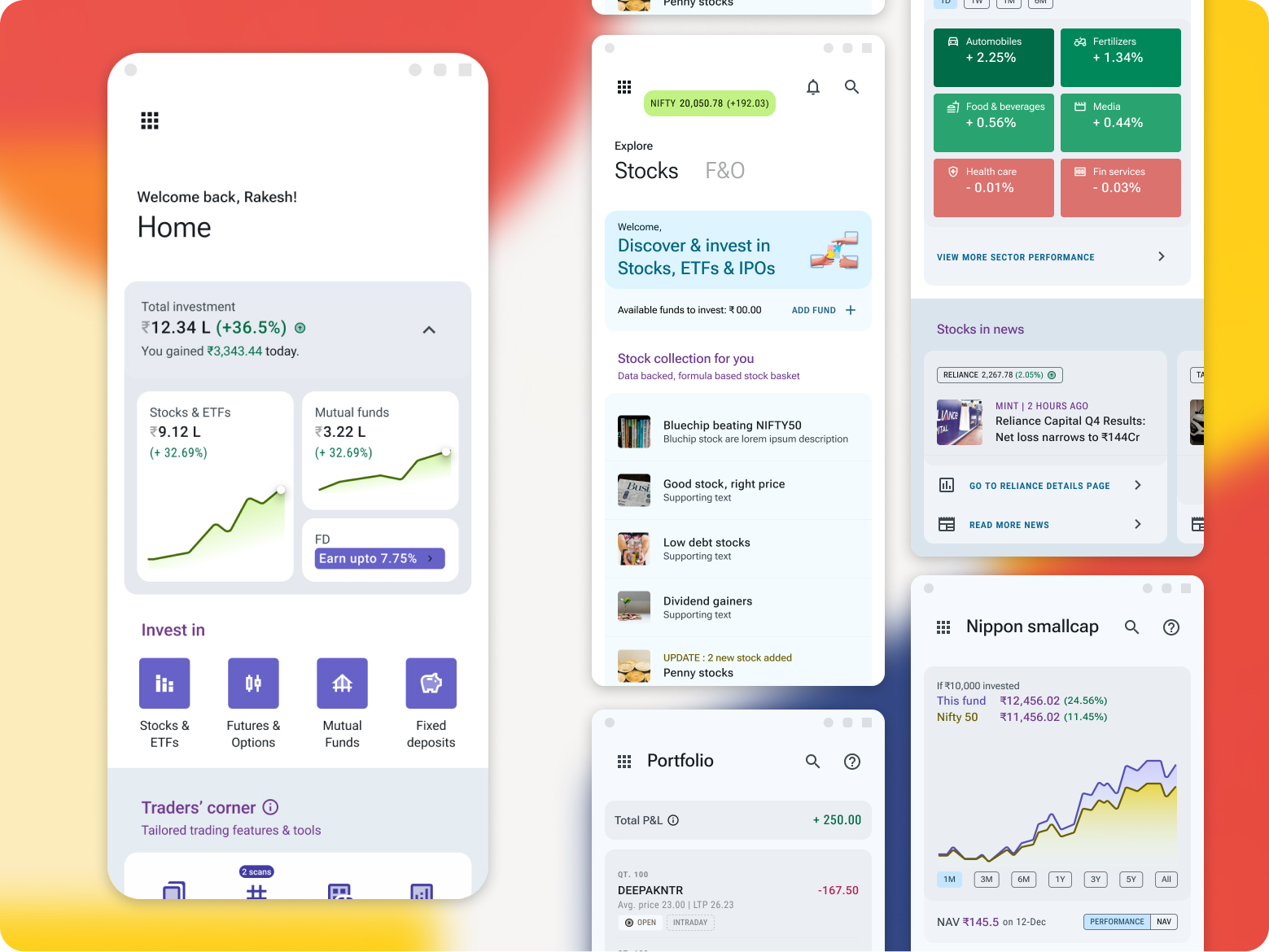

Stock broking platform

Designing a SEBI-Compliant Investment App from Scratch

Behavioural UX

Fixed deposits (FD)

Data-led funnel optimisation under regulatory constraints

UX/UI Execution